🧠 The Takeaways

While the world is chaos, Crocs continues to consistently crush it. We’re going long on the Collab master brand again.

Lean more heavily into family purchasing.

Acquire Rockport to properly get into the comfort over fashion workwear market.

Properly bring the Crocs magic to HEYDUDE to scale that brand.

+ Happy July 4th.

LBAB! Community - Happy July 4th!

For everyone who celebrates, hope you’ve been having an incredible July 4th weekend. It is my favorite holiday of the year.

I know that sounds crazy, but it’s a holiday in the middle of the summer, celebrating being an American.

You’re supposed to enjoy the outdoors, barbecue, and do dumb American things like drink beer + light fireworks. Usually in that order.

This year, I spent it celebrating a friend from elementary school's wedding. Which was a lot of fun but hot in a tux.

I also got to spend some time out in nature, drank beer, and saw fireworks. The only thing I didn’t do was grill (one of my favorite activities, especially on the 4th).

Hope everyone enjoyed it and got to spend some time off.

+ hope your weekend promo crushed it, and you’re still rolling in sales.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

Crocs, the iconic American brand, owns the love-to-hate-em clogs market + hip, comfy dad shoemaker HEYDUDE. They’re plugging away and consistently growing. But they’re not a DTC darling, so one is paying attention to them.

Share price: $101.46

Market Cap: $5.7B

L5 Performance: +67%

P/E Ratio: 6x

Somehow, Crocs is trading at a 6x PE ratio. Which is criminal, seeing how smaller, unprofitable, barely growing DTC brands are trading at multiples of their Revenue.

Crocs is hitting all of the right notes and building a long-term brand.

Today, we’re going long on Crocs to help them run an even tighter playbook and scale this comfort-over-fashion footwear empire to $10B in sales.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $4B (+4%) 👍

Gross Profits: $2.4B (+9%) 👍👍

OPEX: $1.4B (+18%) 😐

Net Income: $950m (+20%) 💪💪

TLDR Analysis: Printing Straight Cash.

Gross Profits rose as COGS fell (-3%), with increasing sales (+4%). 💪

Took $870m in operating capital to pay down debt + buy back stock. 🤯

Net Income +20%, now 23% of Rev. 🤤

How does a Biz whose OPEX rose 18% YoY, but whose Gross Profits only rose 9% YoY, print a 20% YoY increase in Net Profits?

Disciplined spending. In 2024, Crocs pushed their Gross Margins to 61% (from 56%). They moved that extra 5% of Rev down to OPEX in SG&A to push sales higher.

Pay down some debt, play some tax games, and hit a 23% Net Income Margin. 😍

Let’s Examine This Biz

Here are my 3 moves to scale Crocs to $10B in Revenue.

1) Get more targeted with Collabs

Crocs are the collab masters.

