TLDR;

- Finding success in the struggle

- Instacart will change eCom forever.

LBAB Community: Getting Laid off 2x in 2016 made my career.

The holiday season reminds me of when I was laid off 2x in 2016. #2 was weeks before Christmas.

Both were hard when the early-stage startups I was working for ran out of money, but #2 was especially hard.

Startup 1: At the end of April, I was told I wouldn’t be receiving a paycheck.

Startup 2: Outsourced the NY team to Eastern Europe 2 weeks before Christmas.

Don’t get me wrong, I hated startup #2, and it was the worst 6 months of my career, but it was the end of the year. All of my network was in eCom, and no one really hires new roles in the final 2 weeks of the year.

Needless to say, I didn’t know how to pick the right startup to join back then.

It was especially painful since I took these jobs after spending a couple years on a failed College startup that we didn’t get to market.

Plus, I was on the verge of dead broke.

It wasn’t the hot start my parents were expecting after sending me to an out-of-state school and lending me $10k to pursue my startup dreams (a story for a different time) instead of “getting a real job” when I graduated.

I had to scramble for rent/food money while living in my 1st NYC apartment. I really didn’t know how I was going to make it.

But I did what my parents trained me to do: hit my network hard.

I picked up consulting gigs from anyone who would have me. I explored if I could work other jobs. I learned how to sell to clients and retain their biz on a month-to-month basis.

It challenged me to the core, and I was wracked with doubt the whole time.

Was I working in the right field?

Had I just burned years chasing a career that wasn’t the right fit?

As much as I never want to relive that level of uncertainty again, I’m forever grateful for those experiences.

It…

Got me into the Shopify ecosystem.

Made me a networker who could sell.

Forced me to control my biz & personal finances.

Impressed the lesson of not relying on others for your income.

Showed me the value of multiple income streams and never relying on 1.

Lasered my focus and purpose only on eCom.

It was the hardest year of my adult life. But looking back 6 years later, it was also the most important of my career. I wouldn’t be here today if I hadn’t gone through the dark times I had that year.

During that Holiday season I started consulting for LuMee again, where I would eventually transition full time as their eCommerce Manager. From there the rest is history.

I’m sure some of you are coming out of this year thinking it was the worst or that this can’t get any worse.

While I don’t know what you’re personally going through, the one helpful thing I can say is spend the time to focus on what’s changed this year. What’s improved? What have you planted that is still blossoming?

Most of the best in biz and life is earned and learned through tougher times. Alright enough pontificating. Let’s dive into the meat of it and figure out how Instacart is going to change Gorcery, and eCom, forever.

Let’s Revisit This Biz: Klaviyo’s Post-IPO Drop

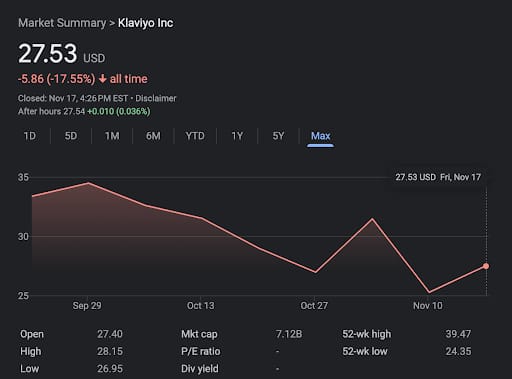

On 8/27, when we covered the Klaviyo ($KVYO) IPO, and made 3 predictions:

So far…

✅: The stock had an incredible pop. It IPO’d atlisting at $9.2B, at IPO then jumped 21% within 2 weeks.

✅: Now, it’s down 16% all time after missing its Q4 estimates.

Jury’s still out on #3. But long term, I’m still bullish on its potential. Missing your first public forecast isn’t what you want to see, but it’s not shocking. Not much has changed about the biz since it IPO’d, so give this 2-3 years to grow into the vision it laid out, and we could see a market cap well into 10 figures.

