TL;DR

- Why I liquidated all of my 401ks.

- Crocs is making ugly beautiful (+$$$).

🧠 The Takeaways

Crocs is a 2 brand biz that’s crushing it because they are maniacally focused on 1 mission: bringing you the most comfortable shoes.

They need to cross the comfort -> style chasm to unlock the next level of growth.

Their biggest win: Replicating Crocs’ DTC success on HEYDUDE.

To keep winning at this level of success, don’t lose the script.

+ I did it! I liquidated all of my 401ks.

LBAB Community - I liquidated all of my 401ks

Disclaimer: This is NOT financial, investing, tax, legal, or any other form of advice. (And I was never here. 😉).

Back in Feb, I talked about how I was going to liquidate my 401ks this year..

Well, I really did it.

Over the past couple of weeks, I’ve worked with my previous 401k providers, and I’ve liquidated all of my 401ks.

I don’t recommend others do this. I’ve been thinking about/researching this for a long time.

To me, the question behind these decisions is: “How can I build up enough income that my wife and I can live comfortably and not worry about working for money?”.

Without going on the full rant about how backwards our society is that we spend the majority of our time working to afford the things that make it easier for us to work, vs. spending time on the things that we are the most interested in…

Here are the real reasons I decided to liquidate.

1) GP commits require a lot of capital.

GP Commit (General Partner Commitment) is the amount of $$$ that the person deploying investors’ money needs to contribute to the funding of an acquisition. The standard GP Commit is 1-5% of the total fund’s value.

So, let’s say we raise a $100m fund to acquire brands. As GPs, my partner + I are expected to put up anywhere from $1-$5m of that equity. We aren’t raising a fund that big, but it makes math easy.

Right now, from all the math I can do, I see this as buying myself a much better paying job.

There are 2 ways that I will earn income once we own a biz (it’s a little different than traditional PE since we are running a Search Fund model):

Take a direct salary from the biz we operate while I’m directly working in the biz.

Take a proportional % of the quarterly earnings as distributions.

Based on the size of biz we’re looking to acquire, my annual income will greatly increase once we are in the seat. From both a salary and distributions pespective.

Yes, I’m risking my capital now, but making a calculated bet that will greatly improve my family’s financial situation in both the near and long term.

2) I have more assets out of my 401ks than in them.

I’ve had an incredibly atypical career where I’ve spent just as much time on my own startups as working for others.

While the amount that I’ve withdrawn isn’t chump change, it also isn’t the majority of my assets. As I’ve been working down my sandpaper list, centralizing my personal finances has been a major focus.

My chief concern with my 401ks has always been that it’s just hanging out on an island with low control + no real integration into my core asset building strategy. I couldn’t centralize it into my overall plan while it was in a 401k.

And the lock up period until 59.5 yrs old doesn’t match with the rest of my wealth building philosophy. Why wait until an arbitrary date to retire.

I’m at the point where I have enough assets that I need to make concentrated bets. My 401ks were a small, weak branch of my overall strategy that wasn’t a needle mover for me, so I decided to prune it and fold it into the main quest.

3) I need to create a sense of life or death urgency.

This is the all-in “burn the boats” bet. And I’m not going to lie. I need it. The greatest lesson I’ve learned from 8 failed bizs over the last decade+ is that I end projects too soon.

I have a tendency to map out how the end states will look and move onto another project that catches my attention. Looking back, I think I made a string of right decisions, but at the same time, winning in this game is a function of time spent in the arena. While I believe I avoided a lot of local maxima, I believe this one is the big bet of my career.

I need to build a forcing function to stay focused and disciplined. Something that will make me stick this out in the long run. I’m using the mechanism of betting “my future” on this opportunity to make sure that I do everything I need to make it successful.

Also, the liquidation isn’t an impulse move I’m acting on. I’ve been talking with my dad (a personal Wealth advisor) about liquidating my 401ks for years. I’ve thought through the strategies + implications. I accepted the money I’m going to “lose” by doing this, but I’m making the right long-term bet.

Let’s Examine This Biz

Crocs is making ugly beautiful, and they are crushing it.

Trading at $156/share with a $9.5B market cap, it’s +735% over the last 5 years.

Today, we’re going long on Crocs and taking a big position. This biz won’t want to sell, and there isn’t much more we can add to this biz. Let’s jump on this one for the ride up.

