TLDR:

The project that changed my career

Let’s lift Wayfair out of the discount death spiral

LBAB Community - Most Important Project of My Career

Back in 2015, I was working as a Product Manager (#2 to the CEO) at an early SaaS biz in NYC where we had our hands in too many buckets. I was a jack of all trades working on 50 different projects: product managing our dev teams, marketing, support, sales, hiring—really, everything the CEO needed help with.

It was an incredible opportunity as an entrepreneur. I was exposed to so many different areas of the biz. Our main area of focus was building what would essentially become Yotpo UGC, back when Yotpo was convincing brands they needed reviews on their sites.

When we needed to raise some cash but couldn’t fundraise (because Shopify’s was “too small” to have a venture-backable app built on it 😂😂😂), we brought on client work. Which is where I worked on the best project of my career, LuMee. If you've been following me for a while, you know that LuMee was Kim Kardashian's favorite selfie case.

While we were building out our app for Magento, Weebly, Wix, Squarespace, Shopify, and all these other early web CMSs at the time, LuMee needed to update to a better-converting site before they premiered on Keeping Up with the Kardashians.

My job was to rebuild their website to convert all that new traffic. We won the build because our proprietary social streaming app (what I was originally hired to build) was a perfect fit for a biz built around taking well-lit photos for social media.

They were an early, rapidly growing biz: 2 Founders, 1 CS FTE, + agencies. This is so long ago they launched with a PR agency.

This was the V1 Shopify App Store. To build the site we were hacking together templates, apps, custom coding pages, and our app to get their store live. Basically operating as their Dev team.

There was 1 point (Kim’s 1st dedicated post) where we called Shopify to give them the heads up to spin up more servers—We thought we might crash all of Shopify (this is THAT long ago). Their response: the only way they’d crash is if someone pushed Kim Kardashian level traffic. We were like, “Well, you should be prepared for that level of traffic.”

After LuMee left as a client, I started consulting for them, which turned into a FTE role where I stayed for another ~3 years. My FTE role began as they were in the middle of a massive Retail blitz. In 2 quarters the biz got into:

Apple, Verizon, Sprint, Best Buy and Target. There were 30 more, but these were the most notable.

My responsibility? Manage the Golden Goose: Shopify. Then I took over Amazon, Retention Marketing, and supporting paid (Meta and Google).

When we started working on their redesign, they had processed ~3k Shopify orders. By the time I left in early 2019, the biz had processed 300k and was a top 1% trafficked Plus site.

What started off as an agency’s side project turned into the the experience that lead me to bet my career on eCom. And more specifically. Shopify. I wasn’t sure I wanted to work in eCo. When I started working at the agency I really wanted to build consumer software.

But the experience solidified my path and I bet the farm on Shopify. It’s worked out pretty well since. Now, let’s focus on how to save an eCom OG, Wayfair from their impending doom.

Let’s Examine This Biz

Wayfair, the Amazon for furniture, is swirling in the discount death spiral without safe harbor in sight. It’s time we take this biz private for $7.5B and reinvent this eCom OG into a real sustainable biz.

