TLDR;

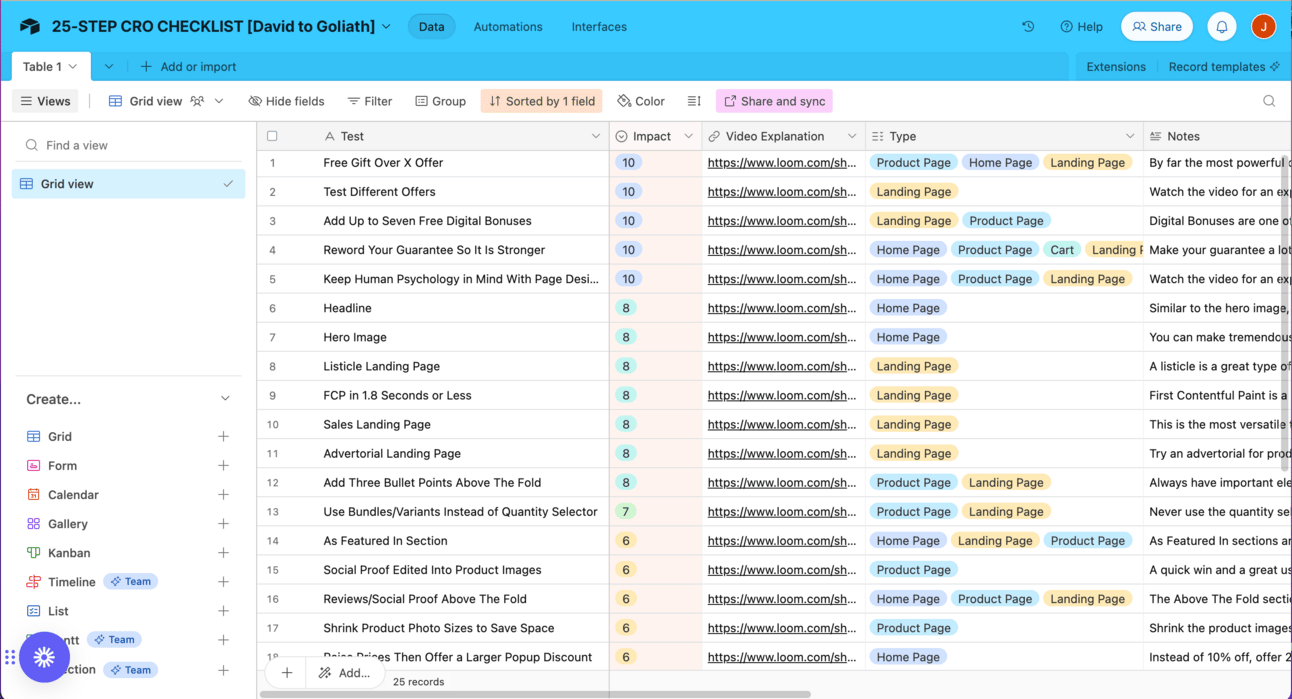

- Your Complete 25-Step BFCM Checklist

- Turning AKA Brands into 1 Cohesive brand

LBAB Community: The Complete CRO Checklist

Black Friday is 19 days away. This is it. It’s GO TIME, people!!!

I love this time of year: The eCom Playoffs.

To prepare you for the Holidays this year, I teamed up with the one and only Nigel Thomas to bring you the BFCM 25 Step CRO Guide to boost your CVR to 5%.

We consolidated all of our lessons from:

Working with 7-9 figure brands over 10 years

Nigel & his agency spending $100m+ on ads

To bring in-the-trenches tactics guaranteed to increase sales this holiday season.

In the CRO checklist you’ll receive:

A video walkthrough with examples for all 25 tips

All of our best strategies to get your LPs to a 5% CVR

5 Daily breakdowns of the most valuable Optimizations to implement

My Cross-Sell Calculator for High value, profitable offers

We only have 2.5 weeks left.

Don’t sleep on this. By the end of the week, bulletproof your final BFCM touches to drive the most sales from your marketing this holiday season.

Now, let’s jump into what happened to one of Shopify Plus’s darling public brands: AKA Brands.

Let’s Examine This Biz

AKA Brands, the Fast Fashion brand house, is a steal to take private. It’s trading at $7.57/share, 0.13x Rev Multiple, and a $80m cap. -93% since the Sep ‘21 IPO.

AKA Brands is the poster child of “DTC is a channel, not a strategy” and why public market investors have taken so many brands to the woodshed this year.

They own 4 pillar brands: 2 focused on Female and 2 on Male customers:

Princess Polly (F)

Petal & Pup (F)

Culture Kings (M)

mnml (M)

It’s not looking good for AKA Brands stock, but they also IPO’d at the tippy top of a frothy market. Let’s decouple their fall from grace (factoring in market timing) and the actual biz.

2022 Key Financial stats (YoY Comparison):

Sales: $611m (+9%) 👍

COGS: $274m (+8%) 👍

Gross Margins: 55% (+1%) 👍

Gross Profits: $337m (+10%) 👍

Sales + Marketing: $232m (+15%) 😐

G&A: $102m (+16%) 😐

OPEX: $509m (+75%) 😰

Net Income: -$176m (+2,846%) 🤮🤮

EPS: -$1.37 (+2,183%) 🤮🤮

TLDR Analysis: Barely Breakeven

Overall, this is an Operationally healthy biz that spent too much on Growth and Headcount. YoY growth for both categories doubled the rate of Sales growth.

Understandable in a tough year.

But how did they get to a Net Income of -$176m, which is a 2,846% YoY increase?

