🧠 The Takeaways

Today we’re throwing our Nike Take private bid in the ring.

Raise prices under the cover of Tariffs.

Invest in Female Collabs for a decade. Grow the women’s biz until it’s bigger than the men's.

Build the largest Materials R&D lab.

+ How I’m surviving Cashflow hell.

Let’s Community - Surviving Cash flow Hell

My post recently on the cash flow hell we’re experiencing at Coco popped off so let’s talk about what I’m doing about it. For full context on the problem check out the post here.

I’m practicing what I preach.

Asking everyone for terms or throwing expenses on a credit card.

Building a detailed 13-week cashflow statement (Reply cashflow if you want a template).

Deeply revisiting forecasts to test how accurate they are.

I’m deep in the classic early stage biz challenge of not paying myself + credit card debt. Both will be resolved this month.

How that 3 step plan helps.

I have more time to hold onto cash. It’s essentially a free loan that gives me to time to pay the urgent bills.

I intimately know the money coming in + going out until September.

The key: Surprise Reduction framework. Make plans accordingly.

I don’t want to have to get AR factoring (Someone loans me money for the value of my upcoming Shopify payouts), but if I need to know I should have a precise idea of when I’ll need the capital and how much I can afford.

I don’t recommend going into credit card debt (especially at the rate I’m paying), but since I know I’ll receive the cash to pay them off quickly. Strategically carrying a balance on my card for 1-2 weeks isn’t going to kill my in fees and greatly smooths out cash flow with Shopify payment cycle.

The next step: Credit cards with longer payback terms. 30 days + points is great. I’d much rather have 45-90 days. That would unlock the next level of growth of the biz alone.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

Nike’s continually declining sales is putting it on the take-private block. So, let’s buy this iconic American company.

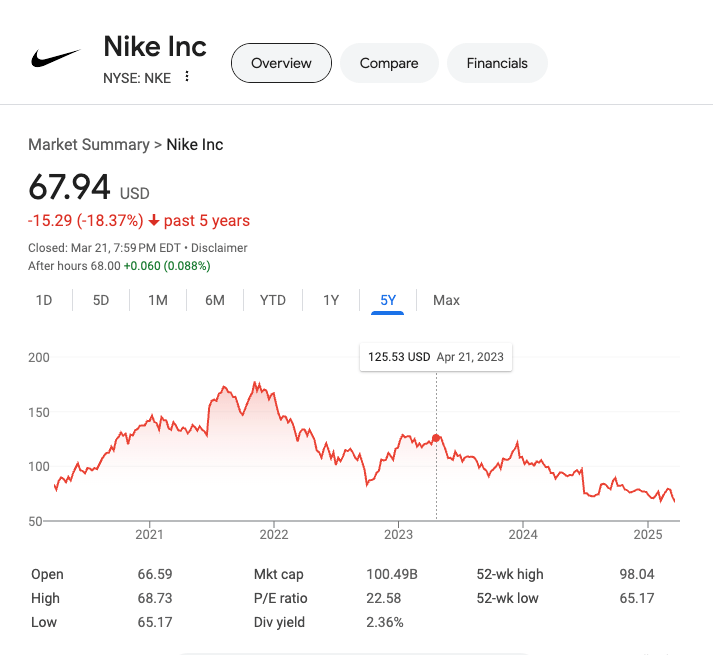

Price/Share: $67.94

Market Cap: $100B

P/E Ratio: 21x

L5 Stock Performance: 18%

Today, we’re rounding up all our Harvard-Club PE buddies and taking Nike private at $130B.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $51B (+0%) 😟

Gross Profits: $22B (+3%) 👍

OPEX: $16B (+1%) 👍

Net Income: $5.7B (+12%) 👍👍

TLDR Analysis: Slow, boring growth, w/ 1 misstep 😟

Sales: Flat + projecting decline. 😟

Margins: Up with lower COGS. 👍

Net Income: Up from 9%→11%. Boring, but an extra $700m. 👍

Nike’s in a tough situation.

They beat earnings and expectations, but they’re facing declining projections and numbers that don’t scream, “We’re going to be super profitable!”

It would almost be better if they took the loss, swallowed the medicine, then had the clean “We’re moving on from here” narrative.

Hopefully (unlikely) they can claw their way out before they take too many more losses. More likely, they’re in for more pain (Rev and Profits) before this gets better.

