- Let's Buy a Biz!

- Posts

- Olaplex’s Crazy Collapse + Only Way Forward

Olaplex’s Crazy Collapse + Only Way Forward

Olaplex grew way too fast and didn’t grow thoughtfully—it brought them to death’s doorway. Plus, my last-minute holiday hack for you.

🧠 The Takeaways

Today, we’re walking through Olaplex’s colossal collapse + a way forward.

Running an independent clinical trial to regain customers' trust.

Bending over backwards to win back stylists.

Partnering with all the leading Hair Health brands.

+ My last-minute holiday hack.

LBAB! Community - My Final Holiday Hack for you.

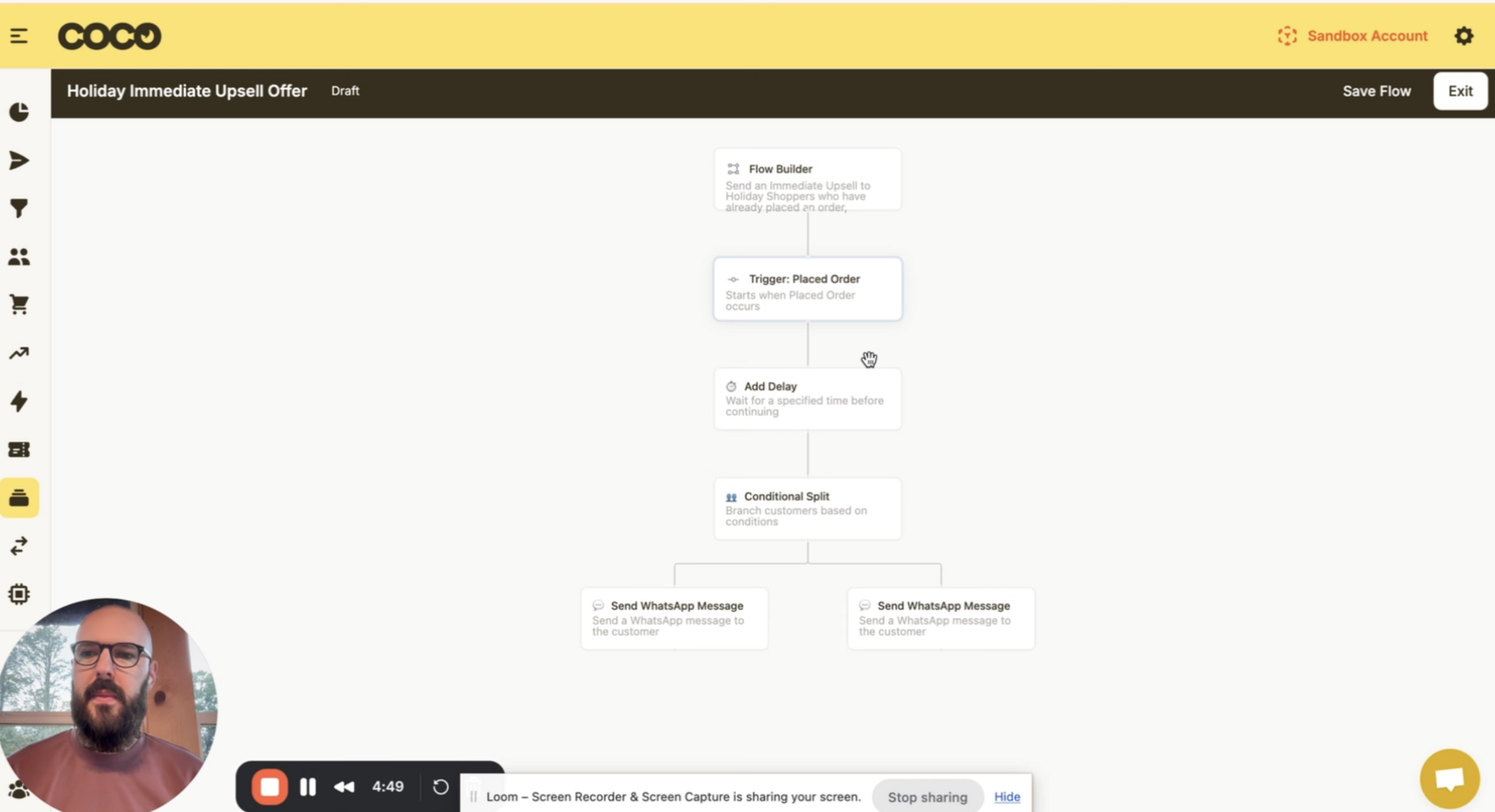

My ultimate Holiday Profit Driving Hack: Automate an immediate 2nd offer to Holiday shoppers across email, WhatsApp and SMS.

