🧠 The Takeaways

The only way to save Lulu’s is to run the classic turnaround Playbook. Today, we’re taking a page out of Drew Sanocki’s book and turning around this big, busted brand.

Dump 50% of Products + the custom stack to unburden this biz.

Rightsize the P&L and workforce

Go all-in on the app.

+ Can you run an “affordable brand” anymore?

LBAB! Community - Can you run an Affordable Brand anymore?

Do “affordable brands” make sense anymore? I've been thinking about this a lot recently.

All the non-premium bizs I've analyzed are getting crushed.

When I look at all the just bigger signals, it looks like relatively few Americans with the discretionary income to spend are aggregating more / buying more. While the majority of the population aren’t.

I’ve seen this unfolding over the last 10yrs: Amazon, Walmart, and Costco and mass producers will eat the spending budget for the 60–70% of the US population that makes <$100k/yr.

All that’s left is to build a brand around that top 30% who can afford to spend the extra and additional money. And realistically it’s targeting the Top 10% who own 70% of all US wealth [Source].

The greatest difference from when I entered the space vs. now is that the affordable luxury + discount brands are discounting sites like Groupon, Woot, and Wish. Dead in the water.

The OG “affordable luxury” brands like MVMT + Casper? Don’t want to be them.

The math doesn’t math anymore. Not just because marketing’s more expensive but because there aren’t large enough customer bases who can afford those types of purchases anymore.

I'd love for someone to prove me wrong and send me their affordable lux/actually affordable biz where they're crushing it and growing more +50% YoY.

The only brands that I know/have talked to that are consistently growing and profitable are in the actual luxury / higher end space.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

Lulu’s, the affordable wedding store for Zillenial women (that rose to dominance with affordable wedding outfits through a seamless mobile app experience), is dead. They just haven’t admitted defeat yet, but it’s over. They’re trading at 0.04x Rev multiple + losing $55m/yr. No one wants to touch this stock.

Share price: $4.69

Market Cap: $13m

L5 Performance: -98%

P/E Ratio: N/A

You might think that Temu or Shein ate Lulu’s lunch, but actually all of Abercrombie’s gains have come at Lulu’s expense. While Lulu lost their way trying to become Revolve, Abercrombie focused on Lulu’s core market: weddings.

Today, we’re going to take Lulu’s private for $15m and flip it for $200m in 2 years by running the basic turnaround playbook.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $315m (-11%) 👎

Gross Profits: $130m (-12%) 😰

OPEX: $182m (+7%) 😰😰

Net Income: -$55m (+187%) 🤮🤮

TLDR Analysis: This is what death looks like.

Rev falling faster than COGS + destroying Gross Margins. ⚰️

Selling/Marketing + G&A decreasing YoY but increasing as a % of Rev. ⚰️⚰️

Net Income is -$55m + exploding YoY. ⚰️⚰️⚰️

When a biz is losing that much money and only has $4.4m in Cash & Equivalents + an available credit facility for $10m…. You can see how this math is adding up.

Lulu’s in bankruptcy court.

Let’s Turn Around This Biz

Here how we flip Lulu’s into a $200m biz.

1) Gut the Catalog & Tech Stack.

Lulu’s has no right to be on a custom stack or to be selling close to ~75k products (est.).

They’ve completely lost the plot on why their customers buy from them and what they should be selling.

I don’t even have to look at the data to know they can gut 50% of their catalog.

Homepage:

Collections:

The fact that the 20% off promo is the only legible piece of the menu tells me everything I need to know.

DUMP EVERYTHING that isn’t weddings.

Yes, weddings are cyclical + seasonal.

But when customers love your brand for 1 thing, sleep in the bed you made. Double down on what you’re best at.

Wedding + Bridal + Bachelorette is a mid 4–6 figure LTV life event. Don’t chase everyday or concert wear. Focus on getting 12 women to buy the 25 items they need for 1 wedding all through you.

This is also the most obvious candidate for a Shopify migration in history. Fashion Nova, Princess Polly, and Everlane are in similar Rev + Catalog ranges.

All doing fine on Shopify.

Slap on an app provider to power their app, and we can erase 7–8 figs in G&A costs/yr.

Takeaway: Don’t make life more complicated than it has to be.

2) Rightsize this P&L.

