TLDR;

- Last Brunch before BFCM!

- Saving Wolverine the 100+yr old Boot company from itself.

LBAB Community: Brunch is back!!

Thank you to everyone who came for Brunch #1 in NYC! It was incredible to hear Fred’s story of exiting Luca & Danni 3x and everything that happened post sale.

We had so much fun, we’re bringing brunch back! This time, I’m bringing Ron Shah from Obvi to answer my burning question…

Why acquire another brand (Coffee Over Cardio), when you’re already growing one of the fastest-scaling DTC brands in the game?

He’s also going to share his M&A playbook.

How he’s thinking about growing his portfolio of brands.

The details:

10/25 at 9am - 11am in NYC

Sign up to find out where

We’ve got 10 spots for NYC DTC founders. These will go fast, so save your spot now. [Link]

Hope to see you there! And learn more about how I can help grow your biz.

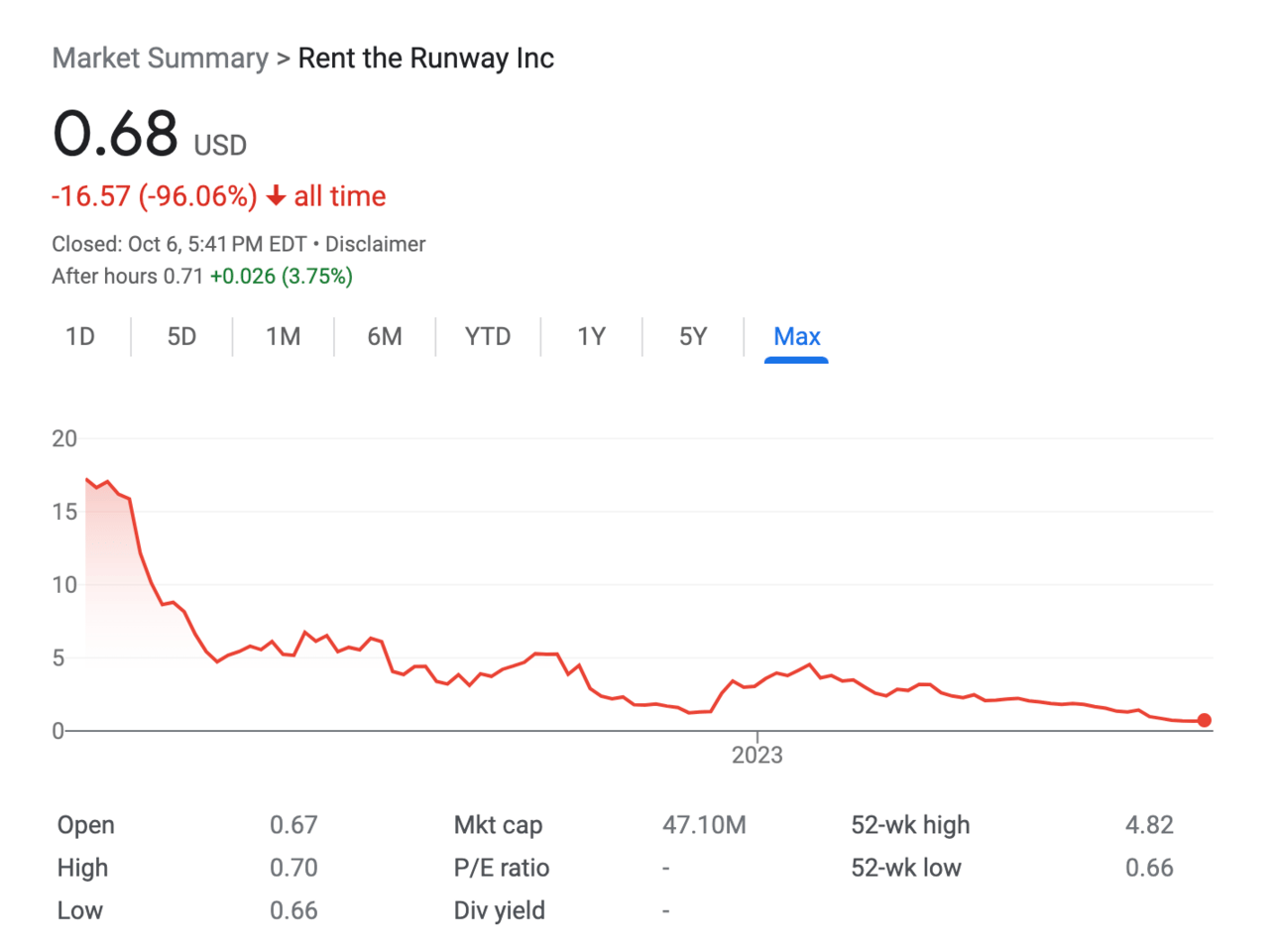

Bankrupcty Court: Rent the Runway + Blue Apron

We’ll be covering both of these stories in the coming week’s in more depth, but the big headlines this week are: Rent the Runway restructured its debts and Blue Apron was acquired for $100m.

Both seeing catastrophic decreases from their ATHs (All Time Highs) and terrible returns for their founders and investors.

On to the main event: Let’s go save an iconic American Footwear brand that’s barreling towards Chap 11: Wolverine.

Let’s Examine This Biz

Wolverine Worldwide (Ticker: $WWW), the legendary US Footwear brand, is grossly underperforming the market and is a prime example of why you need to have a strong, customer-obsessed strategy.

Trading at $8.06/share with a $650m Market cap (0.24x Rev Multiple), this company needs to regain focus in private to be ready to relist as a $2B+ brand.

$WWW is a Portfolio company that owns: Wolverines, Sperrys, Merrell, Chacos, Saucony, Bates, Hush Puppies, & Harley Davidson footwear.

If you just read that and asked yourself… Why are these brands under 1 roof?” You’re already ahead of Wolverine’s management and investors.

2022 Key Financial stats (YoY Comparison):

