TLDR:

Master 1 Thing

Can Lulu overcome peak Yoga pants?

For all the non-scrollers we’re running a new test. Big takeaways right up top.

🧠 The Takeaways

Lululemon has saturated the US Yoga pants market. Will international or Men’s bring the growth they need? Let’s hop on the ride and find out.

Lulu needs to establish its breakout markets and fund them accordingly.

Focus on what you do best and don’t get lost in chasing aspirations. That’s for your customers.

Stop wasting time trying to become a “Men’s brand”. Accept reality and sell to more men through their partners.

+ From the community section ruthlessly focus on your ikigai.

LBAB Community - My Ikigai

To maximize your impact on the world, you need to be ruthlessly honest with yourself and constantly refine your true superpower.

In my case, I've always really enjoyed educating people. I’m fascinated by shifting people’s thoughts or ideas with interesting insights/data—and finding new ways to get them that information. Which is why I’ve always gravitated towards marketing jobs.

But, as I've been on this path of public writing/posting, I’ve come to understand that my unique and valuable superpower that I can provide is translating complicated data and concepts into insights that drive conversations, value, and change.

I'm realizing if it falls outside all this (call it my ikigai), I need to prune it away.

If things aren’t creating or working toward exponential value of driving insights through data, they aren’t worth it.

Everything I do now is centralized around that one massive insight.

You become really aerodynamic and reduce the drag of what your brain focuses on. The result being: you get exponentially better at that one thing.

You invest more resources in it. You spend more time around it.

I encourage you to spend 20-30 minutes every week being ruthlessly honest with yourself.

“What did I do this week that actually created real exponential?” (whatever that project is for you). Then double and triple down on it. Clear off whatever you need to make time for it.

By maintaining that focus, it’s the thing that 10-20 years from now that you will become known for.

You will be an absolute master of it, do something really meaningful for the world… And hopefully get rewarded accordingly for it.

Alright enough philosophizing. Let’s figure out how LuluLemon had it’s strongest years in a while, but it’s stock got hammered.

Let’s Examine This Biz

Have we hit peak Yoga pants? LuluLemon got hammered after their Q1 earnings because they predicted a soft (aka bad sales) quarter.

