TLDR:

- The reverse sales pitch of buying a biz.

- When life gives you Aritzia lemons, make Canadian LuluLemonade

🧠 The Takeaways

While Aritzia seems to be crushing it, but the cracks in its biz model are being exposed. Time for us to jump in before it’s too late.

Cut 20-40% of its catalog before getting stuck with too much slow-moving inventory.

Increase new drop velocity to fuel its best customers’ purchasing behavior.

Own the resale market for gently worn Aritzia.

LBAB Community - The reverse sales pitch.

What's really interesting and what I've come to learn over the 4 years of looking to Buy a Biz is that so much of the buy side is getting the owner to like and trust you.

The best analogy that I have for all of this is that you’re convincing someone to let you adopt their kid. You need to convince them that once you take over, you're going to do the best you can to raise it to the full potential they dreamed for it.

That is all counter-balanced by a heated negotiation. The economic outcome for both parties is dependent on getting the best terms for themselves. It’s this delicate balance of getting someone to like you while consistently negotiating for your best interests. It must have been what dating was like with dowries.

At the end of the day, it won’t be a perfectly equal transaction: one of you is going to be in a better position.

The Seller has better data on what happened but little potential control over the future.

The Buyer has poor access to data but more control over what happens next.

So, to stand out as just not somebody who can show up with a check, you need to get them to really like you and trust you as soon as possible. They need to know that you’ll do right by them.

Showing up with a check doesn’t cut it anymore.

The sales pitch is you.

Ok let’s get into today’s prime section why we need to step in to save Aritizia.

Shout out to Negar who slid in my DMs to request this one. PLEASE hit reply and send me who you want to cover. I’m having fun creating these but my favorite brands to cover are the ones you request.

What’s 1 part of a P&L that you want to learn more about?

Let’s Examine This Biz

Aritzia, your girlfriend’s favorite store that is pretty comfy to sit in, is facing serious consumer headwinds, and despite strong performance, is on a razor’s edge. 2 roads remain: death or glory.

Trading at $25/share with a $1.26B market cap, it’s +79% L5, but -47% since its Jan 2022 peak.

Today, we’re preparing to acquire Aritzia and snap it up for $2.5B, if it gets too far out over its inventory skis to build this to be Canada’s LuluLemon 2.0.

Stock price looks pretty typical for an eCom/Retail brand during COVID, with not much to write home about.