TLDR: Create an automation to send another discount to everyone who buys during the holidays.

How to set this up in Coco (takes 5 minutes max):

1) Set a trigger: All customers who purchased in the last 7 days.

2) Add a delay: Wait 4 days after purchase.

3) Send a promo message: A smaller but appealing discount than your BFCM offer to bring them back.

For example, if they already used your BFCM mega-offer…

4 days later, they’d get a 20% off code for another round.

The beauty of this flow?

You can turn it on for any major promo.

You can add conditional splits (ex: Customer w/ 2+ purchases).

You’re always encouraging your best customers to spend more.

When someone’s credit card is out, they're more likely to buy than anyone else.

Incentivize customers to purchase as much from you as possible.

We can build this out in your CoCo AI account for WhatsApp in literally 5 minutes.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

Olaplex (the meteoric Premium Haircare brand) was founded by 2 scientists who created "impossible" chemistry that actually repairs hair damage. It caught fire with professionals, then rode that credibility to mass-market success. Now, it trades at $1 and is caught in the death trap of a shrinking public brand.

Share price: $1.10

Market Cap: $733m

L5 Performance: -95%

P/E Ratio: 37x

After class action lawsuits from customers and investors, this biz is circling the drain.

Today, we’re going to break down the epic fall of 1 of the hottest DTC brands of the last decade.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $422m (-8%) 👎

Gross Profits: $121m (-8%) 👎

OPEX: $225m (+7%) 😟

Net Income: $19m (-68%) 🤮

TLDR Analysis: Death Spiral

Rev, COGS and GM all falling in line. 😓

OPEX’s still rising. 😨

Net Income’s falling off a cliff. ⚰️

The only saving grace here: they have $585m in Cash & Equivalents and are still profitable.

They are continually shrinking to the point it won’t make sense to be a public biz, but they might be able to survive long enough to pivot and save themselves.

More likely, they’ll burn through their cash supply as they become less profitable and tread water from earnings call to earnings call.

Let’s TLDR This Biz

Founding:

In 2014 by Dean Christal + 2 chemistry PhD researchers, Dr. Eric Pressly and Dr. Craig Hawker from UC Santa Barbara.

Discovered molecule that repaired structural bonds hair.

Previously, these bonds were considered permanent and bleached portions of hair would break off/die.

The "Aha" Moment:

Hairstylists could bleach hair platinum blonde multiple times without it breaking off (previously impossible).

Celebrity colorists started using it on clients like Kim Kardashian.

Olaplex exploded through salon communities/WoM.

Explosive Growth:

Started in professional salons (2014–2015)

Expanded to retail: consumers could use at home (2016+)

Became a cult beauty phenomenon through social media + stylist endorsements

IPO’d in 2021 @ a $15+ billion valuation

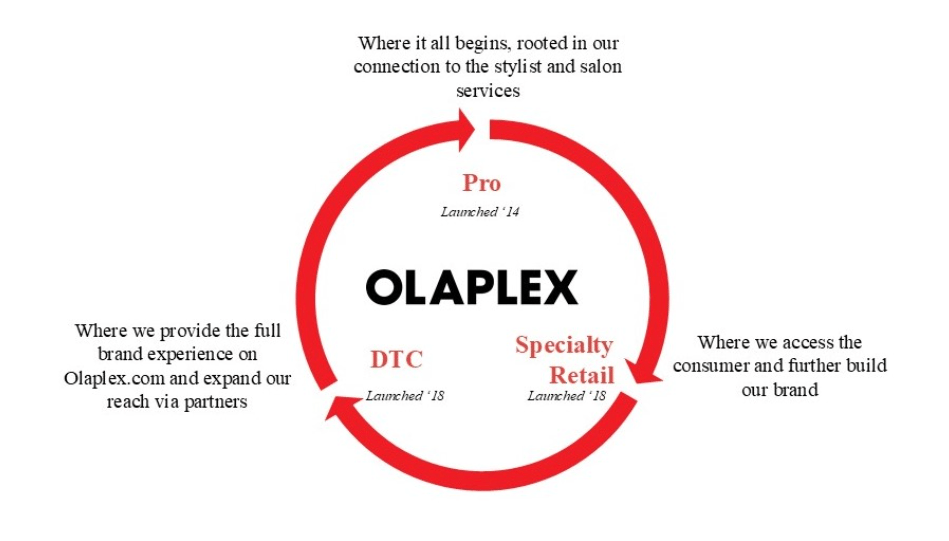

The Model:

Salon ➡️ Home.