Currently, it’s trading $3 below IPO price. While the number might sound small, its market cap is -$2.08B from the 9/20 IPO date.

After 2 months in the public markets, it lost more value than the capital it raised.

Now, let’s talk about Instacart, another success story after the eCom IPO lull— and the most telling eCom trailblazer showing us where we’re all skating to.

Let’s Examine This Biz

Instacart, the grocery delivery biz, took an absolute haircut at its IPO back in September. It listed at $10B after its last private valuation was $39B (-74%). 😟

Now trading at $25.25/share with a $6.99B valuation (-82% from $39B valuation), the bottom has fallen out of this stock and is a great ex. of the Silicon Valley Emperor who isn’t wearing any clothes.

Instacart was supposed to reignite the IPO market with Klaviyo, but it looks more like an accounting in correcting late-stage VC mis-valuations.

And with Instacart and Klaviyo both -15% while the overall market (S&P) is +2.5%, investor sentiment is…

2022 Key Financial stats (YoY Comparison):

Sales: $2.5B (+39%) 💪

COGS: $720m (+18%) 💪

Gross Profits: $1.8B (+49%) 😍

Gross Margins: 72% (+7%) 😍

OPEX: $1.77B (+33%) 😰

SMG&A: $999m (+46%) 😰

Net Income: $428m (+686%) 😍😍

EPS: $1.08 (+196%) 😍

TLDR Analysis: Good to be in Grocery

Some insane stats from their S1:

Grocery is a $1.1T industry in the US. (Online = 12% of that).

Processed 263m orders = $29.4B in Grocery Transaction Volume

Sell for 80k Grocery stores

Have 7.7m active customers. 5.1m of those are on Instacart+.

The Rev breakdown by product:

Transactions $1.8B (71% of overall Rev)

Ads $740m (29% of Total Rev)

The big insight here… The Marketplace biz is breakeven ($1.8B in Transaction Rev to $1.77B in OPEX). Ads keep the lights on.

Could they cut costs and make modest profits on the Marketplace? Probably.

But why strive to run a profitable retail biz at 2-5% margins (traditionally), when you could leverage that data to run a 90%+ margin ads biz? Or parlay that into an 80-90% margin Ent SaaS biz?

I’m going to pass on this biz since I don’t like the fact that they’re basically a tech-enabled ad agency for Grocery stores.

But let’s spend today walking through what the next decade holds for this biz and what that means for the rest of us.

Let’s Analyze This Biz

Here’s the 3 industry shifting trends I see Instacart pursuing in the next decade.

1) Become the B2B Grocery SaaS biz

Everyone knows about the Instacart marketplace, the consumer facing app, but the actual biz has 2 other products (Instacart Ads and Instacart Enterprise).

The interesting piece that’s missing in their current Rev breakdown…

0% of Rev is associated with the Instacart Ent solution. All the Rev is coming from Transactions + Ads.

This is the classic “Give away the value until you’ve established the habit,” which’ll be followed by introducing the pricing playbook we’ve seen from Silicon Valley bizs for a decade.

They’re nailing the “Take consumer insights and build B2B products” playbook we’ve now discussed for both SDC and Chewy.

Here are the top 5 priorities for the company pulled directly from their S1.

In 5 years, Instacart will look a lot more like Amazon than a marketplace biz. Yes, the transaction volume will be the largest Rev number, but all of the profits will come from Ads and the Ent product. Very similar to Amazon Ads & AWS.

Here’s how I would sequence the B2B rollout:

Quasi-Freemium customers analytics/insights platform to power the Ads biz.

More in-store Hardware to capture more shopper data

Buy Online Pickup Instore offering for all 85 partners.

SaaS platform to build the Grocery OS.

Consumer is such a large market and gets the most attention, but for an eCom platform to get to a significant scale, there’s always more money in services than sales.

Takeaway: The money isn’t in selling others’ products. It’s convincing them you can.

2) Become the Shopify + Amazon for Grocery

The most interesting opportunity for Instacart is to pivot the Ent platform into an actual platform with an app marketplace.

