TLDR:

Let’s Buy You Brunch!

What you need to know. About Klaviyo’s IPO.

Let’s Buy You Brunch!

I’m bringing Lets Buy a Biz! IRL at 1 of NYC's best breakfast spots 🥞🥓🥯. But with a twist...

I'll be interviewing Matt Matros on hit path exiting Protein Bar & Kitchen (acq by L Catterton) and Limitless (acq by Keurig Dr. Pepper).

We're curating a list of incredible Brand founders. Let me know if you can come here!

We only have 15 spots so don’t wait on this one.

Details:

- Group: 15 Brand Leaders

- Date: 9/13

- Time: 8:30am ET

- Location: In NYC. You’ll have to RSVP to find out.

With Klaviyo S1 dropping this week, we’re going to take today’s LBAB! in a different direction, and talk all about the upcoming Klaviyo IPO. This isn’t Investing, Tax or Legal advice.

Klaviyo’s S1 Dropped. Let’s Dive in.

Klaviyo, needs no introduction. But maybe a re-introduction. What used to be the more data-driven Mailchimp has evolved into a fully fledged CDP with Email, SMS, Push Notifications, and Reviews.

We don’t know the Lisiting price, but estimates are they are looking to raise $750m with a valuation somewhere in the $5B range in their IPO later this year. That’s a steep haircut from the $10B valuation they raised in ‘22.

It’s touted as one of the most important IPOs of the year. I believe for eCom and eCom SaaS that’s true. So let’s dive into their numbers.

The Financial breakdown

In all of the publicly shared docs you will see them using Trailing Twelve Month (TTM) numbers, but those numbers didn’t report on Operational metrics. So in classic form let’s analyze the full P&L.

The 2022 Key Financials:

Sales: $472m (+63% YoY) 😍

Gross Margins: 73% (+1% YoY) 😐

Gross Profits: $344.7m (+67% YoY) 😍

Sales + Marketing: $213m (+37% YoY) 👍

G&A: $81.8m (+29% YoY) 👍

OPEX: $349m (+41% YoY) 👍

Net Income: -$49m (-38% YoY) 👍

The Financial TLDR:

