Update your email preferences or unsubscribe here

TLDR;

- Taking a lil’ break + 80-20ing my life.

LBAB Community: Taking More breaks

I don't take breaks often enough. I am the biggest proponent of 80-20 and the 4-day work week, but I’m the guiltiest of not taking breaks when I need to.

I work every day of the week.

I frequently work through holidays.

It's a good Saturday if I only work 2-3 hours.

I've come to realize I'm doing a lot of work, but I haven’t nailed focusing on the 1 or 2 things that’ll generate an outsized impact. I’ve been focusing too much on too many of the small things.

That's why this weekend, you’re getting this email early because I automated it, so I could spend some time with my family at the beach, which I do every year.

My family gets together in the spring so we can spend some time together. And this week, I'm gonna take some time off, enjoy time away from a computer screen, and engage with human beings in nature, which is much needed.

2 promises I'm making to myself and you all this week:

1) Taking a long weekend off every quarter, getting into nature, unplugging, and stepping away.

These are incredibly helpful.

They’re a straight up and down refresh.

I usually burn out pretty hard on a ~12 week cycle. My work quality falls off a cliff.

When I spend time thinking, talking with people, and letting my brain truly unwind, I come up with 10x better ideas.

The less I work the more I spend money, which makes me nervous about all the $$ I’m spending and kicks off the hustle cycle again.

2) I am gonna start testing out the 4-day work week.

I don't know how I’ll make that happen, considering that I'm still working the weekends. But I really think there is value to being a lot more judicious with time, even if it means putting 40–50 hours in a 4-day week.

I want to be more thoughtful about how I’m spending my time and what I’m working on. What are the things I actually need to do? Can I reinvent the sandpaper list?

Can I cut out that bottom 10–20% of my work that's generating most of the costs and none of the benefit, and just continually uplevel my skills and my focus?

Do you have a position in Shopify?

Let’s Analyze Shops’ Stock

Today we’re going to break down why Shopify will be a $1T biz by 2034. We wrote a 4.3k article on why this will happen with a ton of:

Research/Context

Examples

Math

Here’s the link for everyone who wants to get in the weeds. For everyone else, this newsletter will be an abbreviated version.

Let’s get the disclaimer out of the way before we dive in:

This content is not legal, financial, tax, or any other advice. And I was never here 😉. I have been an investor in Shopify since 2016, but I do not work at Shopify, nor am I affiliated with the organization other than being a fanboi. This article expresses an opinion, and I am not receiving compensation for writing it. Always do your own research and make your own decisions before investing/spending your money on anything.

Now let’s get to the good stuff.

7 Reasons Why Shopify will become a $1T biz

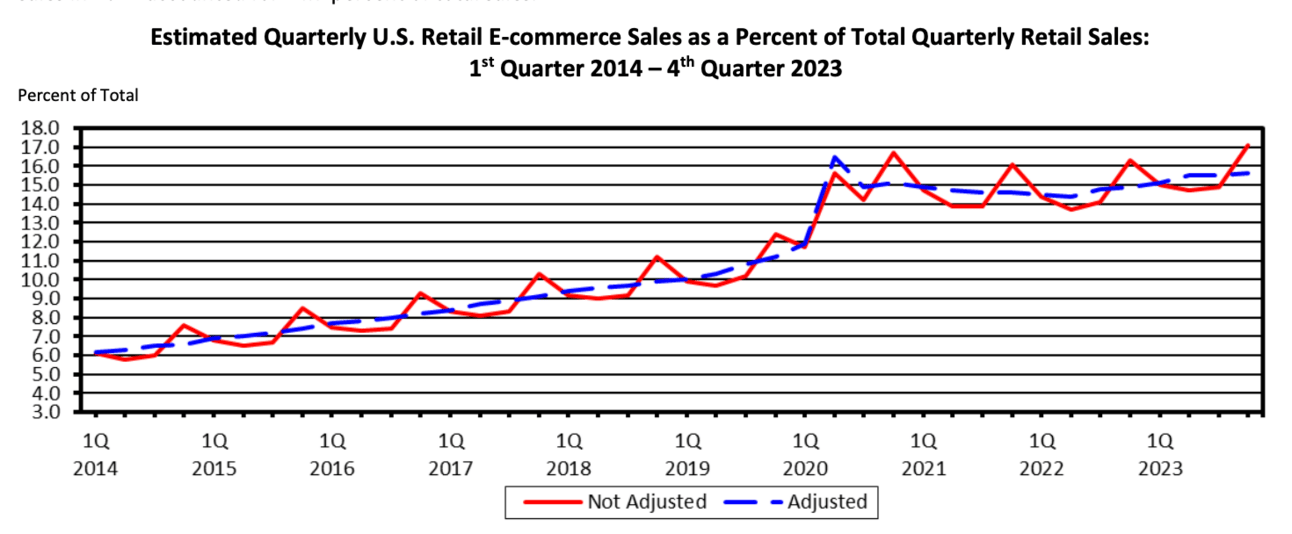

1) eCom Is Huge + Shopify Won

Global eCom is expected to hit ~$6.3T in 2024. Shop’s the obvious SMB -> Mid-Market solution + they’re graduating into Ent.

eCom’s still in the bottom of the 1st Inning. At the end of 2023, Shopify had captured 10% of that U.S. eCom market share. But as eCom continues to eat more of Retail’s share, and Shopify eats more of eCom, those numbers will grow quickly.