Instacart’s current consumer marketplace is essentially the Amazon for Grocery. But what if they built the Shopify for Grocery as well?

They’ll always own the experience on Instacart properties and are already building out the feature set for Grocery delivery, but the 1 big miss here is building it all themselves.

What about a 3rd party ecosystem?

Instead of building it all themselves, why not build the platform to accelerate the glacial pace that grocery is adopting technology, insights, and the new services it unlocks?

Bring Developers, Agencies, and Hardware manufacturers into the ecosystem and become the platform they all build on. This industry is filled with so many brick-and-mortar service providers.

Time to digitize the ecosystem, not just the delivery experience.

Takeaway: Is Instacart going to be Amazon or Amazon + Shopify?

3) Re-Imagine the in-store experience

If Instacart continues to grow, 1 truth becomes obvious. Instacart shoppers become the dominant in-store “customer” segment.

Which means that “employees” become the largest user group in the store. The logical sequence here we’ve seen with other companies in the space is:

Collapse the retail experience -> a warehouse model.

Automate Instacart Shoppers with Robots

Partner with delivery apps.

The grocery store of the future will be much smaller. Either because more of it is delivered from a local warehouse to your door or because more of the footprint of a current store will look more like a warehouse with a smaller storefront for the die-hards who still want to go in person.

There are multiple levels to the value in this strategy:

For Instacart:

Remove the most expensive line item. Humans.

Greatly increase the time to value for customers through increased efficiency.

Create channel partnerships while offloading OPEX.

For the Grocers:

Save on Retail + in-store design costs. Warehouses don’t need prime real estate.

Eliminate Labor costs. Robots stock shelves + check people out.

Turn inventory faster + reduce waste knowing what customers are purchasing ahead of time.

For a massive industry providing a critical service with razor-thin margins, there’s billions to be had by providing incremental improvements.

Takeaway: Eliminate “Shoppers”, unlock massive profits.

Final Thought

There’s plenty of Ent value to unlock for this company that’s incredibly well positioned to do it.

But here’s where I get tripped up owning this asset. They’ve created a brutal Innovator’s Dilemma for themselves in a slow-moving, dying industry that won’t have enough time to build the new ship while the current one is sinking.

Over the next 50 years, Grocery store infrastructure in America will die. Instacart and other players like Misfit Market are the bizs creating the cracks that will eventually bring down the house.

The current supply chain infrastructure and farming practices we use to power the American Grocery industry is killing the planet and ourselves. Food is less nutritious than it’s ever been. It’s getting more costly to stock grocery store shelves the larger it gets.

Consumers want to go back to fresh, local food that doesn’t take such a larger financial and ecological toll.

So what does Instacart’s future look like in that future?

Grocery stores will have to revert to the concept of a 1900s grocery store with the practices of a modern day tech enabled biz.

Local products with less variety and more seasonality

Farm-to-Door delivery to shorten the growing delta of produce time in transit.

Deep connections, data, and tooling for farmers instead of grocers.

This biz will thrive by cutting out the steps and days our current food supply chain requires. The company must establish connections and the infrastructure directly with the farm to source produce directly and deliver it to the end consumer as quickly as possible. Essentially bringing the DTC JIT production model to the Grocery market.

I don’t believe Instacart will win here.

They’ll spend the next decade reaping huge profits, becoming a vendor for the current Grocery industry, putting themselves in a position where it’s financial suicide to cut them and the other 15 functions that support this iteration of food in America that will build the true DTC player in the space.

They’ve found a massive, inefficient market that desperately needs the current iteration of their services.

Great for short-term profits. Bad for long-term viability.

🧠 The Takeaways

Instacart has brought eCom to the largest US market: Grocery. Now, they need to decide how they are going to support its future.

All marketplaces eventually collapse into ads bizs.

Now that they’ve captured both sides, the money is in Grocery services. Time to be Shopify to the grocery industry.

To increase margins, Instacart has to remove their greatest cost: Shoppers. This will rewrite the Grocery buying experience.