🧠 The Takeaways

Today, we’re acquiring Steve Madden to streamline its portfolio + 2x down on its viral growth.

Chop the portfolio from 6 brands to 3.

Heavily invest in men’s shoes.

Turn retail locations into Fashion week catwalks to reignite viral shopping content.

+ My $50/mo EA.

LBAB! Community - My $50/EA

In early 2024 I trialed an Executive Assistant (EA) based in SE Asia.

The concept: someone to manage my calendar, email inbox, and send me a daily briefing.

The amount of work I had to do on training (preferences/scheduling/follow-ups) just didn’t make the $2-4k/mo make sense.

Now, I’m using Lindy.AI (AI version of Zapier) to:

Schedule meetings

Manage my calendar

Manage my inbox (Organize and draft replies)

Record + Create Follow ups for meetings

Create a daily briefing

Monitor competitors + our brand mentions

And now, I’m having it move into automatically managing backend tasks:

Updating Spreadsheets: Data input + analysis

Updating Records: CRM, Documentation

Building hiring lists

It’s starting to get more expensive, but just the core EA tasks would cost $50/mo.

I tried doing this in n8n and ChatGPT operator, but neither really nailed it.

But the greatest benefit from getting something live that I like (still needs work but a solid V1) is every employee in my bizs will now have this by default.

The next version of this project is creating the template to roll this out for everyone on our team.

Previously, EAs were only reserved for execs because it was too cost prohibitive.

But $50/mo/employee to make everyone more productive on a daily basis? That’s a no brainer.

+ why did I choose Lindy? Because while watching this Youtube video I was able to onboard and set up the 4 core AI Assistant agents I needed to get started.

Their UI is the future of AI Agent + workflow builders that I believe we’ll all use.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

Steve Madden (The viral women’s shoe + handbag biz focusing on funky designs) has gotten hammered this year -26% on Tariff woes and lower forecasts, but at its core, it’s still strong and doing well.

Share price: $34

Market Cap: $2.5B

L5 Performance: +13%

P/E Ratio: 27x

But their focus on lower income households + Tariffs + a weak economy will take them under.

Today, we’re going to acquire Steve Madden for $3.2B to scale them up, get them in fighting shape, and flip them for $10B in a decade

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $2.2B (+15%) 👍

Gross Profits: $936m (+12%) 😐

OPEX: $698m (+14%) 😕

Net Income: $169m (-3%) 👎

TLDR Analysis: Growing but not throwing off more cash

COGS increasing faster than Rev 👎

OPEX increasing in line with Rev. 😐

Net Income shrinking. 😓

It’s great to see them expanding + I’d love it if they broke out their SG&A into specific numbers—this report screams headwinds.

Some are definitely macro, but others are the Corp focus.

This biz has an incredible foundation + is performing well, but with a couple of missteps, it’ll get ugly fast.

Let’s Protect This Biz

Here are the 3 ways we’re going to protect this iconic Women’s fashion brand.

1) Clean up their Portcos

Steve Madden is operating as a top tier DTC brand, but you probably didn’t know they own a portfolio of brands.

Besides Steve Madden itself, they’ve acquired the entire biz/core IP of:

If you spend 30 seconds looking at the HP of every brand, and I asked you, “What is the core brand across the entire portfolio,” you’d say: “Shoes + that 1 clothing brand”.

This is another 1 of those “logical,” “smart” decisions but terrible portfolio construction strategy, and it shows: despite Topline +15% YoY, Gross (-2% YoY) and Net Margins (-16% YoY) are shrinking.

There is no flywheel here.

Acquiring + scaling 1 of those assets doesn’t make the portfolio better/sell more shoes.

And don’t come at me with weak tea like “Synergies” or “efficiencies.”

So, we’re doing a massive clean-up project.

By the end of it, Steve Madden will have 3 portcos max, including Steve Madden.

ATM might be a great biz, but a Shoe + Handbag biz running a clothing biz ain’t gonna happen on my watch.

Blondo + GREATS are both solid up-&-coming brands but they’re product lines/sub-brands under Steve Madden.

Dolce Vita is big enough to play #2 to Steve Madden’s main brand energy.

Betsey Johnson is definitely a strong brand that needs to remain independent and wouldn’t make sense folded in. But I’m not reserving the coveted #3 spot in the portfolio for it. It’s too “ outdated Steve Madden.”

It’s a better fit for WHP / Authentic Brand Group who likes acquiring strong brand IP to license it out.

Takeaway: M&A wins come down to Employee + Consumer focus mastery.

2) Move into Men’s Shoes

This is a $2B Rev/yr shoes biz basically only focused on women’s.

