- Let's Buy a Biz!

- Posts

- 10xing Hims up to $100B+

10xing Hims up to $100B+

Hims is the best DTC brand of the last decade. Naturally, we’re gonna 10x them. Plus I’ll build out + Guarantee 10x ROI on WhatsApp this holiday.

🧠 The Takeaways

Today, we’re scooping up Hims to continue this rocket ship ride up to $100B.

AOV exploded from intentionally expanding the product catalog.

Heavily invest in Esports to grow the younger male base.

Break out Hers into its own company.

+ My ultimate Holiday offer for Coco.

LBAB! Community - I’ll Set Up + Guarantee Your Q4 WhatsApp Results.

I’ll set up your entire WhatsApp program for Q4 + GUARANTEE a 10x ROI.

If you sign up for a CoCo AI Pro plan before 11/10, I’ll:

- Build out all of your Holiday Campaigns

- Set up your key (Abandoned cart + Post purchase).

- Configure your AI.

- Give you a 30-day free trial

- Guarantee a 10x ROI.

I’m calling it the BHW (Big Holiday Win) offer. All I need is a 20 minute onboarding call to:

- Install the Shopify app.

- Connect your Facebook account (WhatsApp inside your BM).

- Connect your Klaviyo account.

From there we take care of everything else.

You’ll get:

- 10x ROI guarantees

- 80% open rates

- The next channel to scale your brand.

Your competitors aren’t on WhatsApp yet.

It’s time to stand out + connect with customers.

Let’s make you more money this holiday season.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

Hims (the online Viagra alternative scaled into a full-blown telehealth biz) is the best DTC brand of the last decade. They are crushing it: aggressively scaling, flipping to profitability, and expanding their offering.