This is what consumer excellence looks like. We’ll get into the nitty gritty, but Crocs took their lumps in 2021, got double hammered over their HEYDUDE acquisition and post-COVID pullback, but have been ripping since.

They ended 2023 essentially matching their 2021 highs and have set themselves up for long-term success. 2 brands was all they needed to hit a $9.5B valuation.

I’m going on a tirade on why this is how you build massive scale in consumer, not the aggregator route.

Financial Summary

2023 Financial Statements (YoY Comparison)

Sales: $3.9B (+11%) 👍

COGS: $1.7B (+3%) 😍

Gross Margins: 56% (+7%) 👍

Gross Profits: $2.2B (+19%) 😍

OPEX: $1.1B (+16%) 😐

Net Income: $792m (+47%) 😍

EPS: $12.91 (+46%) 😍

FCF: $149m (-22%) 😐

TLDR Analysis: What great looks like

Rev is growing 3x faster than COGS 😍😍

OPEX rose 16% YoY which is high and offset most of the gross profit gains. 😐

FCF is down 22% YoY, which isn’t great, but considering how profitably they were isn’t bad. 🤷

You always want to see COGS trend in line with Rev. The more you sell, the more costs you’ll have for those goods. The key is keeping the numbers trending in the same direction. If COGS grows faster than Rev, you have serious problems.

But when Rev increases 11% YoY, and COGS only increases 3%, you’ve unlocked a new win. Either selling higher priced items, discounting less or reducing COGS. In any of the scenarios, it’s a massive win for the biz and unlocks new gross margins to make it that much more profitable.

That’s how they unlocked a +47% Net Income increase with their OPEX rising.

Let’s Scale This Biz!

Here are the 3 steps we’ll add to double down and make Crocs a $20B biz.

1) Ride the Comfort at Work Economy

The Comfort at Work economy is a long-term COVID trend that isn’t going anywhere: people got used to working in comfy clothes. It’s why athleisure has been crushing it.

Athleisure has continued to seep into workwear, and we’re seeing a whole new gen of comfortable style brands that consumers can wear to work + go out.

Shout out to Ben Perkins over at &Collar. I love all of my &Collar shirts and pants because it really does feel like I am wearing pajamas, but I am wearing button-up shirts and presentable-looking pants. Crocs needs to ride this wave for as long as possible.

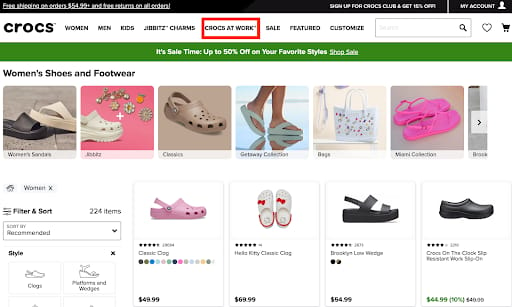

The most important words in this entire screenshot CROCS AT WORK.

Nailing this is the massive new unlock for the brand. They own the brand around comfortable, on-your-feet-all-day footwear. Now, they need to figure out how to make them cool/stylish, so customers are comfortable enough wearing them to the office/out at night.

It will take a lot of testing, and they’ll need to go through many product iterations with their loyal customers. But finding the next major breakout hit will redefine the brand. They’ll no longer be the ugly comfy brand that people sacrifice style of comfort.

If they’re smart, they’ll collab their way to greatness with luxury fashion houses to find that form factor.

Who knows… maybe LVMH buys them. 😂

(Kidding but not really)

Takeaway: Test into the next hero product. Collabs are a fantastic trial style.

2) Bring the DTC Magic to HEYDUDE

Everyone thinks of Crocs as a Retail brand, but Crocs crushes DTC. It’s the core brand’s largest and fastest-growing channel.

The biggest unlock for Crocs is to clone its stellar DTC playbook for HEYDUDE. If you look at HEYDUDE’s numbers, wholesale is slightly declining while DTC is growing the fastest. The major difference between HEYDUDE & Crocs is that wholesale is a larger channel for HEYDUDE.

The simple, obvious move here is to take the entire playbook that's been incredibly successful on Crocs DTC and run it for HEYDUDE.

