Update your email preferences or unsubscribe here

TLDR;

- LBAB! What started off as a warning

- Checking in on our 2023 Predictions

- 2024 Predictions

LBAB Community:

At the beginning of 2023, I set out to launch another newsletter. It’s been amazing to see this scale from an idea to over 3,059 amazing hoomans who tune in weekly to join our theoretical Takeover firm.

I wanted to share more valuable information than just another eCom Marketing newsletter. I had been trading eCom/Retail stocks more, working with PE funds on acquiring eCom bizs and getting much more into market trends.

It was time to start sharing these trends to help readers like you better understand your biz.

What started as a warning back in April has turned into a wonderful community looking to theoretically Buy A Biz! together.

This year we analyzed:

$50B in GMV across

27 eCom/Retail brands

+3 powerhouse SaaS players (Shopify, BigC and Klaviyo)

Explored 50+ out-of-the-box Growth Strategies for these bizs.

It’s been a truly incredible year. We also got our hands dirty on data research projects + personal finance:

This whole crazy adventure wouldn’t be possible without all of you.

Seriously, there’s a reason I get up on a Sunday morning to read through 10Ks. It’s now extended far past just my personal curiosity. And it’s an honor to earn your inbox every Sunday.

The replies, connections, and opportunities this year from sharing this incredible journey with all of you is really why we do it.

This has now grown into a team of 3 and without them we wouldn’t be able to bring you the high-quality content every week.

I also want to thank our sponsors throughout the year.

We have a lot of new concepts we’re testing in 2024 to expand LBAB! We’d love to know what you want to see more of.

What do you want to see more of from us in 2024?

Let’s wrap up 2023, see how we did, and close out the year with some big, bold 2024 predictions.

Let’s Review the Data

Overall, across the 27 brands we analyzed in 2023, OPEX rase faster than slowing Growth. Crippling profits.

2022 Financial Summary (YoY Comparison):

Sales: $50.3B (+5%) 😐

Gross Margins: 45% (+2%) 😐

Gross Profits: $22.8B (+7%) 👍

SG&A: $17.4B (+13%) 😰

OPEX: $23.3B (+15%) 😰

Net Income: $-2B (+692%) 🤮🤮🤮

SG&A looks like the greatest profit killer, increasing +13% YoY and consuming 75% of overall OPEX across all 27 brands.

Selling + Staffing got more expensive. A hard trend to reverse that will require more creativity in the New Year.

There’s no 1 story for all brands:

Some brands had a fantastic year and were able to turn the ship around, i.e., E.L.F., FIGS, and On Running.

Some bizs weren’t so lucky taking heavy losses: Tupperware, Warby Parker, Crocs.

Brands like Smile Direct Club, Amyris, Instant Pot, Bed Bath & Beyond, all went bankrupt.

Plus there was the Worst Acquisition of the Year: Blue Apron by Wonder Group.

Some brands extended their sails and captured the changing winds. Others were violently thrown against the rocks and weren’t able to survive.

It doesn’t look like the winds are calming in 2024. Let’s talk about how we can keep your biz sailing. But first we have to keep me honest.

Let’s Revisit This Biz: 2023 Predictions

🤩 What we got right:

Paid Ads got better in 2023 as Meta received the bulk of brands’ budgets this year.

TT became more viable and Google reset.

Smile Direct Club filed for bankruptcy and didn’t secure a bid to remain in biz.

😬 What we got wrong:

The Consumer Credit Bubble didn’t pop.