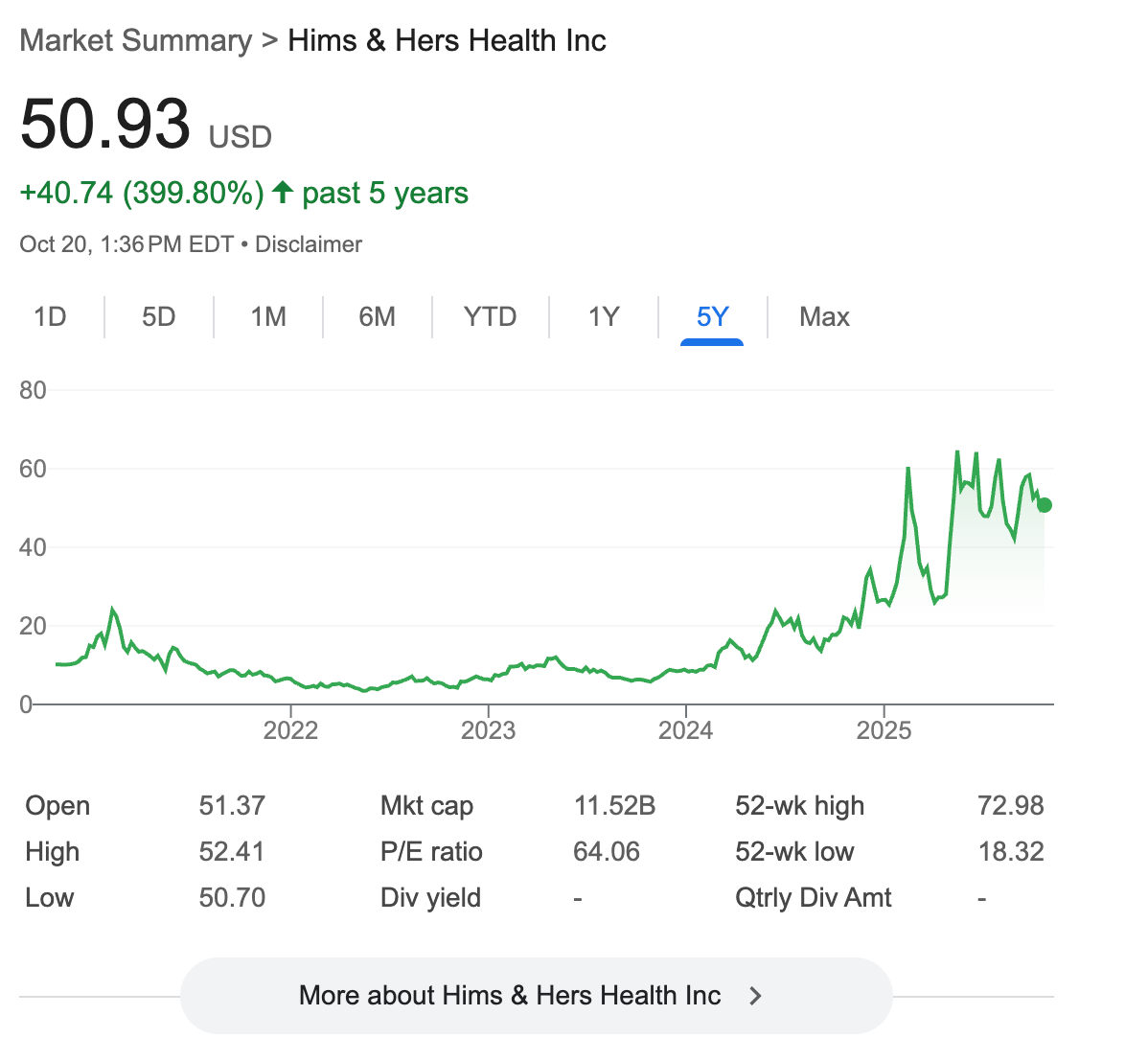

Share price: $ 51

Market Cap: $ 11.52B

L5 Performance: +399%

P/E Ratio: 64x

This will be the next $100B consumer brand.

Mark your calendar folks. Hims is trading at SaaS multiples + is already in the stock-exploding phase.

Today, we’re going to scoop up enough shares to deserve a board seat + turn this biz into the next Health juggernaut.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $1.4B (+69%) 😮

Gross Profits: $1.1B (+64%) 💪

OPEX: $1.1B (+49%) 👍👍

Net Income: $126m (+638%) 😍

TLDR Analysis: This is what we came for.

+69% YoY growth at $1B in sales with 79% Gross Margins. 🤤

COGS (+93%) are growing faster than Rev. 😟

OPEX is coming inline, growing slower than rev + unlocking profitability. 😍

These exact metrics are why investors are willing to fund losses for years before ensuring a biz can be profitable.

At a certain scale, if you control costs enough, you can still grow and have massive profits the biz distributes.

If Hims nails the balance of “tighten the belt but don’t tighten it too much,” they’ll be throwing off billions at a 20%+ Net Income margin within 3 years.

Let’s Recap This Biz

Company Overview:

Hims & Hers is a direct-to-consumer telehealth platform that eliminates stigma around sensitive health issues by making care accessible through online consultations and home-delivered treatments.

The company addresses men's and women's health across sexual wellness, hair loss, skincare, mental health, primary care, and weight management.

The Launch Insight:

Dudum had identified an opportunity to create a business that could help de-stigmatize personal healthcare, recognizing the potential in improving the patient experience by making access simpler, especially for sensitive health issues.

The Launch:

Hims initially sold erectile dysfunction treatment (sildenafil) and hair loss treatments (minoxidil, biotin vitamins, DHT-blocking shampoo).

Meteoric Growth:

January 2019: Raised $100 million Series C at $1 billion valuation (unicorn status) Triple Whale

October 2020: Announced SPAC deal at $1.6 billion valuation Triple Whale

January 2021: Went public on NYSE under ticker HIMS

Today:

Hims & Hers focuses on a suite of products across (Sexual Health, Hair Regrowth, Weight loss, and Anti-anxiety meds). Essentially creating the cheaper alt mainstream drug, discreetly delivered to your door.

Let’s Scale This Biz

Here are our 3 moves to turn Hims into the Millennial J&J.

1) This is how you Merchandize to optimize AOV.

The hardest piece of this game: introducing new, relevant products to core customers and increasing their LTV through those products.