2) The Comps are all wrong

Shopify isn’t an eCom platform. Its competitors aren’t Amazon or Salesforce Commerce Cloud (SFCC).

Shopify is NCR for the internet.

In 2023: $5.2B (73.2% of Shop’s $7.1B Total Rev) came from Merchant Solutions = payment processing and capital products.

Subscription Rev (Monthly platform fees) accounted for $1.8B, or (25.3%).

We can sit here and argue what Shopify is as a biz all day, but the numbers tell the truth.

When 73% of your Rev and 58% of profits come from 1 biz unit, that is your biz.

Everyone needs to stop comparing Shopify to Amazon or SFCC.

Shopify isn’t a marketplace.

While Shopify needs to steal market share from SFCC, they aren’t interested in million dollar SaaS contracts.

Shopify is the digital NCR . When they’re processing Trillions in payments, Rev will explode.

3) Shopify Plus (And Ent) is still a 👶

The average GMV for a Shopify Plus brand is $2m/yr. A handful of brands on Shopify are truly ENT ($1B+/yr).

2 key points here:

Shop Plus ≠ Brand size

The Ent Feature Set isn’t there yet.

1) $2m = avg. Shopify Plus GMV.

When a Brand makes it to Shopify Plus, it feels like they’re a big brand, but in reality most are successful SMBs.

There are a few $1B brands on the platform. While they are the best shining examples of Shopify’s success, they’re far from the norm.

2) Shopify Plus Features are too early for the true Ent. brands

The 3 key areas Shopify needs more investment to win the real Ent market:

More complex product catalogs: 2k SKUs is a drop in the bucket for $50B+ brands.

Better Retail Support: POS is cool, but not ready to support 1000 doors across the country.

B2B customizability: Need to handle complicated pricing structures, CRM integrations, limited inventory visibility.

Despite these drawbacks, Shopify is still winning huge brands. Brick by brick, they’re getting there.

4) Shopify JUST Entered Retail

80% of US Consumer spend still happens in-store. Shopify POS is still early and hasn’t gained the level of adoption their eCom Platform has. Capturing the payment flow here will unlock considerable Rev.

This will be the key domino to landing 11-fig brands.

A more compelling eCom offering will win some more big bois and gurls. A great eCom + Retail offering will make Shop the home for household names.

Shop knows this too. Notice how on all their recent earnings they stopped mentioning how many new eCom stores they gained and instead focus on YoY POS growth %?

This is so valuable for 3 reasons:

5x the GMV is processed in retail. Imagine 2.9% on that pile of money.

More Compelling offering to Mid-Market/Retail brands

Integrated On & Offline sales makes Shop stickier.

The bet is really on whether Shopify can disrupt the Retail backend the same way they did eCom. This is a longer and larger ambition, but no one remembers how hard it was to launch an eCom store back in 2005 when Tobi started.

The same opportunity is waiting for them in Retail. How crazy would it be if eCom ($1T) was the smaller side car market all along?

5) The App Ecosystem: Shopify’s Lock-in

There are ~10k apps in the Shopify App store. The ecosystem isn’t just plugging holes in Shop’s product roadmap. This outsourced GTM + Dev team propels Shop faster than anyone in the space.

We’ve covered this 1 at length. Check out:

If you’re a sub and don’t know the stance here yet definitely check out both reports