We're going to see more stunt collabs with big brands/influencers from HEYDUDE to make the brand cooler and appeal to more audiences. You can already see that with a HEYDUDE x Lee collab:

They'll leverage up their digital presence and earned media to generate a ton of buzz for HEYDUDE. The exact same way Crocs drops stunt collabs.

They don’t spend a lot on paid ads, because they can generate a ton of traffic without the big budgets. And it’s working. Crocs’ DTC site did $1.5B in sales last year. Now, the goal is to generate the same for HEYDUDE.

There’s a potential Deckers (owner of Ugg) HOKA moment where HEYDUDE can become a similar size to Crocs in 5 years.

Takeaway: Run a winning playbook until it doesn’t work.

3) Don’t get distracted

This isn’t the sexiest growth tip, but 1 of the most important. The biggest key for Crocs to win over the next decade is not getting distracted/allowing the success get to their head.

Given the high Crocs is on right now, it’s the easiest time to fall into a rabbit hole or overextend themselves.

I'm not gonna lie. I looked at the market cap of Skechers & New Balance to see if Crocs could acquire them. They can’t, both are BIG bizs.

But this is the point where you don't get too high on the hog. You don't get too wrapped up in your own nonsense. You focus on what's working and do more of the same.

For successful people who taste success and want more, it almost gets boring to be at this level of success. The leaders of these bizs are usually the people who hit blackjack, then want to put all their money back in again.

What they need to do is take chips off the table, stay disciplined, and ride this out. Let compound growth take over and make this biz incredibly successful over time.

This is not the time to:

Acquire another shoe brand

Acquire an athleisure brand

Launch new Verticals/categories

The goal needs to be to ride these wins up + build the war chest for the next major opportunity. Be in a strategic position with a stockpile of cash, take more market share and be patient for what comes next.

When the market shifts, and some other brand falls on tougher times, being in an incredibly strong position to buy low, add it to their arsenal and create a portfolio of the most comfortable shoes on the planet will create the most value for this biz.

This is that impossibly hard moment of staying true to the mission and methodically building this biz step by step.

If you get distracted and get stuck on a side quest, it could easily tank the whole biz or drag down profitability to the point where you have to cut back. (Looking at you Wolverine & VF Corp)

But Crocs goal should only have 1 aim: get back to 30% Net Income margin.

This biz is so close to kicking off $1B in annual profits there's no reason they need to be doing anything crazy.

Takeaway: When you’ve reached a local peak, climb to the next 1.

Final Thought

2 key brands is clearly all you need to build a massive breakout company that is a huge success. Crocs is a $9.5B biz doing ~$4B in Rev/yr and is incredibly profitable at a 15% Net Income margin because they have unbelievable focus. Even in the brand they acquired.

We’ve analyzed other multi-brand bizs (e.g., Wolverine, VF Corp) that build a portfolio of brands to get to the same level of scale. It doesn't work because you don't have a team of people all focusing on the exact same quest.

The reason why Crocs could acquire Heydude and make it incredibly successful is because all they focus on is making incredibly comfortable shoes.

Yes, there are different…

Brands

Form factors

Styles

Legal entities

…but all everyone at Crocs HQ focuses on is making comfortable shoes. That maniacal focus in one key area actually gives them more breadth to focus on more biz opportunities.

You can put different styles, types of products, and experiments under each sub-brand to figure out what works the best for each segment of the market. They can go deep there.

It becomes a giant game of Tetris: fitting the right product and style in the right brand and collection at the right time. It’s not easy, but it’s a playbook that a team can master and become the best at.

The other key insight:

They’re selling the same products to the same customers.

Yes, HEYDUDE is a ‘new’ brand, but Crocs owns the comfort footwear brand. If Crocs owns HEYDUDE, they must also be incredibly comfortable. (I don’t own either, but this is the branding positioning to customers).

As a consumer, I'm going to be much more likely to believe in HEYDUDE’s value propositions because I believe in Crocs. HEYDUDE is going to give me an alternative style or use case with the same style.

It isn’t so much about finding synergies across the 2 brands as being able to obsess over a 1 customer audience who cares about the same core value props, then running different iterations of the same playbook under different brands.

This unlocks the value of a playbook.

Running different variations of it teaches you more of what works faster, and that allows you to update the playbook faster and improve it.

When you have to worry about 7 different bizs all in different domains, you don’t get the same aerodynamic benefits that allow you to grow faster and be more profitable.