🧠 The Takeaways

Today, we’re taking an activist stake in Revolve to get it to the digital profitable future it always promised.

Double down on killer events like Revolve Festival.

Create a Talent agency to monetize matching influencers with hit products.

Sell off trend data to monetize the real value of the biz. Understanding customer trends.

Plus, how Coco did in June.

LBAB! Community - The Coco June Update

Momentum transferred into results. More brands are starting to use and get more out of Coco AI.

Product:

Our Klaviyo Integration is live in the Klaviyo Marketplace!

It’s hard to share just how much work went into building this out. Importing and passing CRM level data is no small feat, and I’m proud to say that we’ve built some really cool features.

Automation Builder is next up in the pipeline.

Then I have a lot of ideas for AI.

Growth:

We just missed the June new logo target. We signed up some great brands but fell 3 short of where I wanted to be.

We’ll have to make that up in July.

Team:

No updates here. The team is cooking. We’re picking up momentum, and I’m still doing everything that isn’t dev.

Financials:

We’re making payroll. I’m still not taking a normal salary, and I had to reinvest more money to crush some credit card debt that has been floating around.

I’ve got a tight grip on our finances. We’re in the pre-holiday growth mode heading into what should be a massive holiday.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

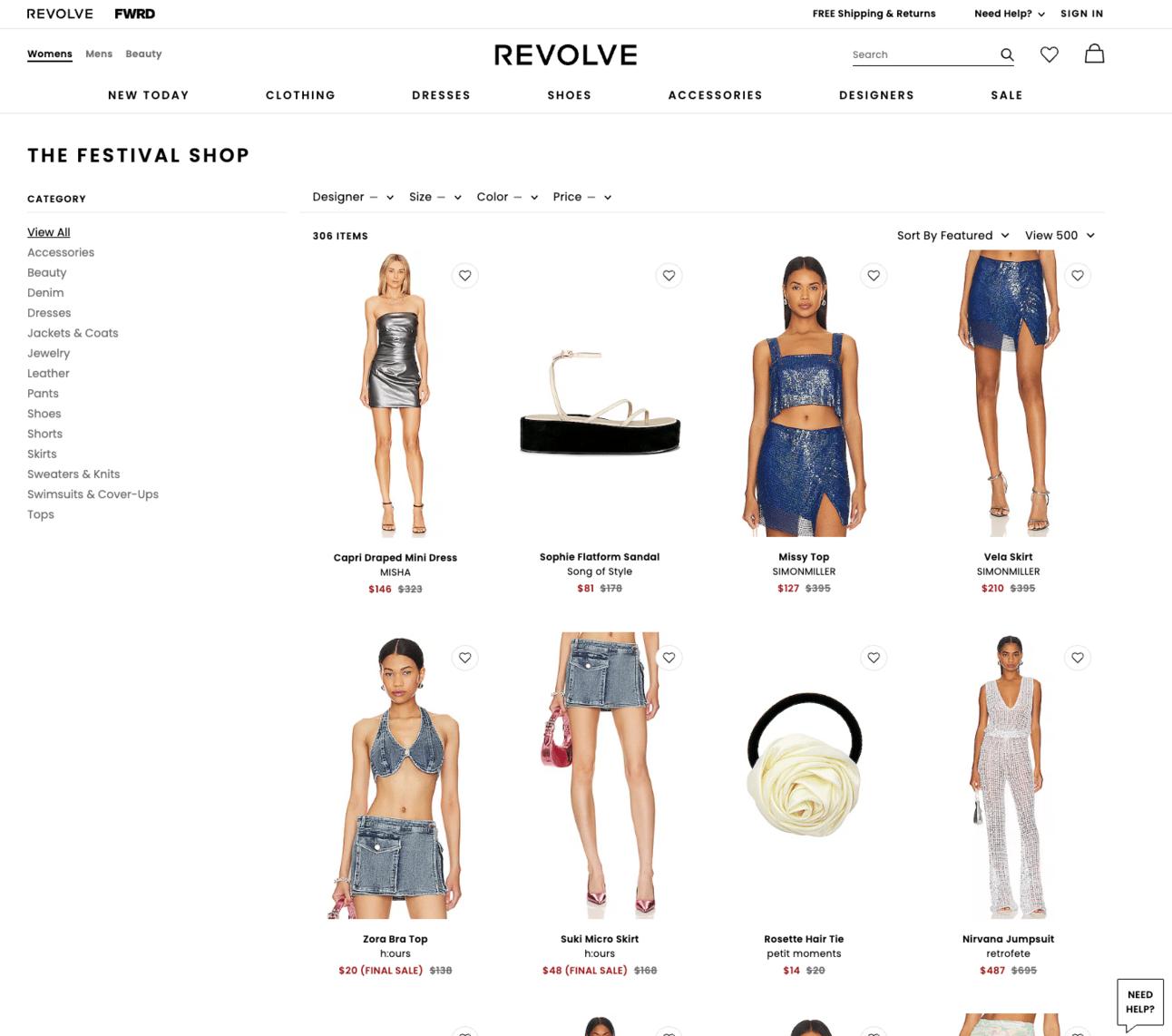

Revolve Group (owners of the Instagram/TikTok Elite fashion brands Revolve & FRWD) is clawing at profitable growth while maintaining their status as the affordable luxury Fashion brand in a tough consumer market.

