🧠 The Takeaways

Today, we’re taking an early activist stake in SharkNinja to stop this biz from going to the dark side to scale it from $15B -> $50B.

Stop the over-hiring creep.

Get out of all these garbage categories.

Actually do more R&D.

+ How to arbitrage the Super Bowl Afterglow.

Let’s Community - The Post Super Bowl Arbitrage

The Super Bowl is a great moment to zig when everyone else is zagging.

The massive brands just blew their H1 budgets on the SB. The world will be talking about it all week.

Time to newsjack.

If you can wedge an offer or promo into the SB chatter (/Valentine’s Day), you’ll be able to surf the big brands’ ad spend when everyone else is pulling back. The inventory won’t disappear but the advertisers will.

As you’re watching the game tonight think about where you can enter the conversation. Great time as CPMs go down, but wallets stay out.

Let’s Examine This Biz

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. I’m not a current investor in Sonos. And I was never here 😉.

SharkNinja, the 5-star home appliance company famous for the (Shark - vacuums + hair dryers and Ninja kitchen appliances), is grossly overvalued as they overextend the brand and crush their profitability.

Trading at $112.17/share

$15.7B market cap (43x P/E Ratio)

+300% since its 2023 IPO.

It’s trading on hype instead of future earnings.

Today, we’re going to take an activist stake and get this biz back on the right track toward becoming a $50B household appliances juggernaut.

Financial Summary

2023 Financial Statements (YoY Comparison)

Sales: $4.2B (+14%) 👍

Gross Profits: $1.9B (+35%) 🤤

OPEX: $1.5B (+41%) 😟

Net Income: $167m (-28%) 🫤

TLDR Analysis: Scaling is too expensive

Gross Margins jumped 7% YoY 🤤

The biz is making less profits ($$ and %) as it scales 🤨

G&A jumped 54% YoY! 😟

1 thing to keep in mind: they went public in the same year, so some of this increase is from 1x IPO stock grants, but still 54% is too big of a G&A increase.

The layers they’re adding on to grow Revenue will be their downfall. Within 5 years this biz will be announcing:

Layoffs

Clearance sales on abandoned categories.

Potentially splitting up this biz.

I’m getting real Instant Pot vibes here.

Let’s Fix This Biz!

3 ways I’d save this biz from itself and keep it on a healthy path to $50B:

1) Cut G&A

I know this is counterintuitive for a biz that’s scaling and seems to be crushing, but SG&A is growing too quickly, which erases the Gross Margin gains they made from keeping COGS under control.

No one likes to talk about this, but brands always overhire with scale because they think bigger Rev requires more heads.

It doesn’t.

The beauty of Consumer brands is how infinitely scalable they are.