Sales: $2.68B (+11%) 👍

COGS: $1.6B (+17%) 👎

Gross Margins: 40% (-7%) 👎

Gross Profits: $1B (+4%) 👍

SG&A: $906m (+11%) 👎

OPEX: $1.27B (+721%) 🤮

Net Income: -$189m (-382%) 🤮🤮

EPS: -$2.37 (-77%) 🤮

TLDR Analysis: They’re Having a Bad Time.

A biz operating with too-thin margins took one misstep and plunged from barely profitable to deeply unprofitable.

Post-COVID inflation brought their COGS and SG&A up a couple % points. Doesn’t sound too bad until you realize they only made 3% in Net Profits.

The problem: they didn’t have the points to spare. This chart from their earnings says it all.

Back in 2017, you would have been better putting your money in the general market (S&P) than in Wolverine.

Wolverine’s category, Consumer Durables & Apparel, is slightly underperforming the overall market, while Wolverine is grossly underperforming.

The slippage in COGS and SG&A erased what little profit Wolverine had.

There’s also some financial engineering here. They have $428.7m in Impairment of Goodwill assets, which means they’re writing down the value of some of their brand assets (literally, the Brand names, trademarks etc).

This Portfolio has incredible brands trapped in yet another bad holding structure.

This just hit our desk and we’re going to acquire it for <$700m. Fix it and relist it for $2B. A 2.6x flip.

Let’s Fix This Biz

Here is my 3-step game plan to turn Wolverine from potentially bankrupt into the multi-billion dollar Footwear powerhouse this 100+ yr old brand should be.

1) Divest Sweaty Betty/Hush Puppies. Stick to its Roots.

Currently the Portfolio company (Portco) really has 3 different bizs:

Active Brands (Merrel, Saucony, Sweaty Betty, Chacos)

Work Brands (Wolverine, CAT, Bates, Harley Davidson, Hytest)

Lifestyle Brands (Sperry, Hush Puppies Keds - exited,)

Each is independently profitable, but the parent Corp resources crushes their profitability. While they’ve already divested (investorspeak for “sell off”) Keds & Wolverine Leather, they haven’t gone far enough.

The lifestyle brands just don’t make sense with the rest.