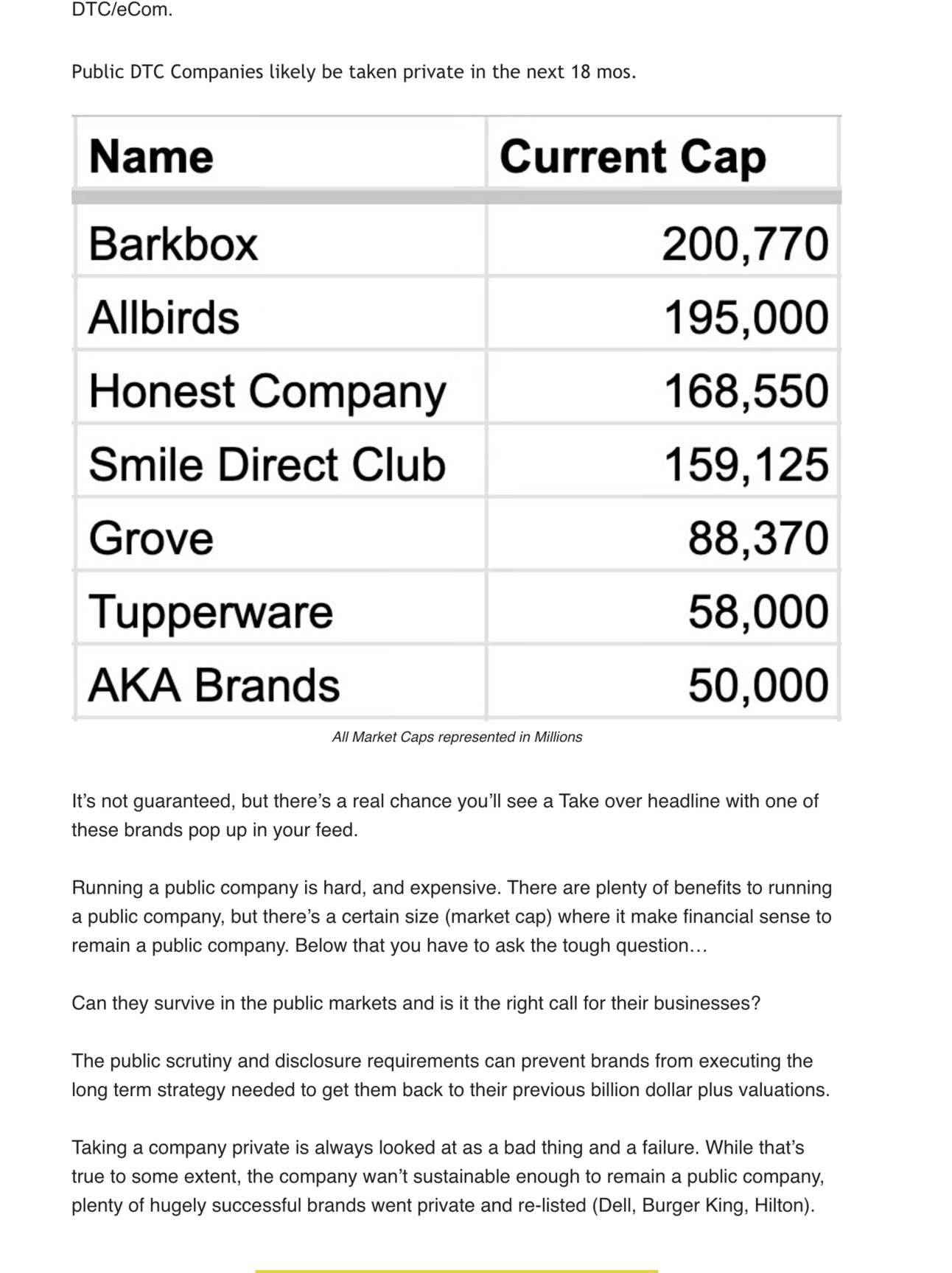

2023 wasn’t the year of major privatization of DTC brands. None of the brands I called out in April were taken private. More went bankrupt than I expected, and even more than that were able to restructure their debt.

Grove wasn’t taken private, but it was delisted.

Honest Co didn’t go bankrupt.

🧐Jury’s Still Out:

Brands will finally learn their financial fundamentals or die. (I’d say it’s half and half at this point.)

Klaviyo Post IPO dip (✅) then rebound (🧐)

😓 Bankruptcy Watchlist:

Tupperware: Was able to Restructure its debt, but has a struggling biz model with still a crushing amount of debt.

Let’s Predict 2024:

Here are my 3 major predictions for 2024:

1. The Valley between “Haves vs. Have-Nots” will widen

The Haves will gain more value and market share.

The Have-Nots will continue to struggle.

Consumers will continue to go back to familiar brands. They’ll buy more from them as they gain more confidence in the economy. They will purchase more of what they already know they love.

