🧠 The Takeaways

Today, we’re prepping our stalking horse bid to take Torrid private after it’s consumed by $670m+ in debt.

Shut down 80% of its stores.

Invest more than 5% of Rev in Marketing to grow this thing.

Become the go-to Fast Fashion Plus size Retailer, taking Fashion runways to Plus size women across America.

+ Don’t overcomplicate this.

LBAB! Community - 1 Offer. Everywhere.

This is a short one today because we’re ALL Swamped.

Make 1 compelling offer and put it everywhere:

1) Pop-Ups

2) Welcome/Cart Recovery Flows (Email + WhatsApp + SMS).

3) Onsite Banner

4) Chat Bubble

5) Home Page Hero

6) Key Collection Pages

7) Retargeting ads

The goal: have your offer seen as many times as possible. Make sure it’s on every piece of real estate you own.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

Torrid (the Hot Topic spin-off targeting Plus size women), is -95% all time, trading at $1, seeing continually declining sales, and drowning in debt.

Share Price: $1.20

Market Cap: $119m

L5 Performance: -95%

P/E Ratio: 38x

This biz is slowly marching to bankruptcy. One wrong move, and creditors own it.

Today, we’re going to prep our stalking horse bid for Torrid when it inevitably goes bankrupt.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $1.1B (-4%) 👎

Gross Profits: $413m (+2%) 🫥

OPEX: $356m (+2%) 😬

Net Income: $16m (+45%) 😕

TLDR Analysis: Hanging on by a thread.

Reduced COGS saving this biz while Rev slowly declining. 😶

SG&A increasing while Rev decreasing. 👎

Net Income slightly rebounding. 👎

Torrid is operating with no cushion.

They’ll struggle on until their debt ($679m in Liabilities, with $270m+ being a term loan & another $250m+ as Asset-based liabilities) kills them.

Let’s TLDR This Biz

Founding:

Torrid launched in April 2001 as a subsidiary of Hot Topic Inc, targeting Plus size women.

The "Aha" Moment:

Inspiration came from Hot Topic customers who filled out numerous comment cards requesting larger sizes.

Explosive Growth:

Quickly found success, opening six stores in its first year.

2008: Hit $151m in Rev.

2015: Separated from Hot Topic into its own entity.

2019: Hit $1B.

The Model:

DTC Retail + Ecom biz selling fashion forward items exclusively to Plus size women.

The Collapse:

Tariff, economic uncertainty, and slowing sales led to 180 store closures.

Let’s Fix This Biz

Here are our 3 moves to get back to $1B.

1) Dump 80% of the Retail locations.

Retail’s been an important part of Torrid’s legacy, but this isn’t a retailer anymore.

Torrid owns and operates 680 stores, planning to be at <400 by EOY.

70% of sales (~$770m) comes from eCommerce.

The mall brands are dead.

Torrid has already made the pivot. They just haven’t rolled the dead leases yet.

Walmart is killing malls. Torrid can die on the sinking ship or gut their retail presence and focus online.

Their Retail operation is a disaster. If Retail accounts for ~$330m in Sales w/ 680 stores, that’s $520k/store/yr.

Horrible, considering an Ave Retail location does ~$1m+/yr to be profitable per location.

Takeaway: You know where dead weight is. Just cut it.

2) Properly invest in Marketing

For 3 yrs, Torrid has spent 5% of Rev on Marketing. It’s no surprise topline is declining ~5-10%/year.

They have some pretty good marketing ideas (e.g., Torrid Casting Call), but they just aren’t spending enough. They need to adapt the DTC playbook for their brand.

@ 37% Gross Margins, they don’t have a ton of room to invest in marketing, but they need to find a way to increase sales again.

Honestly, marketing for an apparel brand isn’t that hard anymore.