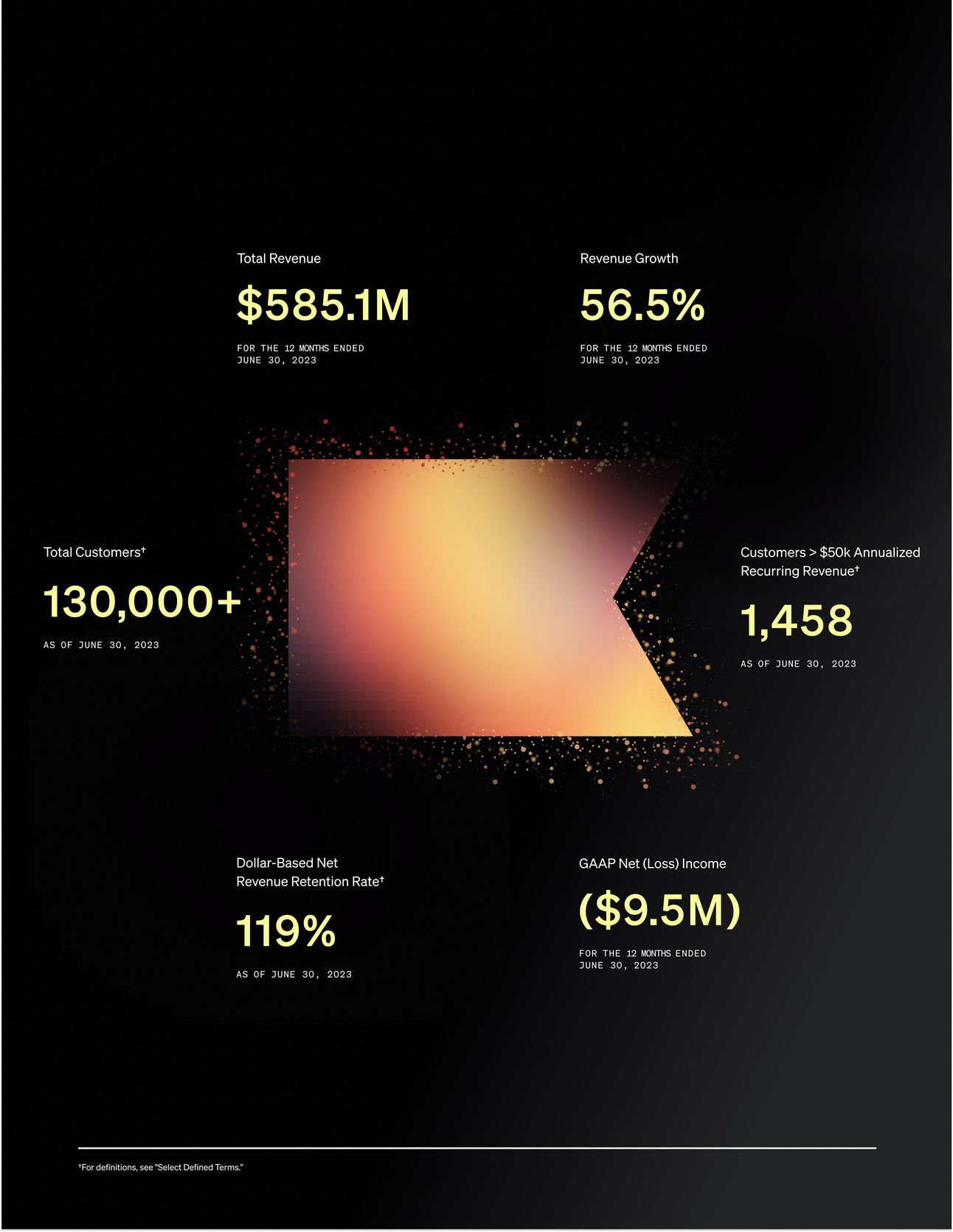

Customers: 130k+

NRR: 119%

Growing 50%+ YoY

This is the IPO stage growth SaaS investors look for.

Topline growth rate is outpacing Sales & Marketing + G&A.

OPEX as a % of Rev is shrinking as the company scales. (85% → 74%)

Net Loss is pacing to a Net Income.

The only area of improvement is Gross Margins at 73%. Not bad, but not in that top Tier of 80%+.

Let’s dive in to see why every SaaS-head is fist pumping about this IPO.

Here’s are the 3 insights you need to know about Klaviyo’s IPO.

1) Growing 50%+ YoY only losing $9m/yr

For the next couple of months you’ll see this image everywhere. Everyone and their mother has an opinion on it. 2 data points in combination are really important.

This data is TTM so will vary from ‘22 numbers.

The company is growing 50%+ YoY with a -$9.5m Net Loss during Trailing Twelve Months. I can’t begin to explain how hard that is for a SaaS biz to accomplish or how rare that is for a the IPO stage.

Some comps of highly touted SaaS IPOs and their Net Loss at the time:

- Shopify: -$22.3m in ‘14

- Zendesk: -$22.6m in ‘13

- Hubspot: -$34.3m in ‘13

- Affirm: -$97.1m in ‘21

Even Shopify Net Loss was twice as much the year leading into its IPO. That isn’t to say that Klaviyo is better, but in a period where investors are looking for more profitable companies. It’s fitting the mold.

That’s because they are RUTHLESSLY efficient with cash. They still have $439m of the $454m they raised (96%).

That means they only burned $15m in the cash they raised. I can’t tell you how incredibly RARE that is for a SaaS biz. Klaviyo built a war chest and hasn’t needed to draw it down.

Takeaway: Klaviyo is hitting the profit notes investors want to hear.

2) Klaviyo’s Ent March begins

77% of Klaviyo’s Rev comes from Shopify Brands. Klaviyo has the highest penetration of Shopify Plus brands at 59%, but only 1.5k accounts pay >$50k. Some eCommerce Thought Boys see this as an issue…

He had a great callout in his thread about how deep Shopify’s pocket is on this deal. And he’s right they can break off a big piece whenever they want.

But this is just the beginning of the next leg of their journey. They have the go Ent in the public markets. The current bottom up strategy works in the PLG, no/low-touch days, but they’ve saturated the Shopify audience. The long term upside is Klaviyo maturing into the Ent product offering.

That’s why they rebranded as a CDP. They already beat out Mailchimp for SMB supremacy. Now they need to beat Braze and Iterable for Mid-Market and Enterprise dominance as well.

Are they there today? Definitely not. But could they be in the next 10 years? That’s the bet.

2nd big bet they’re making is expanding past eCom. I lifted this quote directly from the S1:

“We are attracting Demand from other verticals: education, events and entertainment, restaurants, and travel, as well as from business-to-business.”

This is another juries out moments, but like so many other SaaS providers they’re going to expand multi-product and multi-industry in the public market. Classic SaaS move to keep creating value. That strategy shift will cause massive waves in the Shopify community, but it’s the smartest strategy for the company.

Right before Zendesk was acquired 39% of their Rev came from ACV accounts woth $250k+. SaaS companies don’t start here. They evolve over time and iterate in the public markets. + Go Public to establish more cred with these larger accounts.