But the days of sprinkling money across a variety of brands are behind us.

Big Brands with more awareness and trust will thrive as they capture more consumer spending as it pours back into the market. This flywheel will propel these brands into the next level of growth as they can leverage

Cleaned up Supply chains

Accelerating sales cycles

More capital to grow faster.

The Have-Nots will continue to struggle as it becomes more expensive to advertise to new customers. As COGS + OPEX (non-marketing) get more and more expensive, it will create a vicious cycle, making it too expensive to meaningfully acquire new customers.

Regardless of whether we’ve beaten inflation or not: Wages, Ad prices and Materials costs have all increased and aren’t reducing. All those factors reduce the $ to spend on acquiring new customers.

The bizs that successfully hit the gas and took advantage of the hesitations in ‘23 will make out like bandits over the next 5 years. The ones that didn’t capture the opportunity are facing an uphill battle.

The window hasn’t closed, but it just got harder to sneak through it.

Takeaway: 2024 = Big Banks take Little Banks.

2. Funding returns, but Trickles in.

The Fed cutting interest rates will positively impact bizs and the overall fundraising environment. Just not as much as everyone, or the stock market, is hoping.

Interest rates will cause:

More Confident Consumers.

Cheaper Debt

Investors to Increase Funding

The problem: It won’t be the pop everyone is praying for.

As rates drop, consumers will spend more money. But consumer credit is still exhausted. They still need to pay down their current loans before accessing more. 65% of the US still live paycheck to paycheck.

Consumers don’t have piles of dry powder to tap into with rate cuts, which will help cash flow through the economy but won’t open the floodgates.

Rates dropping will open up the debt markets and reduce the return thresholds investors need to make any investment that isn’t in T-Bills attractive. But Rates dropping to the high 4%’s looks VERY different from the ZIRP environment.

Returns on 0% Bonds 🤮

Returns on 4% Bonds 👍

The other important peice of rate cuts is the dry powder sitting on the sidelines. These are the LPs + Wealthy Investors looking to move Billions -> Trillions of dollars through investments.