The move: divest Sweaty Betty + Hush Puppies. Move Sperry -> Active group. Streamline the resulting org:

Americana footwear brands (Wolverine, CAT, Harley Davidson, Hytest)

Active/Outdoorsy suburban brands (Merrel, Saucony, Stride Rite, Sperry, and Chaco)

I’m all for the brand who masters Footwear then wants to conquer Apparel, but this was a flawed strategy.

Sweaty Betty = a Lulu/Alo clone.

It feels like during lockdown, someone in the boardroom went, “I like wearing Yoga pants. We need to acquire a Lulu competitor.”

They’re Americana Working-man’s Footwear experts, not a Coastal Elite chillin-in-the house brand. Someone in that room should have said:

On the Hush Puppies, front… They’re “bringing color to brown shoes.” 🥱 + no alignment with the branding/vibes of the overall portfolio.

Another example of how the aggregator model doesn’t work. You can’t just acquire brands because they’re an “eCommerce asset”.

Sweaty Betty & Hush Puppies are the obvious: “which one doesn’t look like the rest”.

At <10% Net Income, ruthless efficiency is king. And prioritization is queen.

Takeaway: Build trends, don’t chase them.

2) Launch the $WWW Megastore

This classic old school, siloed brand shows what $WWW is missing the most: Customer data.

They don’t know their customers and don’t have the data to know what to cross-sell them across the portfolio.

I’m a great example of this…

I own 2 pairs of Wolverine Boots (bought on Amazon) and a pair of Sperry Topsiders (bought in-store). None are my everyday shoes, but they all serve functional purposes. I purchased hiking shoes years ago that weren’t Merrells. Big miss for Wolverine.

$WWW is leaving money on the table by not combining brands into 1 online experience.

Here’s what we do:

Launch a domain (better branded than Wolverine Worldwide) listing the entire portfolio.

Amass tons of data (DTC sites already at $691m/yr), and personalize until kingdom come.

Know their customer, what they buy. Sell them more.

Launch with 1000s of SKUs across brands, making it a must-shop destination. Short-term they'll cannibalize DTC + wholesale orders. Long term, they’ll own the customer relationship.

It’s a #CACHack. Sell more products to more customers at lower acquisition costs. And capture more margins cutting out the middleman.

Takeaway: Name of the game. Sell more to the Same Customers.

3) Become the Footwear ‘Brand House’

Lean into the rugged branding & collab with other American Working man brands. This arrangement is already in place with CAT + Harley Davidson. Stack more brands.

Create a functional branded boot that matches perfectly with how consumers would use a product they already love. Tap into natural audience and earned media potential.

Some killer potential brands:

John Deere

Sherwin-Williams

Yuengling or PBR

Dupont

Ford

Jack Daniel’s

Rally around the worker’s love for everyday products Become the brands bootmaker. Then, extend best sellers into fashion-oriented purchases. I have my work boots + the boots I love when I’m not working.

The path is well-worn: Sperry is synonymous with boating + Northeastern fashion/Frat-shion.

Go forth & multiply. Move into larger TAMs, with companies that are never going to enter the Bootmaking biz.

The flywheel becomes similar to Crocs or ELF’s stunt collabs. Enter new markets with collabs to attract new customers. If it works = new product extension + new customer base

Takeaway: When you’re the best. Partner with the best.

Final Thought

Wolverine is a great example of why investors hate low margin bizs.

In 2021, the company had a 3% Net Income %.

When you only keep $3/$100, it puts every decision on the razor’s edge.

One misstep (like acquiring a Yoga pants company because Athleisure is trendy) can take down a 100+ yr old staple American biz.

The hardest part about scaling physical products is the volume of dollars sucked up in Overhead (Inventory, People, Tooling). Every new SKU splits resources from the best-performing SKU. It’s too easy to lose sight of the 10- or 50-year vision when trying to hit this quarter's numbers.

Chasing too many SKUs in too many categories is the easiest way to barrel toward bankruptcy. Ruthless focus and prioritization is key. Chasing the extra buck is easy. It’s hard to have the patience and discipline to let a groundswell build.

The best brands are able to walk this fine line.

🧠 The Takeaways

Without healthy margins 1-2 missteps could mean death.

Stop trying to conquer all worlds. Build trends, don’t chase them.

Master selling more to the same customer(s). 👈 solves virtually all eCom problems.

When you’re the best, partner with the best.