LBAB Community: The Annual Check in.

Every year, my editor and I read through all our newsletters to ID the big ideas, plus interesting things and trends that we saw covering 45+ brands over the past year.

After reviewing all the posts I realized this year was centered around the tried-and-true M&A best practices. I went for the “safe route” more than I would have liked. It felt like we weren’t quite pushing the same edge of out of the box ideas we use to bring.

So, we're gonna make a few big changes to the newsletter.

First, (so that I enjoy it more, and two and so it's more interesting for all of you), I'm gonna do a much better job blending together the “tried-and-trues” with the big bold, out-of-the-box ideas (and maybe kind of the crazy ideas), which is why you originally signed up for the newsletter.

Second, I'm gonna cover more SaaS P&L. There are plenty of SaaS bizs that need to turn their act around as well.

I think that there's a lot to learn from SaaS + how that ecosystem works/makes money/ interacts with a biz like yours.

Third. More Reports. You all love reports. We love reports. Everyone should have more reports.

More interesting + unique proprietary data that everybody can go consume and talk about. It’s always been the most popular LBAB! content, so, we’ll bring more of it to you.

The 10 Plays of 2024

Some of them you’d expect, others should serve as inspiration to push yourself and your biz farther this year.

1. Gamify Aspirational States -> True Personalization

The Play: Tinder for “looks” + customer data = extraordinary shopping experiences.

Putting the play into action: IL Makiage is building the future of merchandising through gamified experiences.

IL Makiage is reinventing both Shopping Curation + the Wishlist. They’re:

Taking Beauty Influencer content.

Creating a gamified experience.

Tying it back to products.

Pre-bundling a simple buying experience.

Instead of getting matched to go on a date, every “like” saves the “Look” to a “Loved Looks” wishlist.

This is 1 of the most inspired shopping experiences I’ve seen in a while.

Inside each Look: influencer content on recreating it. Also embedded are the products the influencers use in the videos, which customers can directly buy.

This is the future of Merchandising.

Collect as much relevant customer info as possible. It doesn’t always have to be demographic, but it should always be relevant + provide a better shopping experience. Then sell more to consumers based on that data.

2. Be Ruthless with SG&A

The Play: Live by the P&L. Die by the P&L. SG&A must be kept in check.

Putting the play into action: Hims is spending like a drunken sailor and Warby Parker is breaking a Law of Biz (Opex > GM).

Hims

Hims would be insanely profitable if it kept Marketing in check.

Decreasing Marketing to 40% of Rev (from 51%) flips them from Net Income -3% last year to +8%.

My greatest issue with dumping half of Rev into Marketing at this scale is that their unit economics are getting worse and worse, and there’s no real motivation to fix them.

Which will, eventually, lead to the death of the biz.

This biz could easily be growing 30-40% YoY and be an absolute cash cow. Why not have both?

Warby Parker

Law: OPEX can never exceed Gross Margins. And Warby needs to fix both.

Gross Margins is 50% of Rev. OPEX is at 65%. See where the problem lies?

On the OPEX side, the fixes are going to come from:

RIFs

Gutting Stock Based Compensation (SBC)

Warby Parker is pretending to be a Silicon Valley tech biz vs. a DTC brand.

If you remove the $70m in SBC last year from their P&L, they’re actually profitable.

Here’s the problem with so heavily compensating employees with stock vs. cash/bonuses etc.

It costs the biz the same amount. Yes it’s stock not cash, but they still have to consider that part of their OPEX.

It dilutes shareholders.

3. Bet the farm on Breakout Markets/Products

The Play: When you have a hit throw everything else to the side and throw your full weight into making your best, the best. Essentially make hey while the sun is shining.

Putting the play into action: Olaplex and LuluLemon both need to obsess over the global markets with the most opportunity, and they will be rewarded for it.

Olaplex

55% of Olaplex’s sales come from countries outside of the US. Hair coloring is wildly popular internationally, and one of Olaplex’s primary use cases is to repair damaged hair from hair dyeing.

% of the female population who dye their hair in each country [Source].

Adapting their GTM strategy for China/Brazil will unlock the next major wave of growth for Olaplex and will build a multi-billion dollar biz.

LuluLemon

LuluLemon needs to double down where there’s momentum: China.

They’re already everywhere in the Americas.

The majority of their future growth will come from other countries, which pushes the overall % of American Sales down, even if sales are growing.

Yes, there’s political tension and a potential trade war looming with China that could massively impact Lulu’s biz, but you know what always wins out even in those scenarios?

Being loved by customers.

Governments always discover ways to find exceptions for beloved products. Continuing to tip the China market will make Lulu more and more valuable to both sides of the pacific.

4. The Owned Resale Program

The Play: Build your own branded second-hand/reseller economy to control as many transactions of your products as possible.

Putting the play into action: Aritzia is a prime candidate to build their own brandiconomy, and Canada Goose should expand theirs.

Aritzia

Poshmark, ThredUP, and Depop are all running ads against the term “buy Aritzia second hand.”

This shows great demand, but…

Aritzia has 0 control over the resale price of items.

Customers can take that cash and purchase anything with it.