Let’s Scale This Biz!

Here’s our 3-step game plan to turn our $130B investment into $500B.

1) Increase Prices in America

America represents 50% of Nike’s Sales.

Tariffs + Inflation are great cloud cover to raise your prices, even past of your COGS increases or the rate of inflation—we saw it happen during COVID.

It’s a short-term play, but with declining sales + est. costs increasing 25%, extracting more profits from existing purchasers is the best way to survive the storm. The rest of the world can enjoy lower prices where costs are lower.

This is the problem with the current Tariff strategy. Nike was never going to bring manufacturing back to America.

Nike’s Production Breakdown by Country:

Vietnam: 50%

Indonesia: 25%

China: 20%

Other SEA countries: 5%

US: <1%

Mexico: >1%

Labor $/Hr in those countries:

Vietnam: $6

Indonesia: $4

China: $6

US: $20

Mexico: $3

To make American labor competitive, Tariffs would need to be 333% before it’s even worth having a conversation. Mexico on the other hand is already very appealing if they can get their quality to Nike’s expectations.

It would have been brilliant for Trump to create an environment where they brought it back to Mexico, using that as a negotiation tactic but he had other plans.

Instead of reducing cost inputs. Increase prices to maintain profitability.

The real play: Donate to Trump’s campaign/golf courses/whatever to get the “special exemption.”

2) The Decade of Women’s Collabs

3 reasons why Nike needs to win more women:

Nike’s men’s biz is 2x the size of its women’s biz.

Apparel Sales are flat YoY.

American women control 80% of purchasing decisions.

Women don’t usually look to athletes for fashion inspiration. They look to influencers outside of sports.

E.g., Nike x SKIMS, which lifted Nike’s stock (+4%)—more than the entire value of SKIMS ($4B).

Our decade will be defined by building relationships with Nike Influencers, Fashion and Luxury houses to make Nike just culturally relevant outside of sports.

If Crocs can convince Balenciaga to make a Stiletto clog, we can convince Coach to add their logo to some kicks.

Bringing the women’s unit in line with the men’s would add $12B in annual sales + $1B in annual profits. More when we get their spending in line with macro trends.

Takeaway: Win women with exclusive must-have products that aren’t just for athletes.

3) Dump everything that isn’t the core brands

The brand is losing its edge with younger generations because it hasn’t put out anything truly innovative in over a decade.

Exactly like Apple. Designing variants on best sellers to milk the profits off their late 90s–early 2000s innovation.

It’s time to change that.

We’re going to sell off Converse (4% of Rev, declining sales), Equipment unit (4% of Rev, growing sales) and dump the proceeds ($2–3B) into inventing the next type of Footwear and Apparel for Nike.

Most PE funds would fire me for long term investing $2–3B in distributable cash, but it’s time for Nike to undertake their hardest challenge of the last 2 decades and build for the next 50 years.

Major players like Adidas + Under Armour are going sideways. Nike’s greatest challengers are New Balance, On Running, and HOKA (Deckers).

HOKA: Winning on quality.

On: Winning on “innovation.”

New Balance: Winning on counter culture.

The single best way to beat everyone back and unlock the next $50B in growth is to invent the next great material.

Small teams accomplish great things, but for the raw fundamental science of reinventing fabric, you need a war chest + long horizon to fund the research.

Nike has both.

Takeaway: Nike needs to become a materials Research Lab. Just Make It.

Final Thought

Nike is one of the most iconic American brands of all time but is at a crossroads because of 1 bet-the-biz decision during COVID: pulling back on Retail.

It obviously didn’t pan out, but the narrative around it is also overblown.

Nike is a 50% Wholesale - 50% DTC biz. They bought into the DTC-everything-future, and they are getting punished for being wrong.

Their market cap is flat from the start of the COVID boom. Like everyone else in DTC/retail. They’re back to March ‘20 levels.

If this is the bottom, it means they outperformed the rest of the consumer market (which crashed harder and earlier).

My greatest concern if Nike is taken private is a PE firm would strip it for cash. It’s the easiest path forward considering the check size, but it would turn an iconic intergenerational brand into a shell of itself.

The toughest challenge for Nike over the next 18 mos is fending off the barbarians at the gate. When staring at that many dollars it’s easy to forget how culturally important they are.

And how much money is still on the table if we make this icon even bigger.