TLDR;

- The Top 100 Shopify Plus Brands

- Stripping Rent the Runway for parts

LBAB Community: Top 100 Shopify Plus Brands

After looking into the Top 100 Most popular Shopify Plus Apps, I was curious…

What are the similarities among the largest 100 brands?

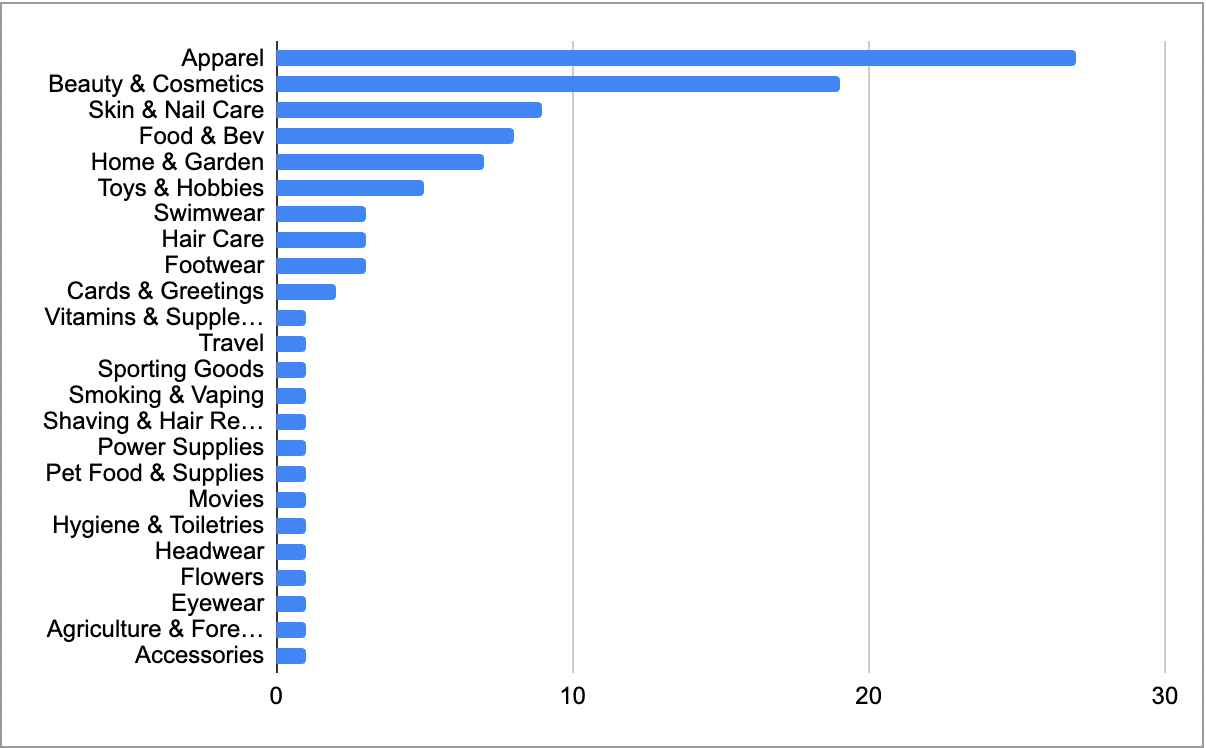

I analyzed the categories to see what the trends are. Apparel and Beauty dominate Shopify overall stores comprising of ~50% and ~25% of total Shopify stores respectively. But what other categories do the largest stores fall into?

The Top 5 Verts 70% of the Top 100:

Apparel: 27%

Beauty & Cosmetics: 19%

Skin & Nail Care: 9%

Food & Bev: 8%

Home & Garden: 7%

My Big Takeaways:

The mix of celeb-backed brands (Kylie, Sanrio, SKIMS) vs. homegrown brands (Morphe, Oh Polly, MANSCAPED).

There are 24 different categories in the Top 100.

My biggest surprise: Home & Garden at the #5 spot.

All supporting, there’s no 1 right way to build an eCom biz. Great products hit in any category with any founding team.

If you want to see on this, check out the Linkedin post on the Top 10 Brands.

What do you think this list will look like next year? Cemented spots, or new entrants? Hit reply and let me know.

Now, to shift from eCom elephants to a complete train wreck of a biz…

Let’s Examine This Biz

Add Rent the Runway ($RENT) to the overfunded VC DTC bizs that didn’t make it. The Netflix-for-Fashion Brand failed because it’s a helluva lot more expensive to rent/reuse a Tory Burch bag than a Titanic DVD.

Trading at $0.68/share with a $47m market cap, -53% since Sep ‘18. This company is too unprofitable and charting nowhere near real cash flow profitability to justify a lifeline. They can’t dig themselves out of the hole quickly enough to make this a viable biz.

For context, $RENT raised $347m at IPO, on top $526m from 13 private rounds (source).

Today, it’s worth 5% of that.

This biz is so far gone that we’ll need to run the full “buy and strip for parts” playbook, acquiring this biz for the lowest price possible and fire selling the assets.

2022 Key Financial stats (YoY Comparison):

Sales: $286m (+54%) 😃

COGS: $27.8m (+59%) 😐

Gross Margins: 90% (0%) 😃/❓

Gross Profits: $258.8m (+54%) 😍

SG&A: $144m (+10%) 👍

OPEX: $400m (+22%) 😰

Net Income: -$138.7m (-58%) 🤮🤮

EPS: -$2.16 (-75%) 🤮

TLDR Analysis: Math Ain’t Mathin’

Their unit economics look amazing right? 90% Gross margins. SG&A (including Marketing) is only 10%.

