TLDR:

I’m back in the States!!!

Restoring Revolve to Ecom Glory

After 3 incredible weeks I’m back in the States.

I’m fighting a bit of jet lag on this beautiful Sunday afternoon here in Brooklyn, which feels chilly after the past 3 weeks at the equator. Truly weird feeling for NYC in the summertime.

To celebrate my second wedding and take some much needed R&R I’ve been in Taiwan for the past 3 weeks which is one of the most beautiful, cool interesting places I’ve ever been (not to be confused with Thailand).

The food was incredible. The view stunning and the people were some of the nicest I’ve ever met. And with the 31:1 exchange rate we also ate feasts for every meal and saw so much of the country.

It was really more of a homecoming for my wife who hadn’t been back in years. We had a great time touring the whole country, stopping in a different city almost every night to share an incredible meal with another member of her family.

It truly was one of the best trips I’ve ever been on and it was hard to come home. But I’m glad to be home and getting back into the swing of things just in time for the holidays!

Enough about me. Let’s get to why we’re here. Putting Revolve back on on the right path.

Guiding Revolve back to the right path.

Revolve, the once DTC darling, is struggling to find excellence as a public market brand and has lost its way trying to become the “ Nordstrom of eCommerce”. It also shows why the department store playbook doesn’t transfer to eCom.

Not looking great, trading at $15.11/share with a $1.11B market cap, -55% since it’s Jun ‘19 IPO. It looks even worst when you compare it to the COVID peak at $84.98/share, but we all know that was an anomaly.

So how did a DTC Fashion brand focused on ethical/sustainable products end up going sideways for 4 years and not really recover post COVID. Even to Pre-Bump levels?

The Financial breakdown

The 2022 Key Financials:

Sales: $1.11B (+24% YoY) 👍

Gross Margins: 54% (-1% YoY) 😐

Gross Profits: $982m (+21% YoY) 👍

Sales + Marketing: $372m (+36% YoY) 😟

G&A: $115m (+29% YoY) 😟

OPEX: $519m (+35% YoY) 😟

Net Income: $58.7m (-49% YoY) 😰

EPS: $0.80 (-42% YoY) 😰

The Financial TLDR:

The company is growing, but with shrinking Gross Margins + Rising OPEX is sure isn’t sexy for investors. Everything about this performance is middling.

Topline growth was good (10-25%), but not great (50%+ range).

Shrinking GM % + Rising SG&A.

Sales + Fulfillment rose 2x YoY the rate of sales.

Net Income halved YoY despite Topline +24%.

10 years ago, Revolve was the DTC darling everyone anchored against that the model works. It’s fascinating to see the biz abandon their core focus to adapt a 100+ year old business model (department stores) that eCom set out to fundamentally disrupt.

Reading through their earnings this company gave me a lot of the same vibes as Honest Company who lost their way since IPO’ing.

So let’s step in and see how we can acquire this biz for < $1.3B to get it back on the path to $10B+.

Here’s my 3 Step plan to restore Revolve to it’s eCom glory.

1) Get back to its Influencer roots

This company has completely lost its way from a Merchandising perspective. And it shouldn’t be a surprise. It’s a direct reflection of it’s strategy. I lifted this quote directly off the About Us page.

“…We deliver an engaging customer experience from a vast yet curated offering totaling over 49,000 apparel, footwear, accessories and beauty styles.”

I don’t know who needs to hear this but this isn’t a flex. This is a lack of real strategy. Why their Gross margin is shrinking + their Cost of sales are increasing. Customers are buried in too many choices. In eCommerce that = more marketing expenses + more discounts. And dead inventory aka the Kiss of Death.

For the company that started selling “influencer’s clothes”, I’m completely lost looking through their site today. They’re selling everything from:

Major brands: Nike, Levi’s Steve Madden.

Other Popular brands: Free People, Re/Done, Journelle.

DTC Up & Comers: Kopari, Beis.

Even the 5-minute Journal.

If all of those names don’t go together or sound familiar, that’s because they don’t.

Revolve has lost the answers to the fundamental questions:

What is their unique curation style?

Who are the providers they must work with?

Why is someone going to buy this product from us?

Revolve has expanded too far chasing topline growth. Now we can clearly see what the cost is. The company grew by 25% to $1B, but profits fell by 50%.

Takeaway: Better Merchandising = More efficient sales = More Profit.

2) What’s the difference between Revolve & FWRD?