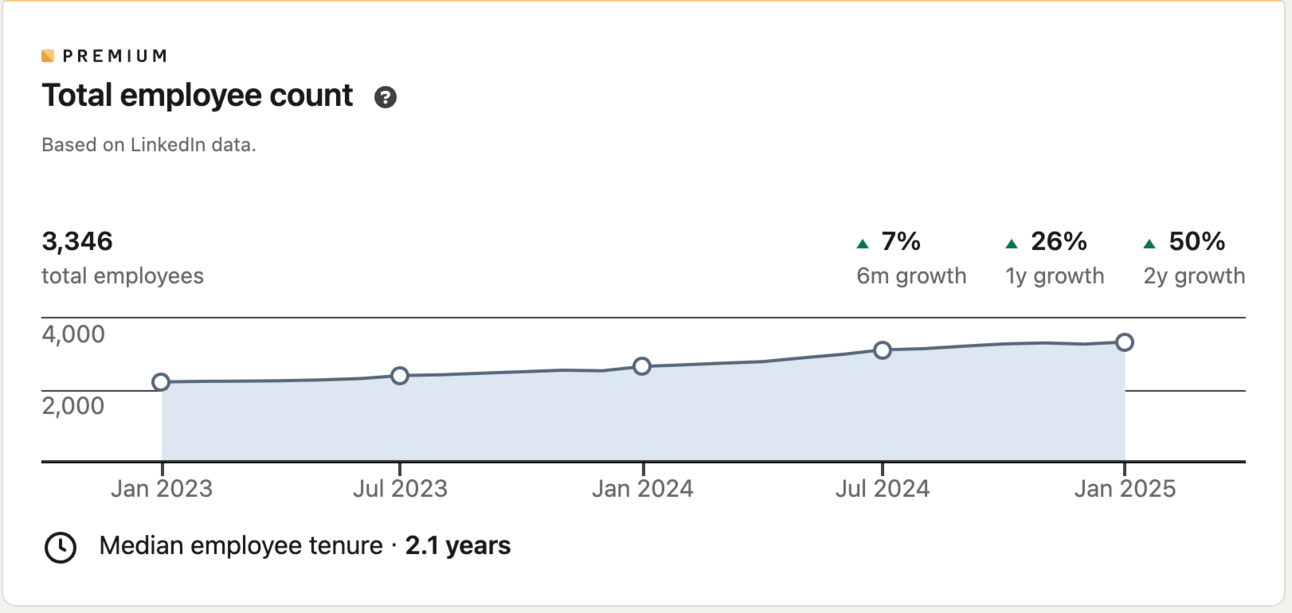

The long and short of it: SharkNinja is overhiring. Over 2 years, Sales Grew 14%; Headcount grew 50%.

The math ain’t mathing. Time to fix that.

Takeaway: Don’t hire when it feels like you’re getting punched in the face. Wait til your nose is bleeding.

2) Don’t get lost in your own hype

No one at SharkNinja is saying no to new product ideas. If they are, I can’t imagine what projects are getting rejected.

Shark became famous for the "no loss of suction" vacuums.

Why’s Shark selling Red Light masks or air purifiers?

Ninja is famous for Air fryers.

Why’s Ninja selling Coolers, drinkware and cookware?

It’s the same problem that post-Steve-Jobs Apple has.

There’s no curator killing the thousand okay/good projects to focus on the 1-2 world-changing ones.

For a biz that prides themselves on producing anything & everything, they need to remember:

If you design something for everyone, you end up designing it for no one.

A huge catalog with mostly mid products is a profitability killer.

A small catalog of category defining ones is how you change the world.

Takeaway: Stick to your core. Don’t believe you can produce everything for everyone.

3) The most fascinating part of their P&L…

For a brand that slaps innovation on every piece of marketing material they don’t spend that much money on innovation.

R&D is 6% of Rev, which is the definition of “average.”

R&D is both a spread of seeds far and wide + a concentrated bet department. Test 100s to find the 1 thing that works, then go all in on making it the best possible thing.

They do have incredibly innovative products, but are they betting the farm on dominating in those categories?

And how many knockoffs of popular competitors will keep this biz afloat? They aren’t investing enough money into making their products the best products ever. Eventually cloning everyone will catch up with them.

If SharkNinja really wanted to win they’d focus all of their R&D + Marketing on putting Dyson out of biz.

Takeaway: Once you find a hit, throw 90% of R&D into making it the best.

Final Thought

I honestly have no idea what the hype is all about.

They aren’t growing that quickly.

They aren’t that profitable.

Most of their products aren’t that unique or cheap.

Is this really the new standard for Consumer public market performance?

I’ve met with a handful of kinda-growing barely profitable bizs that would love to trade at 40x their earnings.

Short-term I’ll probably be wrong here. This biz seems to have momentum + a great narrative on their side, that investors are rallying behind.

But honestly I don’t get it.

They have some amazing products consumers love. But the gems are underneath too much weight.

This could be a great consumer biz that could probably spawn off 3-4 more divisions to become the modern day GE.

But today, the leadership sees money on the table and is clearly grabbing it in whatever trend pops up.

Also know as: the perfect way to ruin a brand.