They should launch a “gently worn” program where on Aritzia.com, customers can sell and thrift Aritzia clothing.

Aritzia doesn’t need to make money here. Collecting the dollars on their platform allows them to give customers credit as a high-value incentive to buy more new Aritzia. The can control the supply and demand for old vs. new products by the incentives they provide the resellers.

Canada Goose

By pushing Generations (second-hand marketplace) more…

Customers who want the latest & greatest (but who may not have the closet space or $) can resell their items, so they can afford to buy the new drops.

Customers who want CG but can’t afford it get a more accessible entry price point into the brand (that isn’t from discounting).

CG can see if there’s crazy demand in the resale market for certain items—that’s a good indication to produce more and avoid price gouging on reselling.

Result: Canada Goose moves the promotional incentive from discounts on new products to “increasing the amount we’ll give you for your used product” protects the brand and price point of new products.

5. Optimize Omni-selling Based on Product Size + Data

The Play: Sell larger/heavier items via Mass Retail + distribution centers and smaller complementary/consumables via DTC.

Putting the play into action: Traeger can optimize their sales by selling grills + pellets via mass retail/delivery + accessories/consumables via DTC.

Every time a customer buys a Traeger grill, they’re a lock-in to buy special pellets as well.

Every Traeger buyer = incredibly high spend on their first purchase, but not many customers are buying a 2nd & 3rd Traeger grill.

To increase LTV, they need to push customers to buy more consumables from the site. For the customer who buys a first-purchase $2k grill, they need to spend another $1k on consumables over their lifetime.

6. In Good Times, Invest for Better times.

The Play: Make your investments when you have strong positions -> reap bigger harvests later.

Putting the play into action: LVMH reduced its strong FCF in the name of increasing operational investments.

It’s easier to cut expenses in hard times than to know where to invest budget in good times. If you can master that, you’ll build an enduring asset. LVMH made those hard moves.

Their Operating Cash is fairly consistent over the past 3 Years (L3), and they’re investing more of their Operating cash, so there’s less FCF. They’re:

Creating an incredible amount of cash.

Reinvesting ~40% of it back into the biz.

Building one of the most valuable bizs on the planet.

Chart #3: Operating Free Cash Flow is THE GOAL for every biz. I don’t care if you raised or not. This is THE END GAME.

When you have the pile of cash you can decide to re-invest it or put it in your pocket.

7. Narrower Focus -> Bigger Wins

The Play: More isn’t necessarily better. At earlier stages of growth, go deeper into fewer markets.

Putting the play into action: Here’s why Zip Co needs to un-conglomerate itself and why Honest Co needs to stop wasting time on non-Baby.

Zip Co

Zip is playing the conglomerate playbook way too early. While that’s understandable because Australia (their home market) is much smaller than the U.S., it’s a bad biz move for their stage.

The Consumer options on their site looks like the Chase points portal. Consumers can shop on typical brands, plus Groceries, Airfare, Hotels, and Phones?

It’s not the wrong strategy, just the wrong time for only processing $10B in annual GMV.

They need to go deep into key categories like consumer shopping and grab a lot of brands in that vertical to gain a network effect. In a biz like this, having a dense network of brands that consumers will buy from is even more important

It’s counterintuitive to shrink your focus to grow into the required scale to support more markets, but it would unlock faster, more profitable growth and tell a better narrative for Zip.

Honest Co

Honest is the perfect ex of when product + category extension goes too far.

The US baby care market ($98B) is projected to grow to $168B by 2032. Honest is wasting its time chasing any opportunity besides eco-luxury baby care.

Get out of all the other categories and focuses: Skincare/Makeup. Laundry Detergent. Hand Sanitizer. These are all products that might sell well, but aren’t gangbuster products for Honest.

Baby is. Baby has been. And Baby will be.

Every year, consumers have kids.

Younger parents are more and more eco-friendly. Own that market. If anyone under the age of 40 making $100k+/yr isn’t buying Honest diapers, that should be the failure.

8. Build the 10x Version

The Play: Build the most impressive version of your product. To inspire the hardest core custoemrs.

Putting the play into action: Yeti should create a $5k version of their classic cooler.

Coolers/Drinkware, like any other aspiration led-category, is all about overselling someone on what the product can do:

Jordans don’t make you jump higher

On Running shoes don’t make you a marathoner.

But the associations make you want them even more.

The bigger opportunity for Yeti is to find the products that the camping/outdoor hardos love but will scale to the everyday millennial/parents. Make the $5k version of their core product.

For the same reason that Coach makes a $100k trunk. It’s not because they’ll fly off the shelf, but because casual shoppers will buy the more “reasonably” priced version given the incredible capabilities that “flow down” from the premium version.

9. Focus on Women

The Play: Women are better customers. Always. Focus on them and build a better biz.

Putting the play into action: Moncler and Coty can both massively increase their bottom line by aligning their products + offers with their biggest opportunity: female customers.