Revolve Group is a ‘group’ because they own 2 brands, Revolve and FWRD. It’s a brilliant strategy and 1 of the best moves they made. They know what she wants to buy and they’re on a mission to expand her LTV. This is the classic Toyota → Lexus play.

Launch different brands in the same category to attract different income demos:

Revolve (Toyota) = Attainable brand

FWRD (Lexus) = Luxury brand

The strategy A+. Execution C+. I’m all for sharing wins, but the difference in branding doesn’t show in the shopping experience at all.

The site experiences are virtually identical

The price points are too close

They even use the exact same models

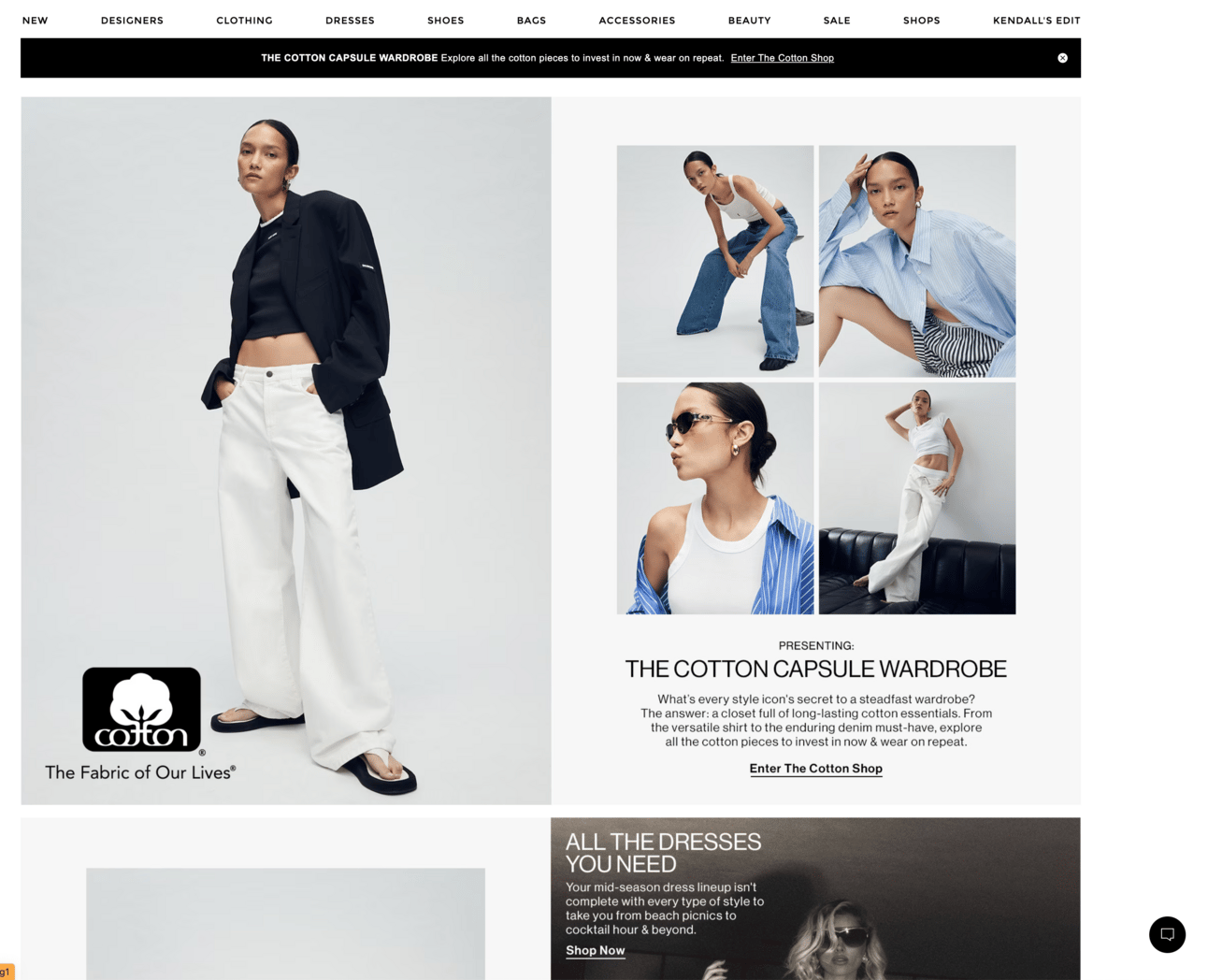

Let’s play a little guessing game… I’m going to remove the logos from both sites. Reply with your guess for which site is which (Revolve or FWRD). No cheating (no looking at the site). In your reply share how you figured it out based on the picture and I’ll Venmo you $10.