GREATS (late 2024 acquisition) is the only brand I’ve seen with an image of a man on the HP.

Women are a much better segment to focus on and have built Steve Madden’s brand, but at their scale, they need to roll their hit playbook into the other 1/2 of the population.

They’re already tackling this from a 2-pronged approach.

Steve Madden Shoes + acquiring GREATS.

But there’s a major flaw in their strategy.

Men buy 5–10 different styles of 3–4 core shoes types (sneaker, dress, boot, sandal/slipper) without the exponential variation that Women have.

The hit maker playbook for the core brand would be to create the affordable knock-off of the viral Luxury version of the hottest men’s product.

Here’s where their current strategy is hitting a conflict.

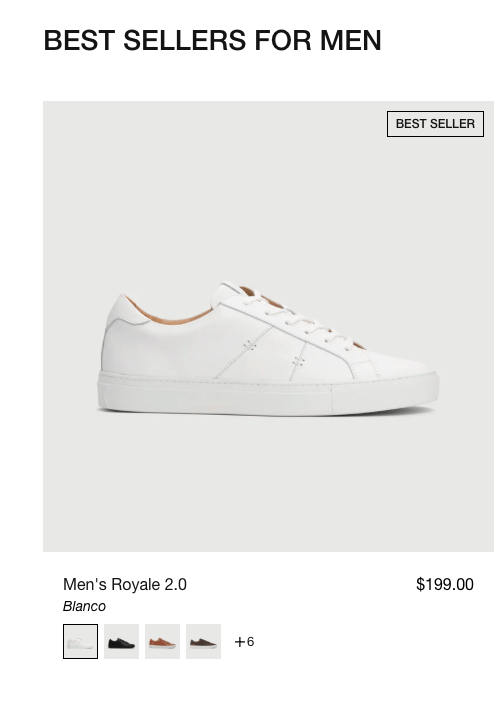

Here’s Steve Madden’s Best selling men’s shoe vs. GREATS:

Notice a similarity?

$5 if you can tell which is from Steve Madden and which is from Greats without searching for it.

Steve Madden should focus on core product production, keep everything under the Steve Madden brand, and play the ELF dupe strategy:

ID viral/trending men’s shoes @ a $500 price point.

Make the <$150 version.

Be the first to aggressively push it through Social + Retailers.

Steve Madden has already mastered the viral-product-push playbook on the women’s side.

If they can roll it out to the men’s side as well, there’s an enormous market they can expand into.

The beauty of viral products in their category is they're highly giftable.

“Must-have men’s shoes” means their female customers are buying more.

BUT do they really need GREATS to do this?

Takeaway: Once you’ve mastered the playbook. Apply it to more relevant markets.

3) Launch new Runway Retail Locations

Steve Madden has 291 international retail locations, but their retail locations look like normal shoe stores.

Nothing about this screams: “ I need to go here, tell my friends about it, and post on TikTok.”

For a brand that’s so digitally advanced across their eCom stack, it’s time to leverage their retail locations to drive more WoM.

Redesign in-store experiences around a Fashion catwalk design.

Make the customer feel like they’re at the NY or Paris fashion week when trying on shoes.

I made this image in ChatGPT in like 2 mins

How to make this go viral instantly:

Seating: so I bring friends/family to sit and watch.

Walk 1-at-a-time experience with feedback from other customers, making customers feel like models.

Leave a little section where kids can prop up their phones to take viral videos.

This would give crazy flywheel power from customers seeing real “models,” in real life, live in their retail locations.

If they execute this well with Influencers, they’ll have lines around the block for the experience.

After feeling so great about an in-store experience, customers will be leaving with thousands of $$$ worth of items.

If a customer’s going to have the confidence to walk down the catwalk in a pair of shoes/boots, they’re going to pair them with handbags + accessories.

Takeaway: Owned Retail must be designed to viral experiences.

Final Thought

Steve Madden’s challenge is to execute their evolution from brand to platform.

Estee Lauder, L’Oreal, and Nike are incredible examples of moving from a brand to a platform of brands where customers come for the core brand but buy from others that drive the overall portfolio.

The core brand will continue to compound, but at this stage in their evolution, they are a Shoe manufacturer with strong marketing + Distribution.

That is the biz model.

Slapping on new logos + products for specific markets, then running those shoe/accessory-related bizs through that model is how Steve Madden continues to scale.

Once we clean up the portfolio, the model will crush the core focus:

Take the best/biggest shoe brands.

Feed them through the system.

Find the next most relevant product set to pump to $1B in sales.

This system takes decades and is incredibly hard to build, but once you’ve mastered it, the strategy becomes a factory line.

The hardest part is staying focused and sticking to the model.