🧠 The Takeaways

Today, we’re taking over Wolverine to make this Footwear portfolio remotely relevant again.

Dumping fringe brands + going all in on Work Footwear.

Revamping their has-been brands.

Acquiring Timberland from VF Corp to own the Workwear space.

+ How I build all our branding docs in 20 mins with ChatGPT.

LBAB! Community - Built our Branding Boilerplate Docs in 20 mins

Back when I was at Daasity in 2020, we spent 3 weeks sweating over every line of a company boilerplate.

Branding, positioning, the “about us” section. It was brutal.

Last week, I spent 20 minutes dropping a sales transcript into ChatGPT.

The output was honestly better than what I killed myself over 3 weeks to make.

That’s the shift we’re living through.

What took weeks now takes minutes.

What was once “good enough” now can be world-class with little effort.

Updating it is even easier than creating it.

+ My prompt was simple:

“Turn this into a world-class boilerplate.”

Could it be improved? Definitely.

But in 20 minutes, I had a resource that was:

Sharper

Easier to manage

Leagues ahead of what we once slaved over

AI is giving us time back to focus on the things that actually matter.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here.

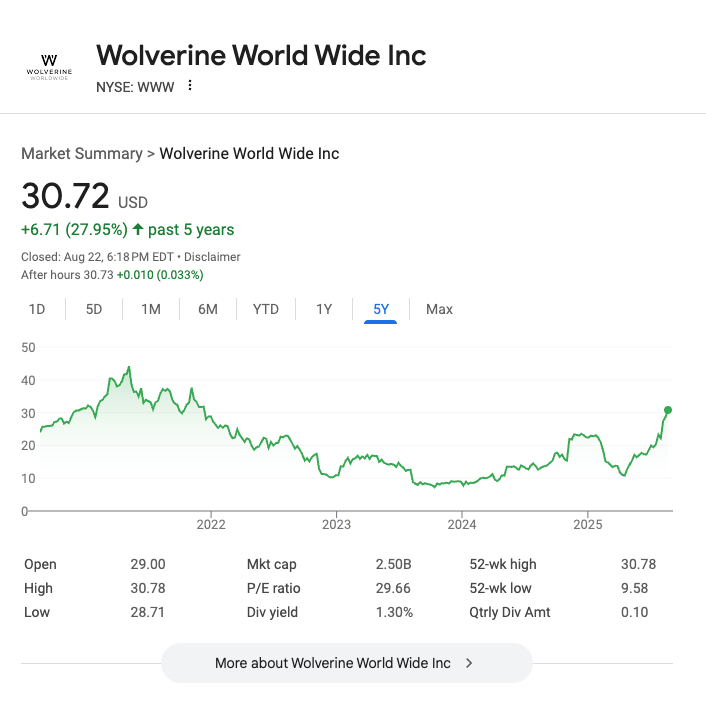

Wolverine, the footwear brand portfolio (Merrell, Wolverine, Hush Puppies and Saucony), has become a turnaround darling (+127% LY) since stripping down and focusing on the brands moving the needle. It’s almost like they listened the last time we covered them.

Share price: $30.72

Market Cap: $2.5B

L5 Performance: +28%

P/E Ratio: 29x

This is why you slim down when overextended and refocus on what actually drives the needle. Since exiting brands, they’ve completely turned the biz around.

Today, we’re going to acquire Wolverine and get it back to growth. But boy did I wish we acquired it in 2023 when it was $650m.

Financial Summary

2024 Financial Statements (YoY Comparison)

Sales: $1.7B (-22%) 😐

Gross Profits: $973m (-29%) 😐

OPEX: $690m (-28%) 👍

Net Income: $51.5m (+230%) 💪💪

TLDR Analysis: Rev down, but Net Income up

Topline keeps shrinking as they sell off brands. 😐

OPEX is falling faster than Rev.

Net Income finally flipped profitable. 💪💪

This is why I rant and rave about Bizs that over extend and why they should divest what doesn’t make sense anymore. Yes, Wolverine’s Rev has fallen for 4 straight years.