Site #1:

Site #2:

Today, it looks like they cloned the exact same business and inserted Luxury brands (YSL, Balenciaga, Alexander McQueen) into a CMS. I’m all for sharing wins, but based on their numbers I feel pretty confident it isn’t working.

If you’re going to ask someone to spend 2x on the same category. The luxury option need to feel more expensive.

The price points should be noticeably different.

The site design should visibly signal more expensive.

The imagery, assets, aesthetics should be full tilt emotion driven.

Takeaway: Invest in Luxury to justify the higher price point. Confused customers = no sales.

3) Spin out a 3rd brand for Discounting

Nothing screams a brand ≠ luxury like a Sale page.

Combined Revolve + FWRD have 33k products on Sale. That’s WAY too many. If they really carry 49k that would mean that 67% of their catalog is currently on Sale. I’m sure that data isn’t perfect, but directionally that validates how poor this model is.

But let’s indulge this strategy for a minute. After all, they are a public $1.1B brand. If Revolve really wants to be the new Nordstrom they’ll need a Revolve “Rack”.

A separate shopping experience for what didn’t sell in season. This is the tried-and-true physical retail, and especially department store, play. Build another storefront to move the products that weren’t a hit during the core buying season to protect the luxury brands identity.

Revolve is already 60% of the way to being the discount site, but 3 distinct brands would be better:

True Luxury (FWRD)

Attainable Luxury (Revolve)

Discount Rack (“Revolve Rack”)

This way each brand is protected and the parent company flows merchandise through each brand efficiently more efficiently. Protecting the branding for the customer that wants to shop at each, while collecting the data to know what and when to cross sell across the portfolio.

Probably the craziest piece of all of this is the new brand would probably be the biggest. If you look at the meteoric rise of discounting apps (Wish, Shein, Teemu), there’s probably an even bigger market opportunity for being the luxury fashion discounting site than Revolve and FWRD’s current sales trajectories.

Takeaway: Protect each brand by building the Digital Nordstrom Rack.

Final Thoughts

This brand falls into the ‘too hard’ bucket to actually acquire. We didn’t even get into what to do with the other crazy categories they sell like Home, Luggage, and Beauty. Another example of how a lack of constraints + too aggressive growth goals leads a great biz down the wrong path.

Since I’m a betting man, I wouldn’t acquire this company now. My best guess: they’ll fall into the discounting death spiral and eventually bankruptcy. At that point, it’d be much easier to turn the company around and shed all this inventory customers don’t want.

But I think there’s a more interesting bigger play here…

If I was really going to buy this biz, I’d raise 20% of the acquisition equity from 5-10 key influencers and become their fashion house.

It’s going to be too difficult to displace the true luxury houses, but every influencer and their mother (literally) are partnering up with businesses to create an “Influencer brand”. A la Seed Beauty + Kylie Cosmetics & KKW Beauty. Why not do it on a platform that already has millions of customers?

It’d be complicated and expensive, but unlock a business value that would truly be unique in the market. The best comp I can think of is Skims who’s currently valued at $4B heading into its IPO. They sell 1 influencers Apparel, Intimates and Swimwear. Imagine what we could do with 10.

There’s a great opportunity to partner with influencers who don’t have the resources to start a fashion house themselves. Revolve would pivot to producing + selling their own products to capture more margin and create a true must-shop destination online.

The team would still curate influencer selects from other brands, but it would flip their current model completely on its head. Customers would come to the site for unique offerings ‘designed by Influencer X’, and their other must have items. Plus it would give Revolve unique products to sell to luxury retailers. Opening up new sales channels.

For now let’s not buy this biz. It’s gotten itself into a deep hole, but isn’t in such dire shape that it’s worth taking down today. But if it does fall into more dire shape, we’ll be ready with the growth plan.

🧠 The Takeaways

Stay focused. Growth is good, but not if you lose your way. Today, Investors punish growing but less/un-profitable brands.

Be Ruthlessly thoughtful about expanding your catalog. It’s too easy to let quality suffer.

Different brands, targeting different customers, need different aesthetics. Don’t confuse customers by being too similar.

Majority of products are in your sales section. 🚩🚩🚩

👷 What can you do about this?

Merchandising is your most valuable decision. Stay focused.

Different brands (even products) need to be unique. Properly invest in differentiation.

Really think about your discounting/sales process. What channel is best to move product + protect the brand.