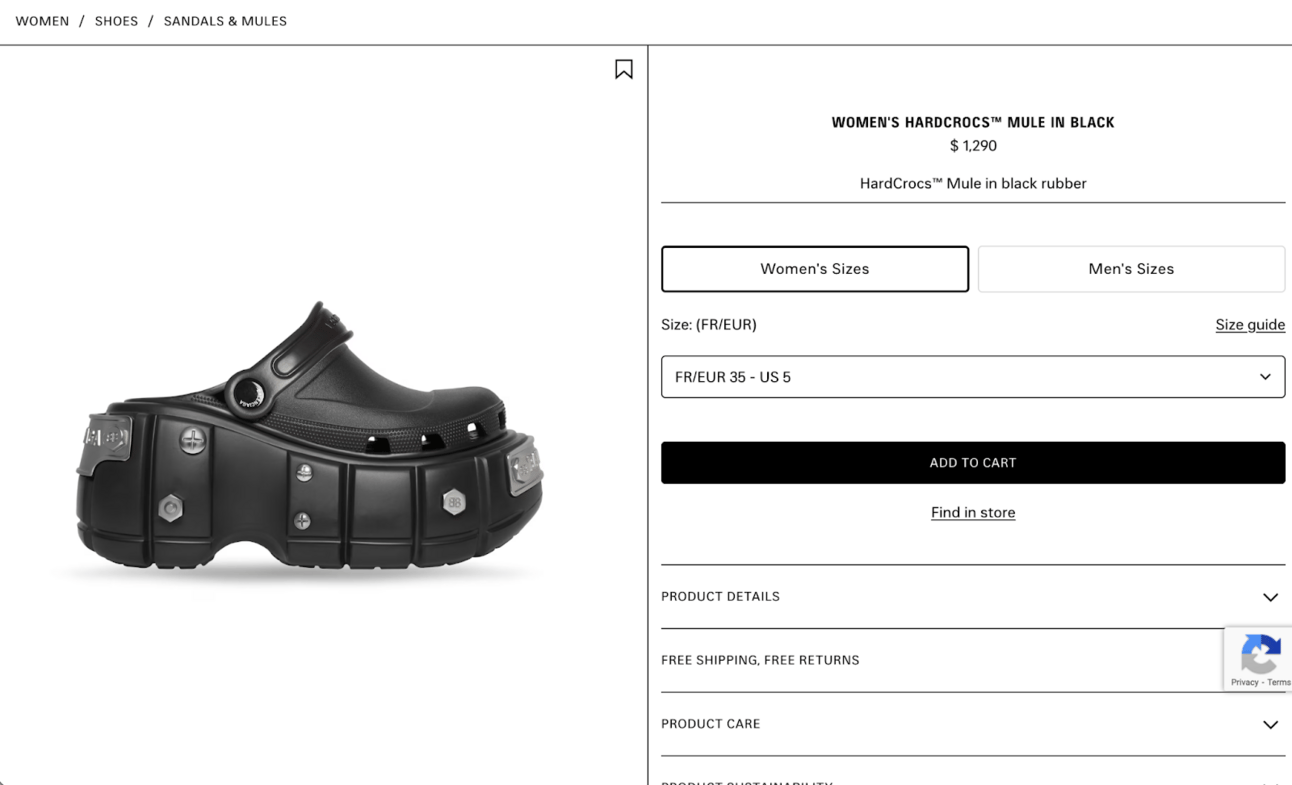

Their stunt collabs with Hello Kitty, Balenciaga, American Girl, and Disney are legendary + should be taught in Biz schools.

But their biggest mistake: not leaning into the kid/childish nature of the product. Crocs look “unstylish” / “childish,” and they must bet the farm on that.

The easiest way to double sales:

Lean into Millennial nostalgia in Adult Collabs. Their Star Wars Collab is the perfect example.

The Kids version (Jibbitz + special designed shoes) are the entry point. When you appeal to Moms and Dads who love Star Wars too, you’ve just 3x’d your Rev/household.

Don’t just license the Mandalorian IP.

Lean into Original + 2000’s trilogies for Mom and Dad. (Jar Jar Crocs?!)

If you’re willing to wear Crocs, you’re willing to wear silly Star Wars designs on them.

Turning the brand into a family outfit based on similar interests is how you 3x sales. Especially among VIPs.

Takeaway: Find your core brand. Triple down into it.

2) Acquire a Comfortable Dress Shoe company

Crocs has a proven playbook.

They have a tight Portfolio (Crocs + Hey Dude) of brands. Now it’s time to take that playbook into the biz attire market.

Sell comfort over style + pump the brands through Retail + DTC.

Crocs’ failed attempt at work footwear is an easy and obvious one.

If everyone knows you from plastic clogs + Jibbitz (also an acquisition) look, they aren’t going to want to wear you to where they earn a living. Other than nurses who get a special exemption.

Crocs should acquire Rockport from Authentic Brand Groups, who acquired them out of bankruptcy. It’s the perfect match for a brand whose customers are willing to trade off having the most stylish look for a comfortable shoe.

(As a previous Rockport customer, that is DEFINITELY the trade off customers make.)

This is a classic branding problem where, no matter what, customers associate you with only 1 thing that fits into a big part of their life.

But that strong association won’t bleed into other areas. That’s what new brands are for.

Takeaway: Crocs needs different comfortable footwears for different parts of life.