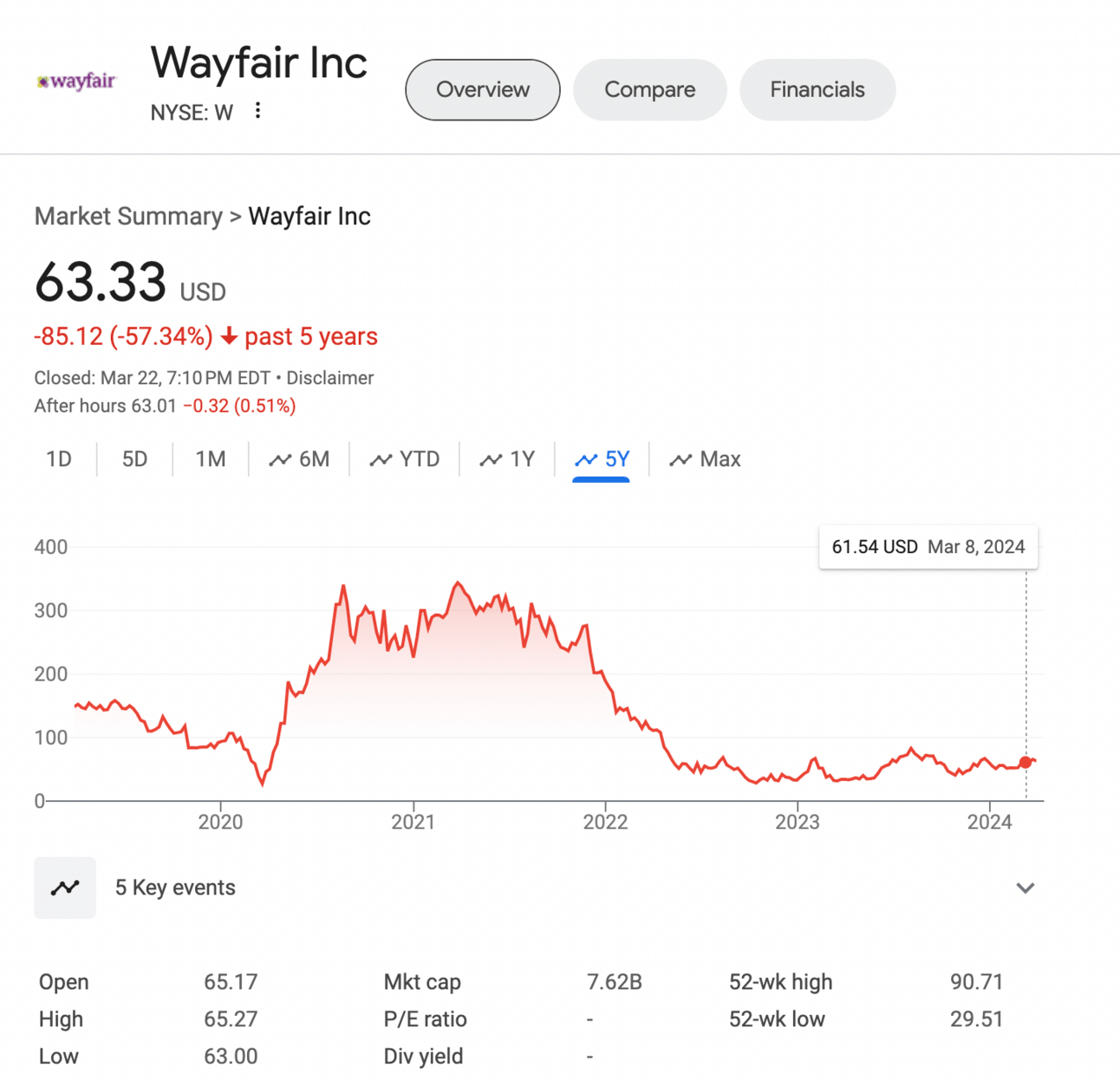

Trading at $63.33/share with a $7.6B market cap, -57% the last 5 years, this affordable furniture marketplace is being upended by cheaper options.

Let’s acquire it for $7.8B, and venture where Amazon can’t won’t. Premium High service furniture marketplace.

They’re now faced with the pivot-or die-moment. I’m officially putting them on my 2024 bankruptcy watch list.

Underneath this race-to-the-bottom implosion, there’s a real opportunity to salvage the marketplace and create the online version of Best Buy. And just maybe, an outside chance at a luxury retail marketplace.

Financial Summary

2023 Financial Statements (YoY Comparison)

Sales: $12B (-2%) 😰

COGS: $8.3B (-5%) 👍

Gross Margins: 31% (+9%) 😀

Gross Profits: $3.6B (+7%) 👍

Marketing: $1.4B (-5%) 😐

SG&A: $2.4B (-7%) 😐

OPEX: $4.5B (-7%) 😐

Net Income: -$738m (-44%) 🤢

EPS: -$6.47 (-48%) 🤢

FCF: -$2m (-100%) 😀

TLDR Analysis: Barely Surviving

3rd straight year of declining Revenues

Need to cut deeper: Revenue, COGS and OPEX all down. FCF is STILL negative.