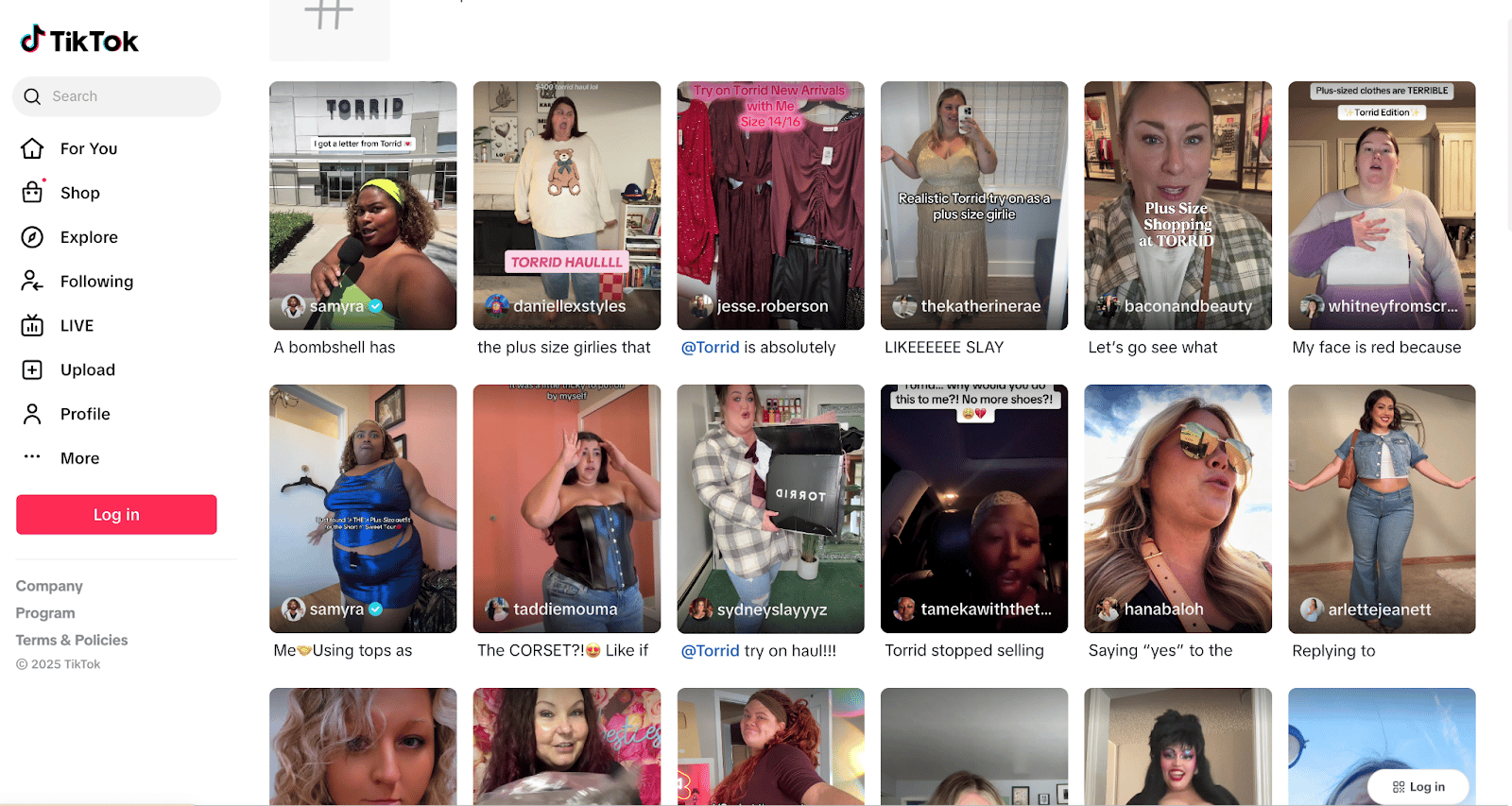

Get a ton of TikTok Haul content (goes viral pretty easily)

Clip the content by theme (vacation, work, causal)

Run ads on Facebook/IG.

If 70% of sales are already on Ecom, double down here. Create a well-known brand that dominates Social media then ripples into other channels.

An Apparel brand like this already has so much repeat built into it.

Now, it’s all about building viral excitement for new products to draw people in.

Takeaway: 5% of Rev on Marketing = life support. Not growth.

3) Become Fast Fashion for Plus Size Clothing

Walmart is eating Torrid’s lunch.

No offense to Torrid’s merchandise team, but their catalog’s filled with horrid products at deep discounts.

Their Products scream “Landfill” over “I care about the latest trends”.

Considering this brand is 100% focused on women, pivoting to more trending products will be the driving factor for the brand.

There aren’t many players focused on stealing the latest Fashion runway trends and creating them for plus size customers—basically just Eloquii.

This is a white space for Torrid vs. competing for the bottom of the market with Walmart who will crush them on scale, pricing, and distribution.

The New Model: rip off every major NY / French fashion house in sizes they’d never make, for a fraction of the price.

The average woman in America wears a size 16 dress.

~54% of American women are considered Plus size (14+).

The majority of latest fashion is not in size 14+.

Takeaway: Always tackle your market’s white space.

Final Thought

Torrid’s history involves 1 of the most gangster acquisitions + PE moves I’ve seen.

It really pushes the bounds of what’s legal.

The quick context.

2013: Sycamore Partners acquires Hot Topic for $600m (Torrid’s a subsidiary of Hot Topic).

2015: Sycamore separates Torrid into a new entity for $55m (insanely low valuation), leaving Hot Topic debt providers enraged.

2021: Sycamore takes Torrid public (Hot Topic is still private) for $2.5B, selling 25% of the company for $266m.

But this is where things get questionable.

Every penny raised in the IPO goes straight to Sycamore.

They don’t use any of the IPO capital to invest in Torrid. Unheard of.

So Sycamore still owns Hot Topic. We have to assume they’ve made money back owning that asset (Bigger at acquisition) for 12+ years. We also don’t know how else they made money on Torrid on the way up.

It’s not the best look for the PE industry but another great lesson in how the true financial players here monetize their assets.

The way the real players make money isn’t always about the maxing growth or profits. They know what their assets are worth and figure out how to collect cash accordingly.