Share price: $20.28

Market Cap: $1.45B

L5 Performance: +34%

P/E Ratio: 28x

This biz has worked really hard and stayed disciplined to go nowhere for 3 years.

Today, we’re going to take an activist stake in Revolve Group and force them to leverage their millions of consumer data points to flip their barely profitable Influencer Retail biz into a data-driven marketplace for brands.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $1.1B (+6%) 👍

Gross Profits: $593m (+7%) 👍

OPEX: $541m (+2%) 👍 👍

Net Income: $48m (+74%) 👏

TLDR Analysis: Running a tight ship

Rev inching up while keeping COGS flat. 👍

OPEX had the smallest increase. 👏

Doubled Net Income Margin YoY 👏👏

This biz is disciplined + operating at a high level in a tough market. They’re nailing the Retailer playbook while inventing creative ways to get attention.

Problem is, at the end of the day, it’s an incredibly low-margin Retail biz and isn’t growing fast enough to hit a massive scale ($20B+) where the Retail biz would print massive profits.

Let’s Fix This Biz

Here are my 3 moves to save this biz.

1) Double Down on Unique Events

Revolve’s entire biz model is based on being the cool, attractive platform where young women go for inspiration.

That is a never-ending battle of chasing + creating trends.

The best way to do that:

Continue must-attend events like the Revolve Festival for cool young people, which is the same weekend as Coachella, in the California desert, and positioned as a more exclusive, celebrity and brand activation.

This is the future of the brand.

It’s a “creating the trend” play. Especially when you sell the products to wear at your own festival.

But the real opportunity here is to double down on these types of events to flip a cost center into a profit center.

When your festival is dubbed “Only where the TikTok Elite are invited,” that presents an incredible monetization opportunity that isn’t just selling more clothes.

3 moves from here:

Sell more sponsorships

Work with the brands Revolve sells to run paid activations at the festival.

Run more must-attend events around major in-market classic events.

A great ex.: run a “Revolve Fashion Week” during New York Fashion week. Sponsor the event to promote your new collections that all the influencers will wear to the event and featured on Revolve.com.

ID the top 5-10 events/yr customers care the most about -> Create the Tik Tok elite version -> Monetize it.

Takeaway: Retail margins are razor thin. Flip $100m Marketing budget into profit = 💰💰💰

2) Become a Talent Management Biz

The brutal but beautiful thing about being an Influencer Fashion Retailer: your taste is what matters.

Picking/betting on the upcoming trends (pieces, models, how customers will react) is the value that Revolve generates in “the marketplace”.

Starting a talent management will definitely be a side quest and makes more sense as a separate biz owned by Revolve.

But Revolve already does so much matchmaking:

The right products

From the right brands

To the right Influencers (/models)

In the Right Distribution Channels

For the right seasons

The major economic value they aren’t properly monetizing is connecting the right influencer with the right brand for the right product.

If they had a talent agent arm, they could recreate the magic of the Kendall Jenner x FRWD deal (Revolve’s Luxury brand) with the 1k+ brands they currently work with across both platforms.

Negotiating:

Deals for influencers to work with brands

Collabs + Influencer products/lines with brands

Promotion + Distribution deals for those products across their platforms

At Revolve’s scale, the real biz-behind-their-biz is convincing the brands that Revolve knows how to sell their products for them.

Takeaway: Master skills to sell products. Monetize the Skills.

3) Sell off their Data

This is the most insane but lucrative layer they can add on to the biz.

Sell the data they collect on customers to their suppliers + industry experts.

The greatest asset Revolve Group has is the reactions + responses they get from their 6m customers, 7m+ Social followers, and 25m+ views/yr across social media.

It doesn’t necessarily need to be sold to competitors, but the value is leveraging that data to all the brands that sell on their platform (+ others that don’t) is worth more than Revolve’s $1.1B ‘24 sales. And the data biz model is a high-margin self-reinforcing Revenue loop.

Brand sells their products on Revolve’s platforms.

Brand buys data to better understand customers’ purchase trends

Brand leverages data to buy more ad/merchandising opportunities in Revolve’s ecosystem.

This is nothing new.

The major Retailers/Department/Grocery stores have been doing this for decades. But when you throw the digital firehose -> $$$$$.

Takeaway: Sell off their data to explode margins.

Final Thought

Revolve is a great case for the non-Amazon marketplace with a very well defined value prop.

The problem?

They can’t escape classic razor thin Retail margins. Despite having 52% Gross margins (great for a Fashion biz), their Net profit is only 4%.

And that’s rebounding after bottoming out at 2% in 2023.

All the great Digital Profitable promises didn’t pan out.

Amazon has already trekked this path and realized that services (Data infrastructure, Seller fees, Ads, Services) on top of their marketplace are the only way they’ll make a real profit.

Revolve can call themselves whatever they want, but at the end of the day, the biz model is Retail.

With Sales flatlining over the last 3 years, it’s time to start layering on the profitable units.

$1B+ in Retail sales isn’t nothing, but at <5% Net margins, they are 1-2 tough years away from being out of biz.