All of that is exciting for Klaviyo. What does it mean for your biz?

Going Ent = More Sales + CSMs costs = Higher Prices.

There’s a lot of room for price increases for the most expensive plans. Klaviyo is probably over charging its smallest customers and under charging its largest. That isn’t by accident.

They’re running the same ‘eat-the-world’ strategy as always, but with one twist. Pricing out the bottom of the market that isn’t serious about using Klaviyo. They’re no longer interested in the free loaders and triers.

As they continue to move upmarket, prices at every tier will move. The Ent price increases will trickle down over the next 5 years to the rest of the base as smaller customers become more costly to support on a relative basis.

Takeaway: More Price increases are coming.

3) Klaviyo doesn’t need to become or add a CRM.

I’ve heard “Klaviyo needs to become a CRM” hundreds of times over the last 4 years. It’s flat out the wrong strategy and a massive distraction.

There’s so much TAM left in the Ent CDP space (what Email/SMS providers are called in the Ent space) that building a whole other tool for another user would be a major and costly side quest.

Klaviyo’s greatest opportunity is to level up its offering to truly go head-to-head with Ent CDPs like Braze and Iterable. Once they’ve conquered that market and expand their CDP offering into other verticals then it would make sense to branch into other products.

But we’re probably talking about a decade timeline and a $20-$30B company at that point.

Think about who uses which tool:

CDP: Marketing Team focusing on Acquisition and Retention

CRM: Sales/Support Team focused on large sales and account management.

If you just follow the money the answer is simple. I’ll use our old LuMee ‘18 budgets ($30m/yr Shopify Plus brand w/ major Retail presence) as an example.

Here was our Monthly Marketing budgets:

Meta/Google: $250k+ (Higher depending on seasonality)

Email Budget: $10k (Fought tooth and nail to increase)

Support Budget: $5k (Rarely if ever discussed)

Retail Sales: Outsourced to 2 agencies. (No internal tech to support).

If the following trends continue:

Shopify eating eCommerce (including Ent brands).

More brands grow through paid acquisition

Brands outsource core functions

The budget decision is simple. You need to be a vendor that supports the largest budgets possible, because it’s easiest sales prop for a tech vendor to prove ROI. The money is in supporting Paid Media. A CDP is common for Mid-Market Ent brands looking for 1 central dashboard to manage all of their marketing out of (aka a CDP).

CRM would move into the Sales/Support function, which sure, they’re capable of, but seems like a massive distraction knowing the bigger budgets, and core focus, is already set on the Marketing Persona. A CRM could potentially be in their future. It just seems really hard vs. the high value path they’re already on.

Takeaway: Stay focused on Ent CDP and conquer the Market.

Final Thoughts

Who knows where this IPO goes.

Last year the company was valued at $10B. Today it’s speculated to go out at $5B. The latest round of investors got hosed. But if Shopify was the only investor in the ‘22 round they definitely have enough provisions and clauses that they’ll be fine no matter what.

What I do know.

Bankers need to drive excitement back to IPOs. Bankers get paid the more IPOs they do. Companies IPO because they think they’ll get a great deal. Investors come back for the financial return.

Everyone is touting Klaviyo + Instacart as the 2 releases to restart the IPO market. My best guess for Klaviyo…

Has a ton of fanfare and aggressively pops in the first couple of months as it’s the best of what’s available.

Gets hit hard in the 6mo - 12mo range when people overhype it too much on IPO and doesn’t immediately grow into the valuation or P/E ratio.

Has great long term growth as they grow into these aspirations.

But what’s more important?

The rest of the Shopify IPO class waiting to see how it goes. Yotpo, Attentive, Shipbob, and Recharge are all in a similar place where they’ll need to IPO soon.

If Klaviyo’s goes well there will be a line out the door of Shopify App IPOs.

Bonus Items from their S1

2 other small notes that really stood out to me from the S1:

CAC payback is <14 mos. 😍 (Amazing for a SaaS brand at this size)

Andrew Bialecki (CEO) receives $81k in Salary + Cash Comp. He does have 15.8m options, so don’t take out your violin for him. But it is a great sign of leadership and instilling spending discipline in the company.

🧠 The Takeaways

SaaS are just treated different in the market. Klaviyo is one of the best examples of that.

Investors are looking for the right balance of Growth + Profitability

Klaviyo is becoming more Ent-focused by the day.

Klaviyo aspires to own all your marketing.

👷 What can you do about this?

Enjoy and watch the journey. Someone from our town made it to the big leagues.

Make your own decision on whether Klaviyo is the right investment for you.

Are you looking for a CDP or an email provider?