Key differentiator: scientifically-backed bond-building technology that supposedly works at the molecular level, not just cosmetically coating hair.

The business model is brilliant.

Salon-grade products for customers to get professional treatment.

Consumer grade quality to maintain care at home.

Expand with premium branding

The Collapse:

In 2021, Olaplex went public at the peak of their hype. Then a tsunami of issues hit the brand:

Competition intensified from multiple competitors (including an original founder of the brand).

Grew so quickly they didn’t invest in customer education. Consumers were misusing the product.

Consumer Class Action Lawsuit claiming their products caused hair loss.

Let’s Save This Biz

Here are 3 ways to save this biz from its inevitable bankruptcy.

1) Run a 3P Clinical Trial

The lawsuit was dismissed without prejudice (didn’t have enough merit to move forward), but the “Olaplex = hair loss” is still killing them.

Salons are fleeing for the hills. No one wants to be associated with anything involving a whiff of hair loss.

Consumers are more cautious about “that brand with a hair loss lawsuit.”

Retails aren’t excited about pushing a product that might expose them to a lawsuit.

They need to invest in independent 3P clinical trials to prove there’s no relationships between their products and increased hair loss.

This is an impossibly tough decision but one that needs to be made.

These trials could sink this biz if they prove hair loss.

But they need to convince more than a courtroom their product(s) are safe.

As a “Scientific biz,” the only way out is a proper peer-reviewed trial conducted by an independent 3P.

The longer they wait, the more the negative association grows, and the harder it is to overcome Consumer and Stylist objections, which will kill the brand as well.

There are no half measures at this point.

Takeaway: The only way out of a hurricane is through it.

2) Win back the Salons

Olaplex’s flywheel is completely dependent on Salons trusting + loving this product.

They’ve lost that.

Professional (aka Salon) Sales:

2022: $300m

2023: $180m (-40% YoY)

2024: $145m (-19% YoY)

Whoever sees these numbers and isn’t throwing every ounce of their being at changing this trend is fired.

1) Launch a 100% Happiness Guarantee

If any customer is unhappy with an Olaplex-certified treatment, Olaplex refunds 100% of the costs for the original service + the treatments to restore customers’ hair.

2) Better Salon Education (w/ Certification)

Continuing education for Stylists + Salon managers But going beyond “here’s how to use and sell our products” (They’re already doing that on their website).

Teach other related helpful and relevant info (how to grow your bookings + manage your biz).

Make every salon that’s willing to bet on Olaplex as successful as possible.

3) Share all their proof with Salons

Win back Salons by proving their products don’t cause hair loss by sharing all the proof they currently have + from their new trials.

Takeaway: Always protect your most important channel partners.

