🧠 The Takeaways

Today we’re taking a long stake in Yeti and riding it to a 5x exit.

Grinding + doing unsexy growth that works.

Acquire Solo Stove adding $500m in Rev for pennies on the $.

Take this brand international + get Yetis into hands across the world.

+ Why you need a hobby.

Let’s Community - Find a hobby

You need a hobby outside of work. I know everyone is grinding and thinks if they step away from their biz for an hour it will implode. (Been there countless times).

But you have to do something that isn’t staring at a computer screen all day.

(Taking care of your family and spending time with an SO doesn’t count as a hobby.)

This was one of my major goals this year, and I’ve already accomplished it. Over the holidays, my friend taught me how to play Catan. And it has definitely become my new hobby.

I’ve probably played 10x in the ~4 months since I’ve learned the game, and it’s a great way for my brain to unwind, while still being active on something I’m interested in.

I’m not going to pitch you all the benefits of finding a hobby, but the key reason why I do it is because it time boxes work.

The more I look forward to my life outside of work, the more I’m forced to be more attentive and productive at work. And shipping great work matters more than time in the seat.

Also doesn’t hurt when the hobby is a social activity.

I focus more on my priorities because I have to get to other parts of my life. Also, it just makes you a more interesting person.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. Years ago I was an investor in Yeti but sold my positions before the COVID Boom. And I was never here.

Yeti, the unofficial-official millennial cooler + drinkware continues to hit singles and doubles in the public market:

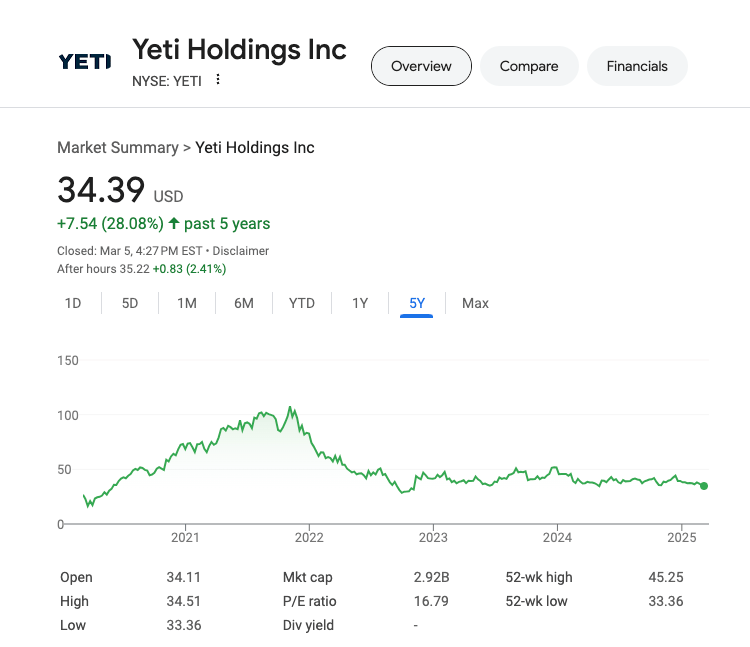

Stock Price: $35.64

Market Cap: $3.02B

L5 Performance: +32%

It might not be sexy, but it works.

Today, we’re going to take a majority stake in Yeti and drive this bad boy to $15B.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $1.8B (+10%) 👍

Gross Profits: $1B (+13%) 👍

OPEX: $818m (+14%) 😐

Net Income: $175m (+3%) 🤷

TLDR Analysis: Unsexy, But Efficient

Net Income only increased +3% YoY 🤷

OPEX growing faster than Gross Margins 👍

Still hitting $1m+ Rev/Employee. 💪

These numbers aren’t gonna grab headlines, but it’s solid dependable growth. 10% YoY growth while they were still dealing with a product recall is impressive. Especially considering they’re a drinkware biz at this point.

This is what best-in-class DTC at scale looks like.

Let’s Scale This Biz!

Here are my 3 moves to get Yeti to a $15B valuation.

1) Keep grinding it out

Yeti has basically added 5-10% of Topline to the brand every year for the last 4 years. Those 5-10%’s are $100-200m a pop, so it’s no small feat.

It may not look impressive for hockey stick growth seekers, but this is how real, massive, successful consumer brands are built. Consistent, stable growth with predictable profits over time.

I know this one isn’t a fun growth hack, but if you have a meaningful scale, a great brand that customers love, and you’re growing steadily, the best way to ruin it is to try to do too much.

It may not be headline grabbing growth, but 10% Net Income Margins @ ~$2B in Topline means Yeti’s profiting ~$200m/yr.

That 10% compounding over another 10 years will lead to incredible returns.

Takeaway: If you have a good thing going, keep your head down and keep grinding.

2) My Annual pitch for Yeti to buy Solo

They may be able to wait until Solo goes bankrupt, but at a $68m market cap (2% of Yeti’s cap), Solo Stove is a natural product expansion where Yeti can pick up $400m in Topline for cheeeeap.

I don’t have the data on this, but the Yeti x Solo stove audience overlap must be sooo high. They’re both heavily investing in outdoor, and the well-off millennial customer will drink more out of their Yeti mugs over a Solo campfire.

Know it’s not relevant but couldn’t help myself.

Solo clearly isn’t going to make it. But Yeti can scale well past $2B in Topline and add some meaningful growth back to Solo’s narrative.

Takeaway: Always pick up easily integrable, cheap Rev when you can.

3) Translate the brand internationally

At ~$2B in Topline, Yeti needs to figure out how to translate the cool American drinkware biz into an International brand.

81% of Sales come from the US.

They have a strong base of American customers who love them, but you don’t become an iconic $10B/yr topline brand from only selling products to Americans.

Yeti has the brand potential and time-in-the game (~20 years old) to start bringing those wins into other big Outdoor/bougie camping cultures.

In 5 years, Yeti needs to have 30-40% of sales coming from Non-North American markets if they want to hit the next growth curve.

Takeaway: Yeti is at the scale where International has to happen next.

Final Thought

Yeti has always been my DTC bellwether. No matter where the industry is going, Yeti has always been the brand that has

Kept a level head

Run the playbook most brands should follow

Proved you can ride this biz model to heights most people 10 yrs ago didn’t believe was possible.

What always get lost in the DTC headlines is how to actually build the massive aspirational brands.

It just takes time to build.

Yeti was founded in 2006, went public in 2018 and has been grinding out 10% growth since COVID.

They didn’t raise a ton of money (1 Pre-IPO PE round where they sold 66% of the biz) or make flashy marketing splashes.

But this is the real playbook.

30-40 years of grinding out building a brand. Taking wins when you get them, not overextending yourself, and stacking the small wins until they become big wins.