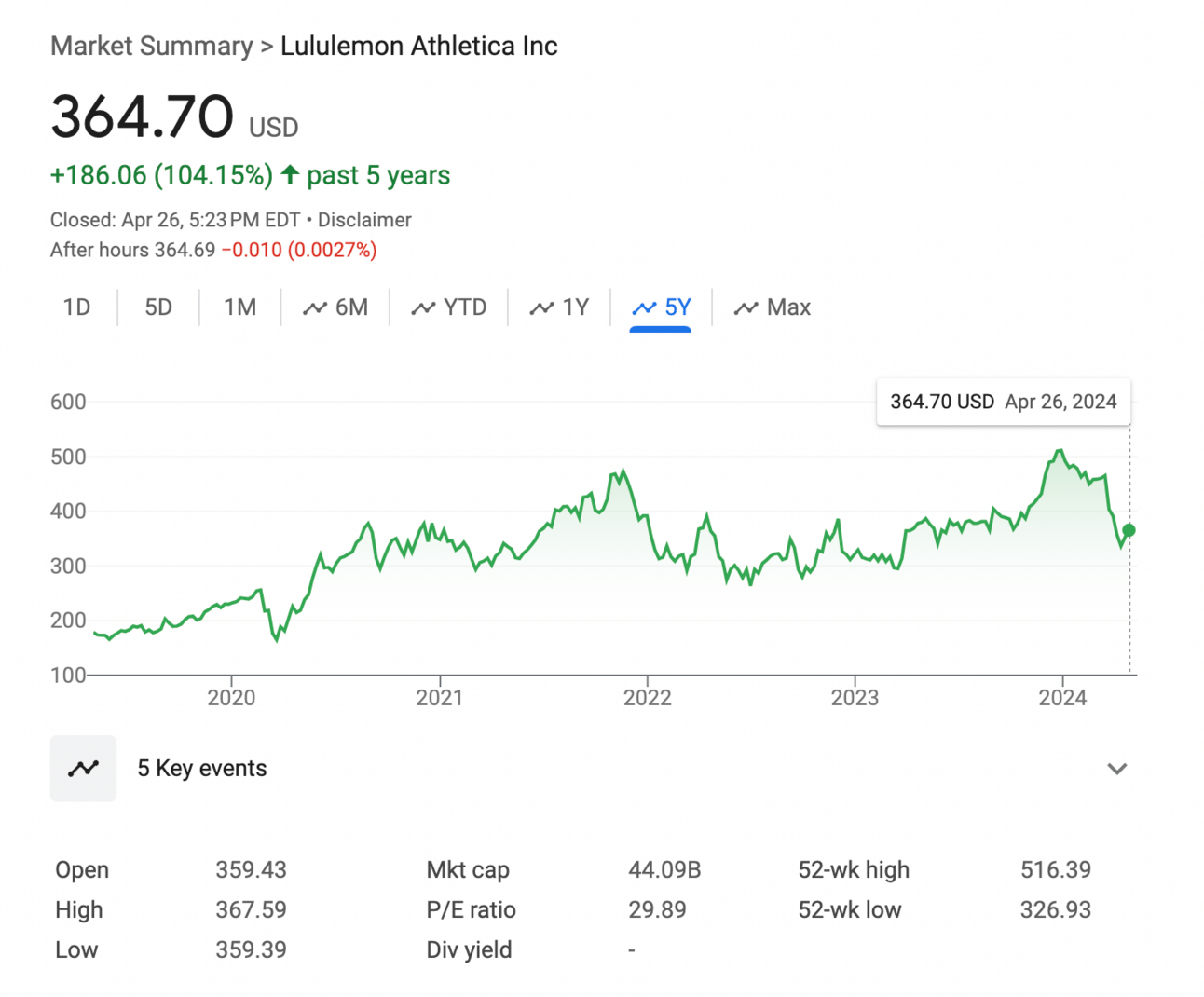

Trading at $364.70/share with a $44B market cap, +104% over L5, this DTC brand in the true sense of the phrase is what success after 25 years looks like.

Today, we’re going to buy a chunk of this biz and ride up what Wall St. doesn’t have the patience to own.

Financial Summary

2023 Financial Statements (YoY Comparison)

2023 Financial Statements (YoY Comparison)

Sales: $9.6B (+19%) 👍

COGS: $4B (+11%) 👍

Gross Margins: 58% (5%) 👍

Gross Profits: $5.6B (+25%) 👍👍

SG&A: $3.4B (+23%) 👍

OPEX: $3.5B (+10%) 👍

Net Income: $1.55B (+81%) 😍😍

EPS: $12.20 😍

FCF: 1.6B (+402%) 😍😍

TLDR Analysis: Nailing the fundamentals

Rev grew faster than SG&A = Higher GM % 😍

SG&A held at 35% of Rev 👍

Net Income hit 16% (was 10% in ‘22) 👍👍

LuluLemon crushed 2023 and saw the increases in all the areas you’d want it to, driving +81% YoY increase in Net Income and +402% increase in Free Cash Flow.

They hit all the blocking & tackling + did the boring things well. Despite having to write off a $500m acquisition shutting down their next major bet (Mirror). LuluLemon read the market, went back to the fundamentals, and delivered profits.

Let’s Scale This Biz!

Leadership isn’t grossly mismanaging this asset, but there are 3 core areas we can greatly help them accelerate.

1) Break out the winners

China is rapidly expanding. Double down where there’s momentum.

We want to see sales in every region expand, but Lulu is already everywhere in the Americas. The majority of their future growth will come from other countries, which pushes the overall % of American Sales down, even if sales are growing.

Yes, there’s political tension and a potential trade war looming with China that could massively impact Lulu’s biz, but you know what always wins out even in those scenarios?

Being loved by customers.

Governments always discover ways to find exceptions for beloved products. Continuing to tip the China market will make Lulu more and more valuable to both sides of the pacific.

From there the team needs to figure out what country currently bundled in “Rest of world” (Non-China APAC and EMEA) can break out to become their next major market?

The crucial nuance between going international and actually succeeding comes down to localizing for each country/segment of countries. Lululemon’s expanding the most in Europe (EMEA) and Asia (APAC). But each of those regions have 10+ countries within them.

This is where gut -> data -> gut becomes crucial. At Lulu’s scale, they have decent data, but also not necessarily enough to know where to place the next big bet. Especially when you consider there are 3-4 other countries that have the scale to become another Americas or China for Lulu.

Find that core market, dedicate a small team with resources to make it a huge success. There’s such a long checklist from Operations + Supply Chain to Marketing in each market that once something is winning, break off 5-10% of resources to a small risk for the next big thing.