Financial Summary

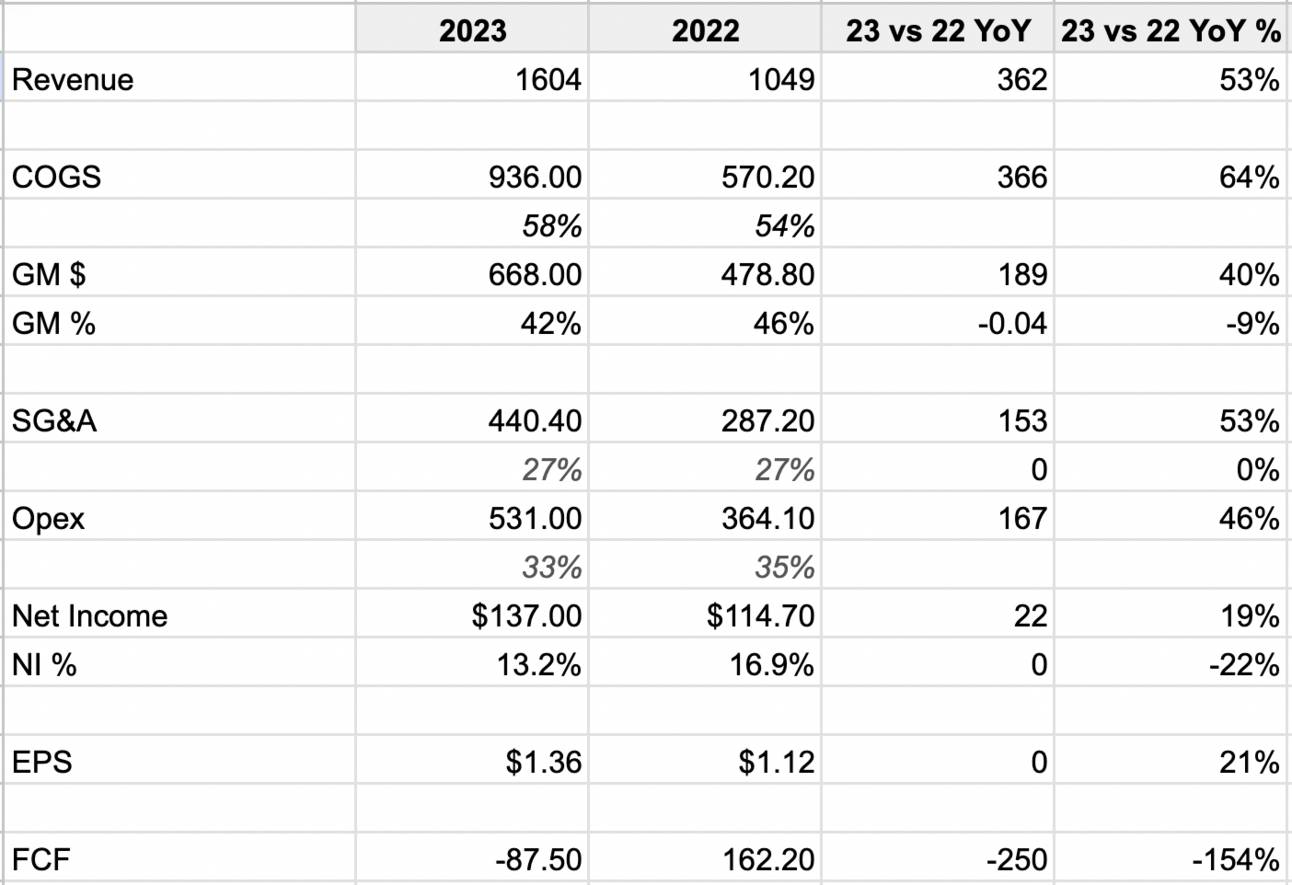

2023 Financial Statements (YoY Comparison)

Sales: $1.6B (+53%) 😍

COGS: $936m (+64%) 😰

Gross Margins: 42% (-9%) 😰

Gross Profits: $668m (+40%) 👍👍

SG&A: $440m (+53%) 😐

OPEX: $531m (+46%) 👍

Net Income: $137m (+19%) 👍

EPS: $1.36 (+21%) 👍

FCF: -$87.5m (-154%) 🤢

This biz looks like it’s firing on every cylinder and by most metrics is crushing it. But they’re also showing the telltale signs of a fashion biz that is about to tip from 🚀🚀🚀 → clearance firesale if they don’t get nail the landing the next 3 quarters.

TLDR Analysis: Great Performance but Cracks are showing

COGS are rising faster than Rev. 🚨🚨🚨

OPEX is decreasing as a % of Rev. 👏

Net Income is increasing while FCF got eviscerated. 😬

On the Operations front, it looks like Aritzia is doing all the right things, but their COGS growing faster than Revenue is an indicator that something seriously bad is on the horizon if they can’t reverse that trend.

Let’s Strip This Biz!

Here are my 3 steps to turn Aritzia into Canada’s 2nd coming of LuluLemon.

1) Get COGS under control

COGS went from 54% of Rev in 2022 -> 58% of Rev in 2023, and the team is predicting they will hit 60% of Rev in 2024.

This trend needs to be reversed immediately.

COGS at 54% of Rev is in the “fine” territory as long as OPEX (Marketing + SG&A) is tight, but 60% is putting the whole biz on a razor’s edge. If they miss on a few SKUs, Hires, or Marketing campaigns, that 13% Net Income Margin evaporates real quick.

This is 1 of the most difficult challenges for a fashion brand and especially one in the quasi-fast fashion industry. They need to constantly be sourcing new materials for new styles, so they can’t leverage economies of scale with big raw material buys.

Aritzia is going to have to get creative with how they position themselves. They’re about to get squeezed in the consumer pinch of increased COGS @ Higher Discounts.

The other area where COGS are likely to get eroded are “normalized markdowns” aka customers need more discounts to buy.

My 2 counter-intuitive plays to thread the needle:

Cut 20-40% of the catalog.

Make all of the most popular items limited runs.

Continued markdowns tell us there isn’t enough urgency to buy what’s available. We can’t let this biz fall into the discount death spiral.

For a brand with 10.8k SKUs online, there’s too much variety. Customers have too many choices, which means Aritizia’s catalog is too bloated, and that bloat leads to inevitable markdowns to clear inventory.

At Billions in sales, they have enough data to know what sells and what doesn’t. The worst-performing sellers are the most obvious because they’re always in the dread column of the Weeks of Inventory report.

Let’s unburden the biz from the capital commits of massive broad inventory buys and concentrate $ on the winners. This is basically what Wall St. has done the past 2 years. They dumped all their money into the tippy top performers (Mag 7) and shed everything else that might have lost money.

(To be clear, that’s a crazy extreme where the principle applies, but don’t literally move all your working capital into your best sellers. This only works if you convince customers to dress like Han Solo).