3) HEYDUDE needs more of the Crocs Magic

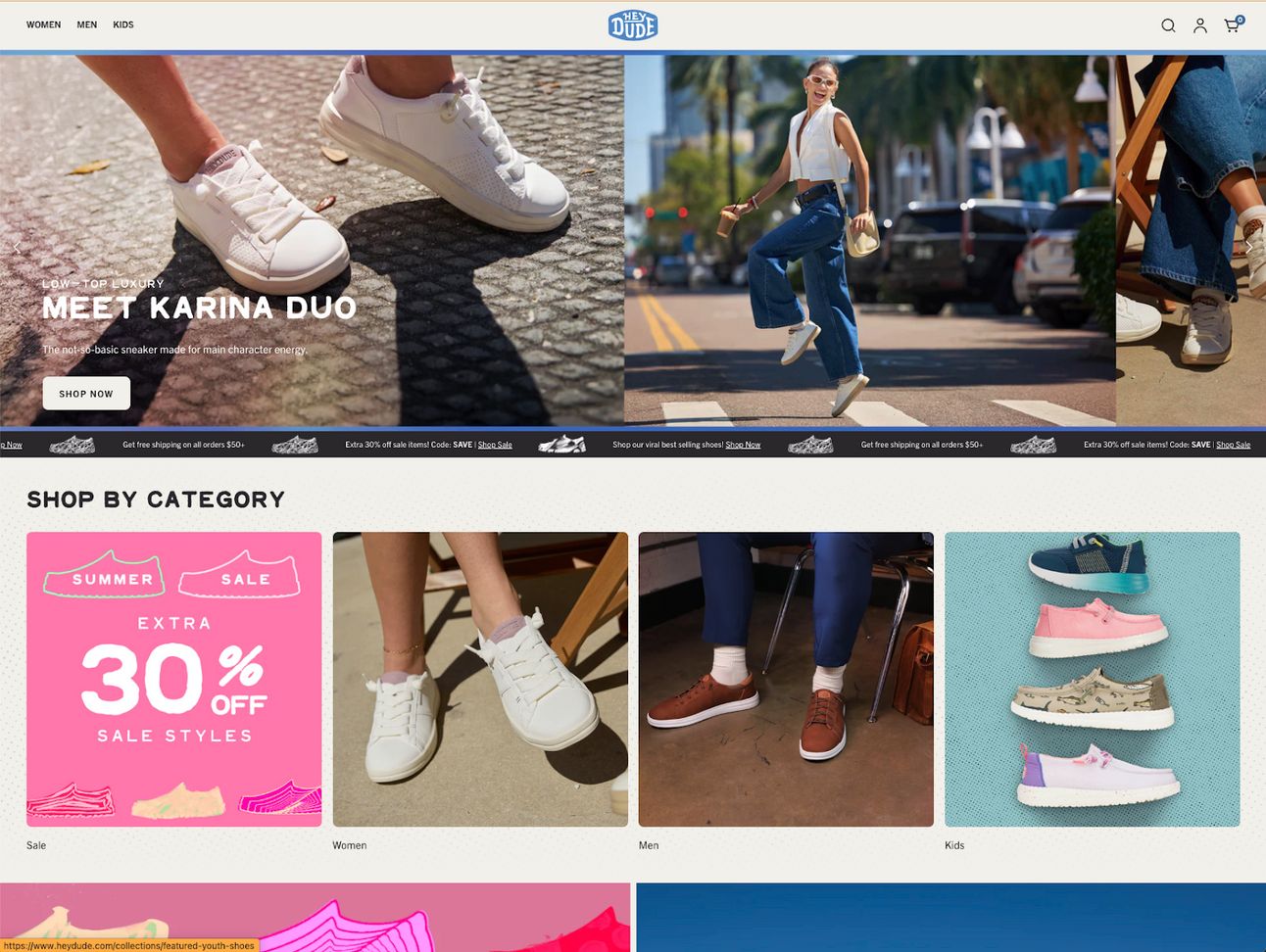

HEYDUDE looks like such a different store from Crocs it’s no surprise that they’re struggling while Crocs is thriving (Slightly declining YoY sales).

The entire magic behind Crocs’ model is customizable comfort shoes.

Crocs takes a design/aesthetic (mostly popular colorways/other brands) and gives customers a platform (the actual shoe itself) to express themselves.

Where do you see anything like that on HEYDUDE’s Site?

Instead, they’re falling into the classic Retail death trap of guessing what their customers want then discounting what they overstocked on.

Their collabs section is at the bottom. On Crocs, it’s the Home Hero Banner.

Clone the Viral stunt collab + hit licensing model from Crocs. Apply it to HEYDUDE’s audience.

No offense to Jaws, Billabong or SOLO cups, but HEYDUDE is half-assing it with these collabs. Are those really the Dude equivalents to Disney, Hello Kitty, and Harry Potter?

This isn’t hard to think of. It just takes commitment:

Chipotle/Taco Bell

Popular Sports (NFL/College)

Alcohol (Beer + Spirit brands)

Athletes

Star Wars/Marvel

The hard part here will be finding the Jibbitz replacement, but it’s a cloth shoe. Finding a cloth customizer isn’t rocket science.

Takeaway: When a playbook works. Rinse, Lather, Repeat.

Final Thought

This is how you build a modern consumer brand.

For Crocs (the biz unit), DTC + Retail Revs are a 50-50 split.

They strategically use DTC as the primary channel in NA (65% of NA sales) and Wholesale as the primary channel internationally (67% of Intl orders). There’s no debate about whether Crocs is a Retail vs. DTC brand.

They leverage their strengths according to each market.

Most importantly, they focus on the products customers love. They’ve done the research to understand their customers.

They simply give them what they want.

There’s a reason that Crocs is one of the only brands (public or private) I see that isn’t hawking a sale on their HP.

Because they don’t have a mismatch between Inventory & Advertising.

They create enough of the right product with enough demand to move the products in every channel. Doubly Protecting their brand:

Customers don’t see or expect discount codes.

They brand build through their customers’ other favorite brands.

The “cost” of a $50 plastic clog to their customer doesn’t seem expensive because Crocs has found the formula to consistently move inventory and isn’t in a position where they have to run a sale to hit their Revenue forecasts.

That is how you build an enduring brand that consistently, profitably grows.