This type of analysis can be done at any level (Sales channels, states, market breakdowns). The important question to always ask yourself before adjusting your strategy is: “Am I tapping the largest TAM?”

Lulu only needs to worry about this because they’ve saturated their home market in the Americas and need to find growth elsewhere.

Takeaway: Give special treatment to breakout stars.

2) Separate Aspiration from Attainment

Last year, Lulu decided to stop selling Mirror and double down on their mobile app to sling more fabrics. They’ve decided it isn’t the time to realize their aspiration to own the whole studio.

The real TLDR here is they overpaid for a tech startup and couldn’t figure out what to actually do with it. This is the tough part about M&A. No matter how smart your plan may seem, or no matter how good your timing was (or you thought it was), sometimes a plan doesn’t survive getting punched in the face.

Where this strategy really fell down: Lulu grasped for their customers’ aspirations vs. taking an honest stock of why their customers actually buy their product.

Customers’ aspirations:

Be in shape

Be great at yoga

Look great in their outfit.

Why customers really buy Lulu’s products: Comfy status symbol that’s acceptable to wear everywhere.

Lulu got a little out over their skis thinking customers wanted to have Lulu be their exercise partner, not just their outfit they wear to “exercise”.

It’s easy to get caught up in the hype and believe that you can take over the world.

But you always have to come back to the reality of why customers actually buy from you. Those who see the world as it is don’t get lost in the sauce. They play the game strategically.

Takeaway: Be Real with yourself and why your customers buy.

3) More Couples/Family Bundles

Lulu can have all the aspirations in the world to become a men’s fashion company and use that as their great new growth potential, but c’mon.

Lululemon has been, is, and always will be a women’s Apparel brand.

Women are WAYYYYY more valuable customers.

Lulu is going to torch mountains of money trying to convince men to buy.

What I’ve never understood about these Apparel bizs who want to jump from women -> men is why they don’t just sell men’s clothing to women.

Instead of dumping hundreds of millions into marketing to try to convince men that Lulu is a cool men’s brand and not “your partner’s yoga pants brand”.

Just sell matching outfits and other items to existing customers (women), who will convince their BF/husband to wear it.

It’s an easy test during the holidays when everyone is already gifting.

Men are the hardest-to-acquire but easiest-to-retain customer group. What do most men do when they find a shirt/pair of pants they like? Buy 5 of the same thing in different colors.

Here’s a $100m sales pitch for Lulu:

“Honey, I got you these super comfy shorts for our next trip. Try ‘em on and see if you like them.”

“Honey I’m not sure I like them.”

“Just try them for me.”

“Wow! I love these! Do they make them in Grey and Camo.”

We’ve gotten so wrapped up in these overcomplicated biz building strategies that we forget the most basic of human behaviors and how shoppers actually shop.

A little creativity can save Lulu billions in marketing investment building a Men’s brand that could have just been some extra emails, SMS, and postcards to the existing base.

Takeaway: Obsess over shopping behaviors, not strategies/hacks.

Final Thought

Diversification only matters when you’re big. Lulu, a 25-yr-old, $9B Topline biz operating in 30+ countries. The success allows them the privilege of worrying about diversifying biz lines because they have to play defense.

For all my basketball hardos.

Yes, they still want to grow, but the exec team won’t necessarily get fired if growth slows. They will ABSOLUTELY get fired if the biz backslides/loses money.

Lulu has 49 Manufacturing vendors, 67 Fabric suppliers, and needs to worry about the economics and geopolitics of multiple markets. That should be completely irrelevant for 99.9999% of the people reading this.

Your biz is still likely in the growth + offense phase, where it’d be painful to lose what you’ve built, but the upside potential is still so much greater that it would be irresponsible to not place the big bets.

It’s so easy to hit a major milestone, look up and see what the mega players are doing and say, “I need to add some of that to my biz.”

You really don’t.

Complexity should be avoided at all costs. Stripping everything down to the basics and keeping it as simple as possible for as long as possible is the key to success. Simple is better for 2 reasons:

Complexity = Expensive.

Complexity = Headaches.

The key to growing both quickly and profitably is streamlining as much as possible. Every new program/tool/person/product in your biz doesn’t necessarily make the biz more productive, efficient, or cheaper.

Heading into every nThe real questions you should be asking yourself:

What major opportunity does this new “thing” unlock for the biz?

What major problem are we solving for our customers?

As long as that new initiative is profitable over the long term, and you have the timeline to see it through.

That’s where the value of adding complexity comes from.