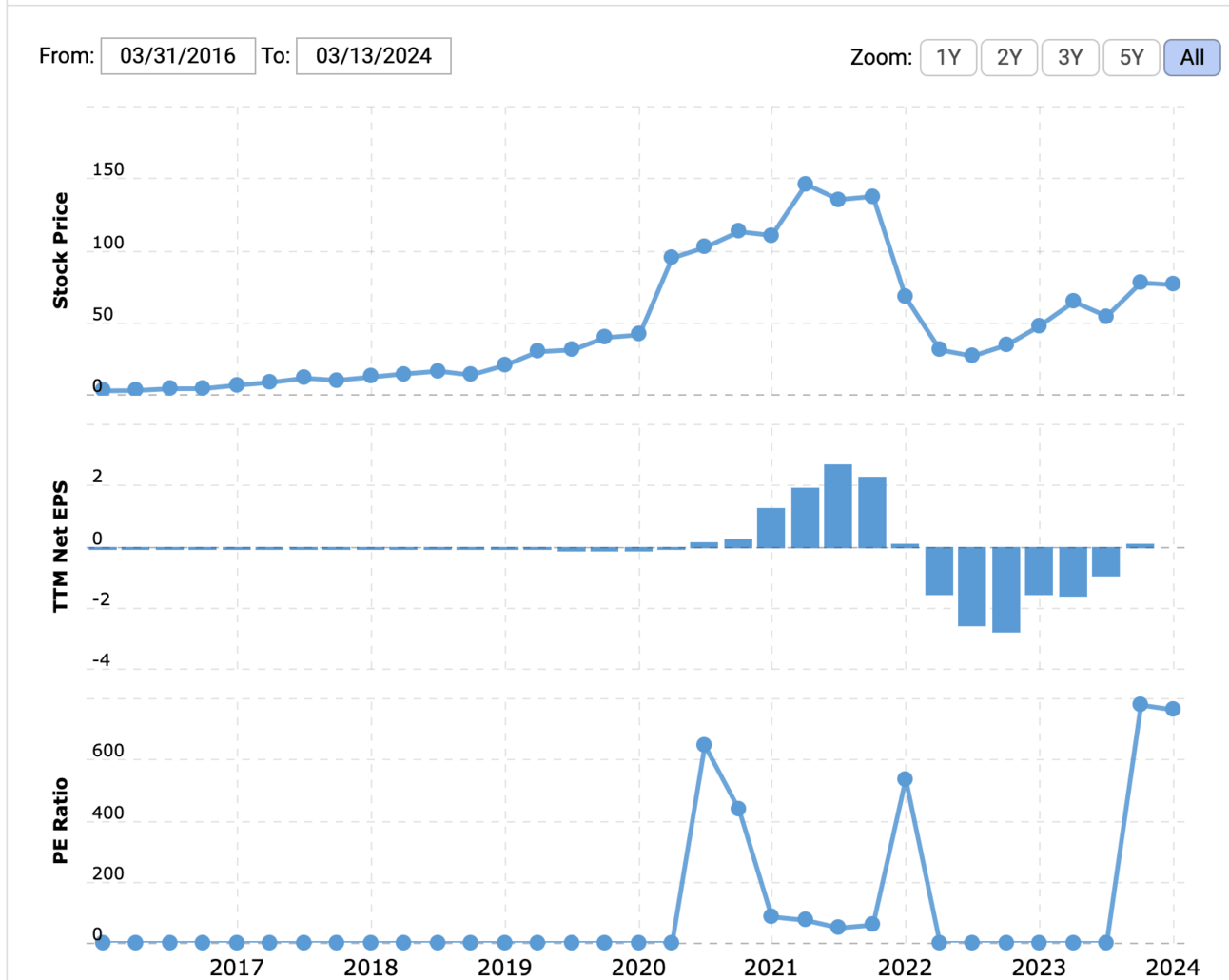

6) Stock price analysis

Shopify’s Rev CAGR = 34% over the last 4 years.

In the next 5 yrs, they will likely make big gains in subscription growth + small but meaningful retail POS share (more Mid-Market brands). Then, in 5-10yrs, that combo will explode Services (Payment processing) Revenue as they grab more Ent merchants.

(I went super deep on Rev Multiples and P/E ratios in this section. Plus the history of Shopify’s valuation and market projections. Recommend if you want to go deep on the stock analysis jump over to the article and read the full section. This one is hard to TLDR.)

Here’s a little teaser of their P/E Ratio and Stock price over the last 9 years.

7) Shopify at $1T: What It Needs To Be + What it Could Be

If you’re still reading at this point go read the article. It’s too good to not dive in. This is where I put the tin hat on.

Final Thought:

It feels insane to say that Shopify is a 10 bagger at $100B when it has a skyscraping P/E ratio today. But at the same time, it has so much room to grow in front of it in huge, valuable markets.

The team is showing no signs of slowing down, and the momentum is still building. You might call me over optimistic or too much of a hypeboi, but there’s 1 brilliance in their biz model we should all take inspiration from.

The insane value they provide on the feature side, the SaaS biz, is a lock in for the real biz model.

Their SaaS features make it as easy and affordable as possible to launch an eCom biz. But what they’re really doing is getting you to commit to a feature set that locks in for payments, which is significantly more lucrative.

It’s basically their version of Amazon Prime.

It’s the same reason I’m very bullish on Disney+ (regardless of Disney’s current stock price). You’re paying for them to advertise to you the next toy, vacation, and movie you’re going to buy from them.

It’s rare, but the truly great bizs find their unique monopoly where the value they provide on the front end powers a much more valuable biz underneath the surface. And that, my friends, is every investor’s El Dorado: The natural monopoly.

Takeaways:

Shopify has a long road ahead, but if they knock over some huge dominos they’ll be a $1T biz in 10 yrs.

So many Shopify programs are still early. They have to keep featuring up to move upmarket.

Retail is Shopify’s next frontier. How will they conquer it?

The Street doesn’t know where to categorize Shopify. Fintech wrapped in SaaS doesn’t have clear comps today.