Moncler

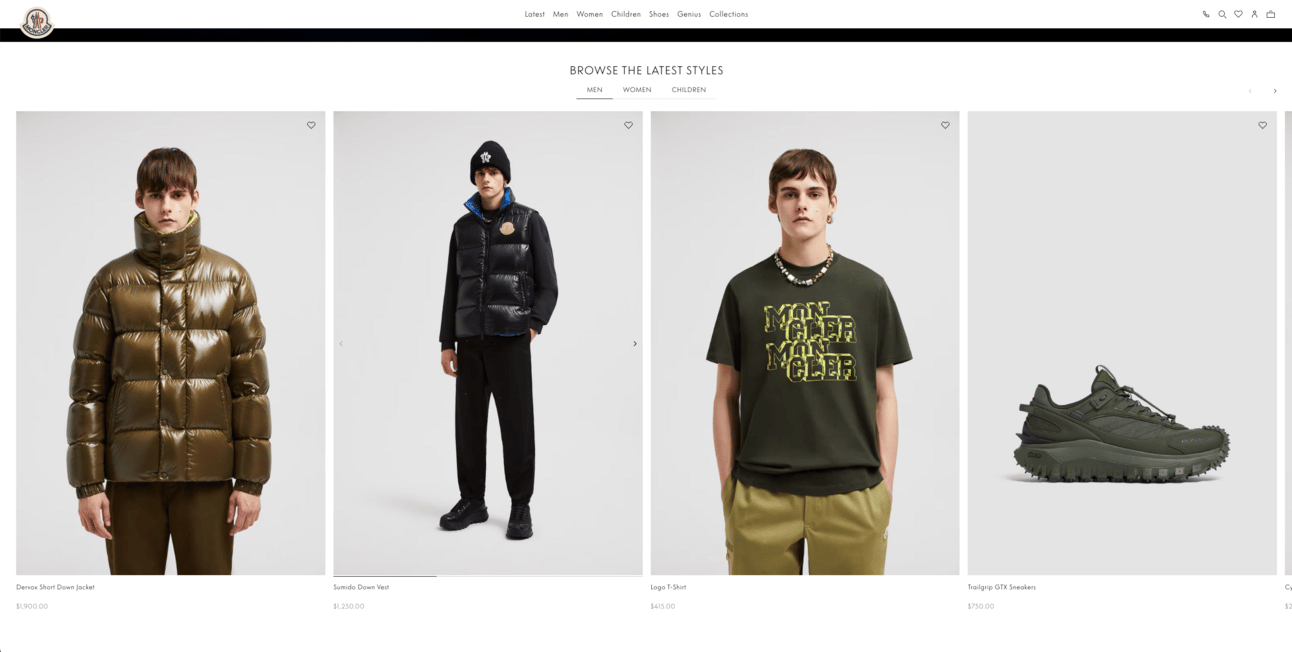

Moncler (Luxury Outerwear brand) has a 69% female customer base, but they focus on male products a lot.

This is what they’re home page looks like.

Their basic customer demo:

69% of customers are women

67% of customers are in EMEA

64% of customers are < 40 yrs old

It’s one of those small steps that greatly improves performance by removing basic friction. If the core/majority customer doesn’t need to scroll/click to see what they’re interested in, the right people will see the right products (= more sales).

Coty

Coty (beauty + fragrance manufacturer) is largely focused on creating products for Men’s brands (e.g., Hugo Boss and Calvin Klein).

They also happen to own Kylie’s Cosmetics, KKW Beauty, CoverGirl and Lancaster. Those are powerhouse brands with more appeal to more female customers.

Throughout my career, the common theme I’ve found success in is focusing on female customers. With natural products like Beauty & Fragrance, Coty has the opportunity to substantially increase their current half billion in Net Income.

10. Build Your Universe

The play: Making your brand universal.

Putting the play into action: Netflix should buy 6 Flags to bring their favorite characters to life!

Theme Parks accounted for 69% of Disney’s 2023 Operating Profits on only 36% of its Revenues.

We can talk all we want about the power + multiples of software, but the real $$$$ still comes from premium IRL activities.

Netflix already has the IP to create a full-blown park. It would take too long for Netflix to build a Theme Park themselves, but Six Flags just went through a massive merger + could use a shot in the arm.

Netflix has the opportunity to turn the Theme Parks into immersive worlds. Must-attend destinations + unique experiences + price points people will travel for.

They need to own 100% of the world. That’s what locks the flywheel + their own monopoly within their universe.

Final Thought:

There is no one way to build a biz.

But the best way to create value is to do something that others can’t or won’t. The major problem with every biz pursuing best practices (and how everyone else is building their biz)is greater competition and the death of profits.

Eventually, someone will come in for cheaper, faster, and more value. They’ll run the exact same playbook you did, and now you’re in a race to beat them. That will cost you margin.

I’m not saying a great profitable biz can’t be built in a competitive market.

But Consumer brands, and most bizs at scale, become “Winner takes All/Most.” That means you have to be in the Top 3 to survive.

What I hope to inspire through this newsletter is for brands to think about growing their bizs in unique ways. To find opportunities that look crazy, hard, or dumb to other people. Throughout my career (and, life, to be honest) I’ve found those are the best opportunities that led to the best results.