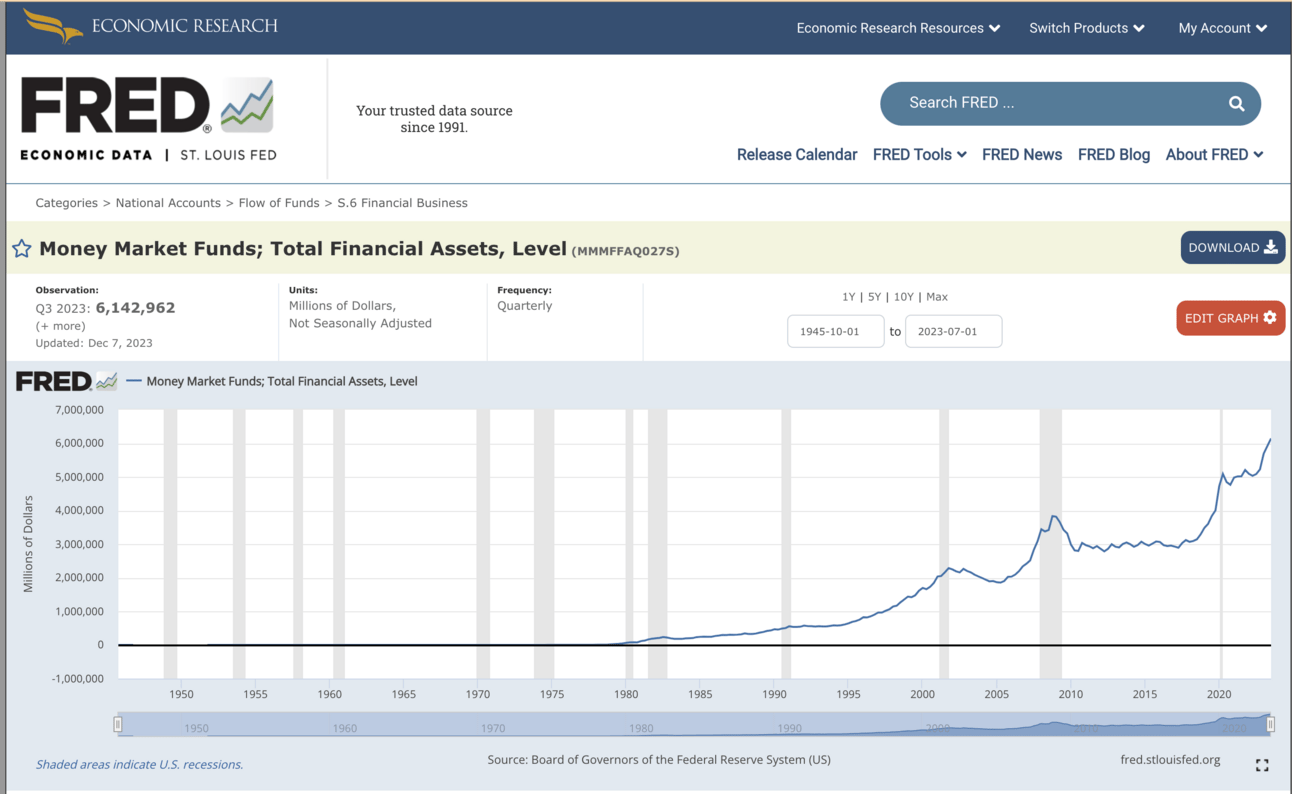

You can see the line where the amount of money they put into money market funds (aka T-Bills) went vertical from Q3 2022 when the Fed started raising rates.

Now that the returns on those investments will fall (lower interest rates = lower returns), it will push money back into other asset classes. This will be good for some M&A but expect it to be in line with rate cuts. Money won’t pour in on 0.25% cuts, but it will once cuts are in the 1% range.

A big round of fundraising isn’t going to swoop in to save too many of the deeply unprofitable bizs. But the absolute best of the best will be able to grab more cash. Whether they need it or not.

Everyone else needs to build their biz the old way: Credit cards, Cash Flow, and Revolvers (CCR).

3. M&A, Bankruptcies, and Shutdowns will continue to rise.

In the second half of 2023, we saw exit activity pick up. As more loans came to term, significantly more brands faced the music. As these loans continue to reach maturity, this trend will continue.

Hopefully, we see as few bankruptcies as possible, but declaring is an undervalued and important resource for the right bizs. The only other alternative is to shut the biz down, which provides little to no legal protection.

M&A will pick up now that exit multiples are returning back to normal levels. In fact, I’d expect M&A to pick up substantially, as there are good bizs out there that need more resources, or the founders are ready to move on:

Additionally, a lot of founders just want out. They’ve run their biz for 7-15 years. Built a good biz. Survived the roller coasters through COVID lockdowns, iOS14, rate hikes and whatever is coming next. Now, it’s time for them to move onto the next thing.

Physical product bizs are grueling. The past 10 years have greatly changed how this game is played. Many founders had a great run, and it’s time to move onto the next major focus of their lives.

If you know anyone I’m always looking to talk.

Takeaway: Exit activity will pick up. But it won’t be a flurry.

Final Thought:

2024 will be a better year for the industry, but it won’t be all sunflowers and roses. There are still going to be some bumps in the road.

That being said, Growth is back! Consumers will feel richer, and that will translate to more spending.

But it hasn’t been this expensive to run a biz in a decade.

Vendors and employees will expect to get paid more.

CACs will continue to rise as consumers are more discerning and less expertimental.

Creative grow plans will be the key to thriving in 2024 and beyond.

Also, all of this is completely dependent on the Fed actually making the rate cuts they’re proposing.

Oh, and this is all heading into one of the most controversial Presidential elections in recent American history, which regardless of where you are in the world, will impact ad prices.

Regardless of what happens, I’m incredibly excited to dive into another great year with you all and figure out where we’re heading next.

We have some exciting new projects and ways we can get you more and better insights on how to grow your biz.

Takeaways: Major ‘24 predictions

2023 was one heck of a year. 2024 will get better, but the pendulum won’t swing all the way back. It’s still going to be a grind.

The Valley between the Haves and Have-Nots is only getting wider.

Funding is coming back. But the bank isn’t open.

M&A and Exits are coming back.