BUT, they became profitable again, gained momentum to become more profitable through better focus, and 3.8xed their valuation in 18 months.

Let’s Fix This Biz

Here are our 3 moves to turn Wolverine back into a power footwear brand worthy of investment.

1) Continue the Divesting

I wouldn’t have sold off Sperry’s in the grand divestiture Wolverine undertook in 2023-2024, but I respect the move.

Giving up a crown jewel like Sperry’s is always a brutal decision to make, but it was clearly the right one for this biz.

My only problem is they didn’t go far enough. And this one chart says it all.

This chart shows you what your returns would be if you invested in the general S&P composite, S&P Consumer Durables/Apparel brands, or Wolverine.

Easy to say Wolverine hasn’t been the move.

The returns have been awful because… what IS their portfolio? What is their area of excellence?

Footwear? Then what is Sweaty Betty doing there?

Workwear? Then why Saucony, Merrill, and Sweaty Betty?

Without having an existential crisis, let’s sell off Sweaty Betty and focus on being a top tier Footwear brand.

If expanding into women is a focus (Chaco, Sweaty Betty, Hush Puppies, + Saucony?), we should be doing it through what the company does best. Footwear.

Takeaway: Always finish the job. Don’t let limbs slow you down.

2) Reinvent the core brands

When was the last time Wolverine was in a conversation about cool boots? When was Saucony last considered a great running shoe?

The core brands need a shot in the arm. The hard part is there are so many of them.

But you have to start with Saucony.

There has never been a better time in the running market to make a name for yourself with Nike imploding and every running brand taking off (On, Hoka, New Balance, hell even Brooks).

Saucony is primed to take an angle in that market, grab some meaningful market share, and boost the portfolio’s sales.

From there, we roll out the playbook to the largest and most important brands (Merrill, Wolverine, etc.) to get people talking about these brands again.

Takeaway: If no one’s talking about you. No one’s buying.

3) Acquire Timberland from VF Corp

I know this sounds crazy, and the portfolio is in the process of dumping brands, but this could be the deal that revives both fading consumer rollups.

Timberland ($1.6B LY Rev) is the high-impact odd-man-out brand at VF Corp that seems to be sitting on a shelf. Would become the crown jewel of the Wolverine portfolio (+ 2x the ENTIRE portfolio’s sales overnight).

It’d bolster the overall portfolio and breathe fresh air into this stale product mix.

Timberland needs a bit of a refresh, so it fits right in with the major brand that has the major overhaul to make it cool again. Then, we’ll use that playbook to reinvigorate the other brands.

At Timberland’s size, it’d be difficult to finance the deal outright, but this would create so much value for Wolverine it’d be worth it to either merge bizs or give VF Corp a meaningful stake in Wolverine.

And it’d immediately turn Wolverine into a $5B biz.

As much as all of VC Corp is currently worth.

Takeaway: Acquire Timberlands to own the Work Footwear category.

Final Thought

Corporate structure and governance are super boring topics but really matter when building meaningful bizs at scale.

1 of Wolverine’s greatest failures of the past 5 years not putting a lot of thought into theirs. They:

Aggregated too many brands under 1 roof.

Didn’t consider how they were curating them.

Got stuck holding the bag on a bunch of under performers.

If Wolverine thought about how they were structuring their brands (what brands lived under what legal entities), there’s an obvious insight that they could have capitalized on.

Clearly, given their more recent acquisitions (Hush Puppies, Sweaty Betty), focusing on female customers is a priority, and they want to diversify away from the blue collar middle-aged working man who was their core demo.

I’m game with this strategy.

But the blindingly obvious question: does it make sense to house all of those brands (especially in the new direction) in 1 legal entity or split them out?

Wolverine Worldwide can own multiple portfolios of bizs the same way that they own multiple brands under this portfolio.

It isn’t just financial and legal decisions. It’s your hiring, your focus, and your mission.

Different portcos can be built that all roll up to 1 major ownership entity that have different focuses and ambitions.

It’s boring legal/accounting work, but when done right, it’s the foundation for success.