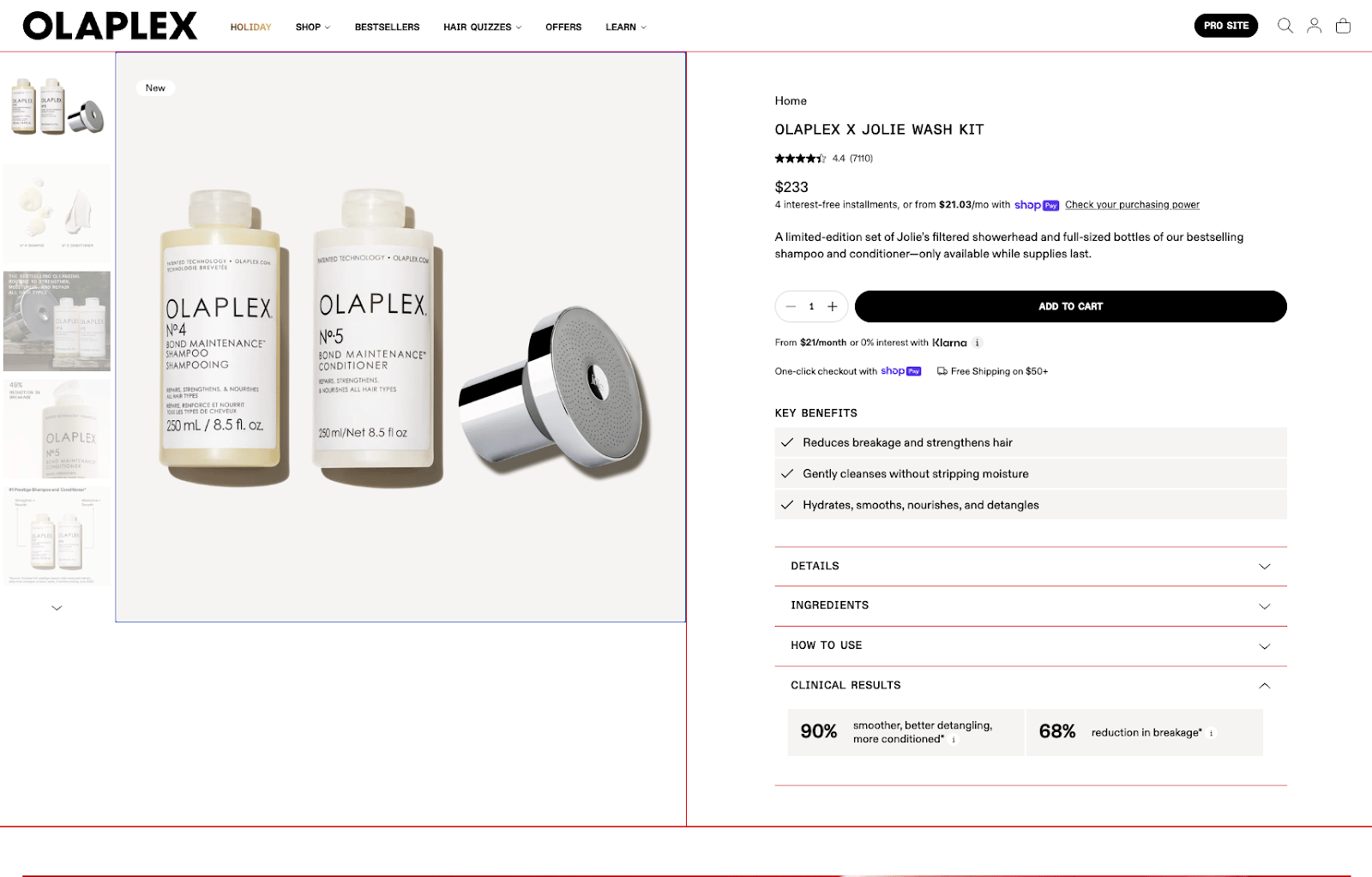

3) Buy Back Trust through Partnerships.

Olaplex is running a smart test, partnering with Jolie on a Wash kit to restore hair.

They need to ripple this play out with all the major “best-in-class hair care products” that have strong brands around hair strength/regrowth.

Dyson Supersonic: Wash + dry your hair at home with the least damaging products.

Nutrafol: Great Haircare + Regrowth Supplements to protect your hair.

Overtone: Haircare for seriously dyed hair.

Depending on brand size (bigger =Dyson; smaller = Jolie/Overtone), run bundles, partnerships, and activations with them.

Just like how Crocs became cool, or ELF became polarizing through collabs.

Olaplex needs to constantly reinforce strong, healthy, growing hair.

For the smaller brands, relevant acquisitions can make sense if they can push them through the Salon channel.

Takeaway: Leverage strong partner positioning. Regardless of size.

Final Thought

Olaplex is the perfect example of what happens when you grow too fast.

When you have an amazing growth moment and run up the score with insane metrics but don’t make the proper long-term investments to scale, the wheels come off.

In 2022, they were:

Growing +18% YoY.

With 35% NET MARGINS (!).

The market leaders.

Little to no competition.

And in 2 years, everything’s come undone.

If they took 5-10% of Rev in 2021 and 2022 and started running more clinical trials (obvious to do for a brand like this) + investing more in educating customers/Stylists on how to use and talk about their products…

They’d probably still be a growing brand whose stock pulled back like all other consumer brands did.

But they wouldn’t be staring death in the face.

They’d just be struggling to build a generational brand like the rest of us.

Reply