Gross Profits had a temporary bump on serious COGS Cutting.

Their FCF was -$2m YoY. $1B better than 2022.

Their C-suite can talk about focusing on the fundamentals all they want. That’s like a cruise line focusing on rowing in the eye of a hurricane. This biz has death spiral written all over it.

Let’s Save This Biz!

This biz is stuck in the agony of the discount death spiral. Here’s the 3-step process we’ll use to free it and turn it into a $20B biz.

1) Cut Deeper & Harder

The classic mistake most bizs make in tough times: not cutting deeply enough. The old adage “Cut once, cut deep” exists for a reason. Wayfair has had multiple rounds of layoffs and restructuring over the past year, and it’s the worst possible combination of the 2.

You obliterate morale, as everyone is constantly afraid of being cut vs. 1 painful moment you put in the past.

You build a culture of people afraid to invest in growth because a cut is always around the corner.

You always end up cutting the same amount regardless. It just comes in multiple waves.

Their half measures won’t solve the problem.

The biz is now in its 3rd straight year of declining sales. We can blame COVID demand pull forward for some of this, but let’s be honest: Amazon is the real problem here. I’m sure the CEO of UPS is making the same macro excuses on their earnings calls as well.

Macro is a problem, but Amazon is the death knell. Wayfair no longer has a unique offering, and they can’t compete on price, speed, or selection (their self-proclaimed value props).

Also Wayfair needs to get TF out of Retail. Wayfair is opening their 1st Retail store in 2024. Are you kidding me?! With this state of the biz, category and balance sheet?

I believe eventually retail will be a crucial leg of their strategy, but Wayfair has no biz opening up retail locations today. The additional costs could literally implode their biz.

Takeaway: Have the conviction to Cut Once & Cut Deep.

2) Become the Retailer Safe for Brands

Become the non-Amazon destination for legacy brands looking to sell online. Major appliance manufacturers like GE don’t want to sell on Amazon:

They’re bitter about Amazon destroying their classic retail-first model.

They require a higher level of service/installation that (let’s be honest:) Amazon isn’t going to invest in.

They need a friendlier partner than Amazon.

Wayfair has already started charting this path with a GE appliance store on their site. But they need to replace the cheapest-and-lowest-quality-direct-from-China model and upgrade to durable high-quality producers.

If you sell someone else’s products, your margin is always low and eroding. At a certain point the cheapest options doesn’t generate enough dollar volume to support your biz, so you need to move into the $$/$$$ categories.

Who manufactures those products?

Basically everyone who sells in a Best Buy: GE, Whirlpool, Sony, Samsung. None of these players have properly adjusted to digital. Wayfair can be their solution while saving themselves.

This marriage would provide legacy brands with massive awareness and access to the modern sales motion to target younger customers.

And provide Wayfair:

A path to $$$ items. (Even if @ a lower % of Rev).

More product curation to defend against Amazon.

Product Catalog that naturally requires services

Pre-built Retail Supply Chain to augment their Dropshipping model.

Wayfair’s line that they will “compete on availability, speed, and price” is comical. Amazon will eat their lunch every day of the week, and again on Sunday. As we’ve seen 1000x, just because you have infinite shelf space online doesn’t mean you should carry that much product.

Wayfair needs to solely focus on where Amazon can’t or doesn’t want to. Luckily for Wayfair, Services and additional product support fall deeply in both of these categories.

Wayfair needs to pivot to become the eCom destination for home buyers who want to buy affordable, quality products and need help installing/setting up their homes. As Zillenials hit peak home buying age, play the same convenience card offline that has made the brand successful online.

Takeaway: Align Product Curation + Audience Selection + GTM

3) Become a Luxury Furniture Retailer

It’s an easy thing to say, but it’s a long march upmarket to target wealthier individuals. Wealthier customers don’t all of a sudden think of a retailer as luxury just because they put some new product on the “shelves.”