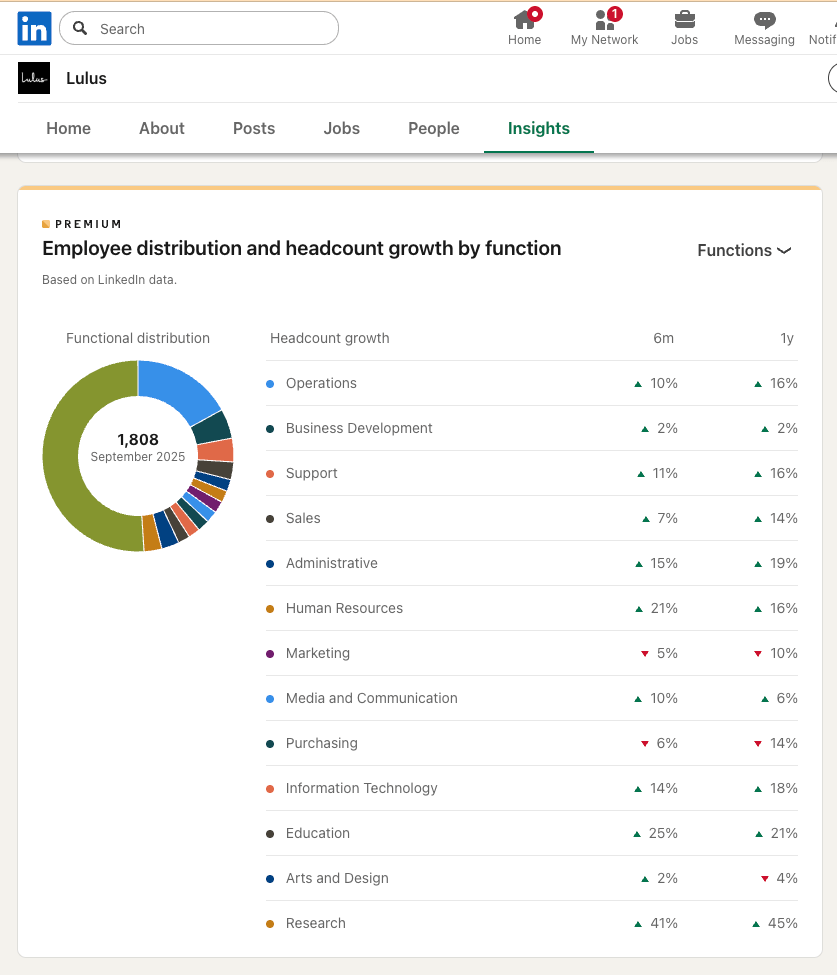

How on God's green earth are Operations, Support, and Administrative 3 of Lulu’s Top 5 largest, fastest-growing teams?

In the last 2yrs:

Revenue is falling >10% while COGS increased

Selling & Marketing budget was cut by -4% and -9%s.

Clearly none of that is working, but it doesn’t seem like the team is placing the right bets or even trying to course correct.

Dumping half the product catalog will free them to RIF a considerable amount of employees.

It’s unfortunate but necessary. Lulu’s won’t be in biz much longer to pay these people if they continue down this path.

At a 41% Gross Profit Margin w/ OPEX at 58% of Rev, we need to find 17% of Rev to get to breakeven:

~5-7% in COGS by dumping the losers + not discounting so much

~10-13% in G&A by rightsizing the team/tech stack.

-5-7% in Selling & Marketing, as we’ll have to slap on a fresh coat of paint.

It’s like helping someone who ate/drank terribly (+ didn’t exercise) for years.

The solution’s awful and painful, but there are only 2 options:

Don’t change + die.

Radically change + live.

Takeaway: This biz needs a radical change at every level.

3) Make the App THE Biz.

All I honestly want in this deal is the app.

A 4.9 ⭐ review on 52.2k reviews is INSANE, and it’s the real gold mine

Ideal scenario:

Streamline the entire biz to let the app shine.

Double down on the shopping experience.

Get everyone who’s getting engaged to download the app. Use it for outfit inspiration across all wedding events they’re attending.

Create the women’s The Black Tux. Where a bridal party manages the all outfit coordination in one place and buys what they need for every event:

Bridal Party

Bachelorette Party weekend (3-10 outfits)

Wedding (2 outfits)

Wedding weekend events (3-5 outfits)

If we can capture entire bridal parties’ purchases, each wedding will be $25-50k. That fundamentally changes the unit economics of what we’d be able to spend to market, sell, and service customers.

And if all else fails and we can’t turn Lulu’s around, the app will be our parachute.

The consumer data that Lulu’s has on its customers is worth more than $50m to at least double our money as a worst-case scenario.

Takeaway: Always go deeper before you start going wide.

Final Thought

I hate almost everything about Lulu’s post-IPO strategy over the last 4–5 years…

Other than 1 attempt, which has been buried in an onslaught of unfocused nonsense:

They tried to launch Homecoming Products.

Why:

Lulu’s does have a real, existential long-term risk to their biz. Younger Americans are dating / getting married less. Over the next decade, this will directly impact their Revenue/growth opportunities.

A relevant + natural adjustment would be to take their core strengths and re-apply them to another market that won’t be impacted by the same societal trend.

Over a 5–10 year horizon, focusing on the Homecoming market is a good candidate for a meaningful pivot that isn’t completely off brand.

Many women who go to Homecoming will eventually get married, but you also have major life events in between:

Graduation (parties, related events)

College Formals

Friends and Family member’s weddings

Engagements

These can offset likely losses from fewer weddings.

But their 1 existential execution mistake: Homecoming isn’t a collection within Lulu’s. It needs to be its own brand.

16–18 yos aren’t/don’t want to use the same apps that “adults” in their late 20s/30s use.

They want their own cool version of the app and shopping experience. Curated to their culture.

If shifting to younger demo life moments were the critical strategic play, they should have properly invested. To break it out as its own store (could have launched on Shopify in 2 weeks) and tested that it was worth the continued investment.

Now they’re stuck in the middle, trying to unload $50 prom dresses to Gen Z while also convincing Zillennials to buy $300 wedding dresses.