Takeaway: Shed the Catalog. Fewer SKUs. Faster Turn. More $$ in the Bank

2) Increase new product velocity

I know this seems counterintuitive to my last counterintuitive point, but Aritzia needs to increase the reason customers go into stores. The single best way to do that is constantly launch new products.

As consumers’ wallets get crunched, and they purchase less, the cream of the customer crop will separate from the average. You have to operate under the assumptions that:

The average customer will shop less.

The bottom 20-40% of the customer base will fall out since they can no longer afford it.

Best customers NEED to shop more.

What’s the best way to get the best to shop more?

Give them more of what they like. Your top customers = High Affiliation + High Discretionary Income won’t be impacted as much by hard financial times.

Figure out who they are. What they buy. What they’ll buy more of. Give them a reason to keep coming back over and over and over again. Increase new product launch cadences from 1x/quarter -> 1x/month or week.

The brilliance here is the velocity keeps their credit card out more frequently, while maintaining bigger assortments for the average/casual customer who shops quarterly/bi-annually.

And if you think this only applies to Apparel brands, you’re completely wrong. We did this in consumer electronics (Different colorways/designs) and it crushed.

Takeaway: Increase Topline (+ Profits) by increasing drop cadences w/ limited runs.

3) Launch a Rewear program

There’s enough demand for Aritzia secondhand purchases that Poshmark, ThredUP, and Depop are all running ads against the term.

While this is great to see, there are 2 glaring problems:

Aritzia has 0 control over the resale price.

Customers can take that cash and purchase anything with it.

What Aritzia should do is launch a “gently worn program” where on Aritzia.com, customers can sell and thrift Aritzia clothing.

The always-shopping customer can naturally replenish their wallets and closet space to buy more brand new Aritzia.

The bargain hunters who need a discount, get a lower cost entry into the brand.

For Aritzia, the most important part: it keeps customers' cash flowing through their system.

Aritzia doesn’t need to make money on this program, they can consider it a marketing expense, but collecting the dollars on their platform allows them to give customers credit as a high value incentive to buy more new Aritzia.

They can create the Aritizi-conomy. The amount of credit they use is very similar to the economics of a Loyalty program. The value is completely made up and can be changed based on the biz needs.

Want more new customers to sell their current clothes and update their wardrobes?

Increase the resale value for them.

Need more customers to clear out inventory from a slow-moving launch?

Decrease the credit offered on used item sales to incentivize customers to purchase new.

These secondhand purchases are already happening across Facebook Marketplace + the Resale sites anyway, and Aritzia is missing out.

… And Aritzia doesn’t get the data of what is being resold over and over again. There’s incredible product feedback data and a deeper understanding of customers' financial situations waiting to be analyzed.

Takeaway: Own Your Secondhand Sales.

Final Thought

Using Contribution Margin as the “line” for your biz is such an easy way to quickly ID where the problems / opportunities are emerging.

You’ve probably heard of the phrase “above and below the line”.

Every P&L I read, I split my initial analysis into 2 buckets.

How is this biz performing above the line? (Gross and Contribution Margin)

How is this biz performing below the line? (OPEX)

M&A Note: I add in Marketing expenses (Contribution Margin) because for eCom bizs, Marketing is as important as producing your product.

What this allows me to do within a matter of minutes of seeing a P&L:

Is there a problem with how profitable this biz can be?

Gross Margins: 50%+

Contribution Margins: 25-30%+

Is there a problem with how profitably this biz can operate?

SG&A < 15-20%

OPEX << Gross Margins

Where is the opportunity to have more % of Rev fall to the bottom line (Net Income)?

If we take Aritzia’s YoY P&L as an ex:

Their Gross Margin increased from a raw dollar amount (+40% YoY), but it’s highly discouraging to see the Gross Margin % fall from 46% in ‘22 -> 42% in ‘23.

👉 That insight is what immediately led me down the path of what is happening above the line that might be harming the biz.

M&A Note: It’s much easier to fix below the line problems in eCom bizs than above the line ones. Below the line problems are operational. Not fun, but doable and high control. Above the line are connected to customer/macro problems, which are lower control/harder to right the ship.

If we look below the line, OPEX is decreasing as % of Rev YoY, which is exactly what we want to see. As the biz gets bigger, efficiency should unlock more profitability. As Topline gets bigger, the overall dollars will increase but it shouldn’t be $1 for $1.

⭐The Best bizs can add $2-$3 for every $1 they add in OPEX.

When you quickly look at Aritzia's numbers in this framework, it’s clear they have Above the Line problems. That immediately discounts a brand that otherwise looks strong.