…That’s until you realize Rental Product & Depreciation costs are a different line item.

A biz who makes money renting clothes to people doesn’t consider the cost of the product they rent (or the depreciation) of those products to be their Cost of Goods Sold?

I don’t want to get bogged down in the nuances of accounting classification here but…

They spent:

$84m of Rental products & Depreciation (29% of Rev)

$92m on Fulfillment (32% of Rev)

$55m on Technology (19% of Rev)

Total: 80% of Revenue

80% of their Rev is spent on what they don’t consider to be COGS or SG&A (another $109m = 50% of Rev).

For the people who were in the room that raised $873m over a decade+, I get it. The delusion that another funding round is always right around the corner is an easy delusion to believe.

But who was looking at their books over the last 3 years? Who was asking how they were going to survive to the promised land?

Let’s Strip This Biz

This biz isn’t worth saving. We’re in straight fire sale territory here.

Here’s my 3-step plan to get the investors as much of their money back as possible.

1) Stop Running a Laundromat

Rent the Runway invested massive CAPEX to build impressive processing facilities to handle the reverse logistics of a fashion rental biz. The problem…

An eCommerce marketplace shouldn’t be handling that scale of Operational complexity all by themselves. Everyone needs to take a real look in the mirror and stop trying to be Amazon.

There are 28,592 dry cleaners in the US (-2% YoY) [Source]. Rent the Runway doesn’t need to build another. Silicon Valley heads will say you need to verticalize everything, but we know how that story ends. Looking at you, Amyris.

These are real assets buyers will want, assuming they own the actual building. The Commercial Laundry market is $1.4B in 2022 and growing at a CAGR of ~3.4%. [Source]

Options:

Sell the Facilities to industrial cleaning services.

Strip the PP&E and sell off the Real Estate.

There’s a reason Netflix doesn’t rent DVDs anymore.

Takeaway: Ruthlessly prioritize In-house vs. Outsource. Know Thyself.

2) SaaS-ify the Technology

Rent the Runway built an Ent-grade logistics software. The ability to manage that level of inventory in such a complex supply chain is really impressive.

I have a hunch there’s a billion-dollar SaaS product buried in this $50m (The Real reason behind my bid).

The company is currently able to:

Track inventory across many lifecycle stages (Product Cleaning -> Restocking)

Manage Reverse Logistics processing (i.e., Returns Management, Product QA, Cleaning → Restocking)

But if you combined this technology with high-end laundromats, this would be a great play for a dying Department store like Macy’s or Nordstrom.

TLDR: the ultimate try-before-you-buy program:

Customers rent the latest fashion

Pick up & return locally.

Keep what they like.

Partnering with that many cleaners would only be feasible at mass retailers’ scale.

If the retailers don’t bite, there are plenty of Logistics providers that would happily take the technology to improve their operations.

And there are plenty of other industries that operate on the Rent & Return model who’d be interested. Construction equipment/vehicles, I’m looking at you.

This story has some real Slack vibes. The major difference being $RENT flamed out in the public market and can’t pivot themselves. Slack abandoned video games and built out their core tool before their A round.

Takeaway: Unleash the Software beast. And Margins

3) Bundle and Sell the Marketing Assets

$RENT proved they know how to capture customer demand and move fashion items. That is valuable to the right buyer.

Consolidate the blog, Site, Social channels, and Email list. Auction them to the highest bidder. Preferably as a bundle.

But we’ll sell asset by asset if we need to.

They have…

785k Facebook Followers

486k IG Followers

58k Twitter X Followers

These aren’t as impressive as I thought they would be. I would have estimated at their scale they’d have 1m+ email subscribers, but based on these social #s, I’m paring that down to 500k.

There’s a fashion brand out there that would love a new audience to run more promos to.

Takeaway: People will always buy monetizable Sales assets.

Final Thought

Reporting Adjusted EBITDA should be illegal.

(Post-Enron, the US government built all these rules via Sarbanes-Oxley Act and GAAP accounting to have clear processes on how a bizs report financials so we’d all be on the same page.

For some reason, we’ve just stopped enforcing that.

In April 2023, $RENT’s Founder/CEO said:

“‘...We posted our first full year and third consecutive quarter of positive Adjusted EBITDA ahead of the timeline we outlined at IPO… We believe we are set up for strong Adjusted EBITDA and significantly lower cash consumption in fiscal 2023, on our path to achieve free cash flow breakeven.’”

5 months later, their stock ($50m) isn’t even worth their cash on hand ($133m).

To be clear, it should be illegal—not because they’re misleading investors. If you’re foolish enough to base your judgment on something that’s stated “Adjusted,” that’s on you.

Reporting Adjusted numbers should be illegal because it allows the C-Suite/Board to lie to themselves.

They hit their “numbers,” with “small” tweaks (AKA removing massive costs the biz incurred) for that to be true.

We know the reporting structure these bizs need to follow to be healthy. It’s time we return to fundamentals.

There’s no more ZIRP environment to bail them out.

🧠 The Takeaways

The days of everything-vertically-integrated bets are over. Focus on your core zone of genius.

Operational investments are necessary. Up to the point they support your actual biz. Not the biz you want to be in a decade or two.

Building an amazing asset to support the unique element of your biz might have more commercial value then your biz. Don’t bury both under one org structure.

If channels make money, there will always be a buyer for them.