But the $30B question… Can they become the online version of Restoration Hardware?

Wayfair already has a luxury shop called Perigold, which is the only growing + healthy margin part of Wayfair. It’s small today, but could it grow over 1-2 decades to become a meaningful part/majority of Wayfair’s biz?

If we nail Step #2 and move from Bargain Basement -> Attainable Luxury in the core Wayfair brand, I’d take all profits and re-invest them into 3 key resources to elevate the Wayfair shopping experience, creating the backbone to propel Perigold:

AR virtual modeling

Services Marketplace (think elevated niched-down Taskrabbit)

Curated Sales platform for major brands.

A) AR Virtual Modeling

The current home design process is too manual and requires too much human interaction. I learned this lesson the hard way investing in a home landscaping marketplace.

Leverage technology to make it easier for an interior designer to create more realistic mockups so if someone spends $5k - $5m redecorating a room, it’s easier for that homeowner to visualize and faster for the designer to build.

The beauty of this kind of technology is it can be applied to both properties and can scale whether someone is looking for a new couch or a completely redesigned room.

B) Help me find a professional

Everything from “I bought a couch” to “I need help designing the downstairs of my 10 bedroom house.” Who can customers find locally? How do customers know they’re great? And how can Wayfair help them generate more biz?

To create the marketplace for everyone from the TV stand installer to the luxury home decorator, Wayfair must become the preferred vendor for all related products.

Shopify is the master of this. Create a platform that’s highly templatized. Build a massive ecosystem around that platform. Let the 3rd-party players propel your biz forward.

C) Get better brands to sell on Wayfair

I know but still an important one. Wayfair needs to stand out for its product curation. At least on Perigold. They need to move away from Availability / mass variety as a pillar and instead focus on curation.

Momentum around sales with specific players will build, then more luxury names will want to sell in the Wayfair ecosystem. This flywheel will give them a net new MOAT that’ll protect them from Amazon or other players trying to enter the space.

Layer on partner commissions, ad rev, and the new services that pop up from this playbook, and there’s a profitable biz that sells furniture online trapped in here.

Takeaway: Product Curation matters. In Luxury, it matters most.

Final Thought -

There’s a point in every biz when you outgrow your initial arbitrage. Wayfair’s was essentially Amazon for furniture. They had a great 20-year run, but the ground they built their house on is experiencing earthquakes from the shifting Tech-tonic plates.

It’s time they really reexamined their biz, truly reexamine the market + their core competencies, and find the next frontier to settle on. Wayfair’s home page continues to look like a Going out of Biz sale.

$35 free shipping??? What are they doing?

Most likely, they continue down this path too long and become the online Bed Bath & Beyond.

But if we were able to get ourselves in there and put in the hard work to turn this back into an eCom innovator, we could find the next frontier. Amazon has already won the price + convenience game. And that victory has unlocked more variety than consumers know what to do with.

It’s crazy to say about a $7B biz, but Wayfair’s not big or valuable enough for Amazon to even care about it. They’ve basically rolled out Wayfair’s current biz as a small category for them.

But what won’t Amazon do? Heavily invest in Services and ongoing Support. It would require Wayfair to move into more roll-up-your-sleeves, less sexy categories, but it would also build more loyal customers and explode their AOV. Wayfair doesn’t have to eat the services/support cost on their OPEX if small biz owners build bizs around Wayfair’s marketplace.

A customer researching 1-2 items will pick the cheapest option. A customer who’s paying someone else to advise them will take a recommendation from their trusted advisor and spend more money on a better ‘investment’. Especially when those advisors are incentivized to sell more high-priced products.

🧠 The Takeaways

Wayfair is gasping for air + suffocating in the discount death spiral. We can save them by improving product curation instead of racing to the bottom.

More aggressively rightsize their OPEX to get to a good place faster.

Elevate their suppliers to legacy brands who won’t sell on Amazon.

Invest more heavily in Perigold as a luxury platform instead of eCom site.