Hims has nailed this process so well it’s worth taking a section to examine what they did:

Their AOV has been expanding over the last 4 years.

2021: $74

2022: $82 (+11% YoY)

2023: $97 (+18% YoY)

2024: $137 (+41% YoY)

+ They’re compounding:

Subscription units per transaction

Subscription length

Let’s go back to when Hims was founded in 2017.

2017: Launched with ED + Hair Loss products

2018: Launched skincare products

Also launched Hers with Birth control, Hair loss, + skincare products

2019: Launched Anxiety product

2024: Released Weight loss products

Based on the size of each product on their HP, we can make an educated guess on what’s selling best.

Hims:

Strategically expanded into products their core audience would add on

Has scaled super effectively because of focused + controlled expansion into adjacent markets (vs. new markets/products).

+ an important callout is how long it took for this compounding to take effect.

Hims didn’t release a new product from 2019–2024 on the men’s side and it still took until 2024 for AOV to really explode.

Clearly, the Go To Market team needed time to figure out how to get customers to buy all of those products.

Takeaway: The #1 rule of biz. Sell more to the same customers.

2) Diversify spend into Esports.

Hims currently spends $3m+/week on Facebook and Google Ads.

They’ve already hit Influencers, podcasts, TV, and OOH, but they’re missing 1 of the largest markets of young men in the world:

Esports ($6B, growing @ 21% CAGR).

40% of Esports’ revenue comes from ads, and the average consumer age of 33.

This is Hims pipedream.

The ads write themselves.

“Feel a little nervous about the next round? Been up for 12 hours playing Call of Duty? On your 4th Monster? Try our Anxiety meds.”

Once customers are in the funnel, target: Sex, Hair, weightloss, and Skin products.

Hims will need to figure out how they want to play this branding, but they should take a page out of Dude Wipes’ and Liquid Death’s playbook and lean all the way into the culture.

Make childish boys’ jokes.

Sponsor the attention-grabbing personalities in the space.

Hims is a regulated brand, so we can’t go too crazy with this, but there is a real opportunity to lean in and create a brand that isn’t just the cheap, convenient, discreetly-delivered-to-your-door telehealth biz.

It’s so obvious it’s crazy that they haven’t done it before.

Takeaway: Find your Customers’ Communities. Invest everything there.

3) Split out Hers into a different org.

Hers now accounts for 30% of Hims overall sales ( ~$500m run rate).

It’s time for Hers to truly become its own brand.

If you look at hims.com and forhers.com, the team’s done an incredible job of creating a template + site UX that’s an incredible experience for both brands.

But as I’ve talked about many times here, the greatest value DTC brands are inherently unique.

As the female audience grows, the experience needs to be customized for them.

The team already knows this.

They wouldn’t have broken hims/hers into 2 separate domains otherwise.

At this scale, there should be a CEO of Hims and a CEO of Hers. While it’s important to keep both brands aligned and working towards the same goal, it’s time to throw Hers into the spotlight.

E.g., Hers would require a massive Esports-equivalent investment applied to their customer base.

Hers should be operating at the same run rate as Hims.

Takeaway: Hims is pacing to a portfolio of brands. Not just one.

Final Thought

I make a lot of bold calls across here and socials, and I’m often off the mark, or the biz decides to take things in another direction.

But it’s always nice when a call lands.

I covered Hims last year and 2/3 of my growth recommendations happened.

My top growth lever was cutting Marketing as a % of spend from 50%+ -> 40%.

It’s sitting at 46%. Not quite my target, but heading in the right direction.

Go Full Tele-health.

They’re still making strides here, but it really does feel like they’ve converted the in-clinic questionnaire into a product quiz. Add Drs. to answer questions (à la Chewy’s Vet chat service), and we’re basically there.

Be more aggressive on pricing.

This is where I missed the mark. Hims is already the affordable option on the market + from here will have the scale and distribution to start increasing pricing when they want.

These newsletters are always meant to be hypothetical thought experiments, but if they happen to land on Andrew Dudum’s (Hims CEO) plate…

I hope they’re helpful.

Reply