There’s a bit of Financial engineering going on. They wrote off $173m in Goodwill Impairment (aka their “brand” value isn’t as valuable as they thought it was), which comprises 98% of their Net Loss.

This is a massive write-off of their investment in Culture Kings and Redbolls (They don’t mention either much, so I’m guessing it isn’t going well). Basically: “We made an oopsie and overpaid, now we want the benefits after fixing our mistake.”

I’m not going to let them Adjust that. They wanted to get the frothiest stock price at the top of the market. But looking at their biz, I’m going to operate under the assumption that they should be a couple million dollars away from being Net Income Positive on an annual basis.

Let’s Fix This Biz

Here are the 3 steps I’d take to transform AKA Brands from barely profitable -> cash-flowing, profitable Brand House.

1) Take the Medicine. Properly invest in Wholesale.

I hope we can all agree that the DTC-or-Die mania is dead. DTC is a channel, and like all other channels, it has strengths and weaknesses.

It’s been impressive to see AKA scale from a local Australian shop to one of Shopify Plus’s largest brands.

The problem: DTC can only scale so far, and it’s evident in their numbers. All the costs related to selling the Product (Sales, Marketing, and G&A) went up 15% YoY, while Net Sales only increased 9%.

I’m calling up my buddy Jason Greenwood back in to build out proper wholesale infrastructure.

They need to start getting their products into relevant retailers and leveraging national distribution to get their products into more customers' hands.

While they are building their own Princess Polly store in LA and a Culture Kings store in Vegas, this is a LONG investment cycle that we haven’t seen many of the DTC OGs (I’m looking at you Casper, Warby, and Allbirds) actually make work.

Vuori, backed by Softbank’s $400m, will be the last stand for this Owned Retail hypothesis, but I’m not holding my breath.

Takeaway: Wholesale is hard, but necessary to scale.

2) Consolidate or Divest.

I get the strategy they were going for.

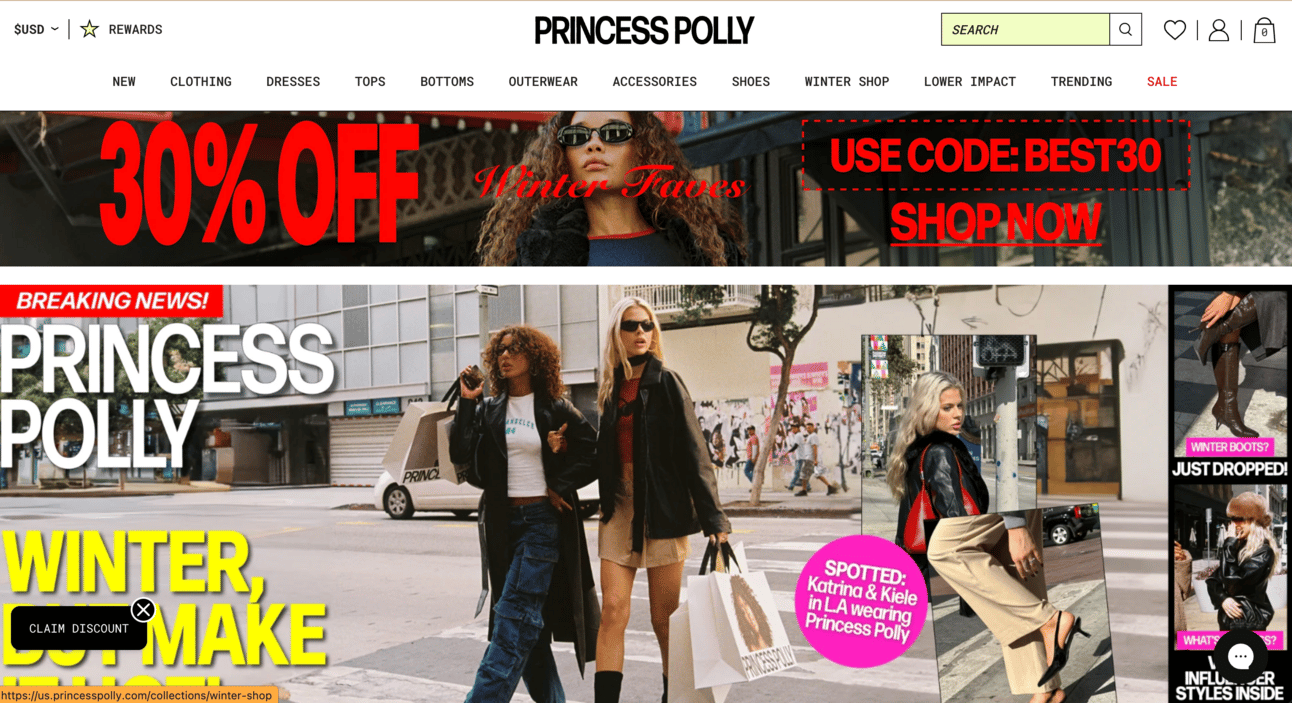

Princess Polly: Women’s Streetwear at more affordable price points.

Petal & Pup: Slightly more expensive Women’s going out brand.

Culture Kings: Men’s Streetwear Retailer in multiple categories

mnml: Men’s Streetwear brand focused on cost conscious customers.

This is a boardroom-smart strategy, but it falls apart in practice.

Here’s the problem at scale:

eCom/Retail bizs are incredibly capital intensive. You can’t just brute force inventory and ad expenses to scale 4 brands that are similar but don’t have actual overlap.

AKA brands is just an aggregator with a small portfolio of larger brands. Even within Fashion, there are only so many synergies to be had. What all of these aggregators keep missing from the traditional PE model is the platform and bolt on strategy.

The firms who do this really well don’t look to have a bag of independent brands under one umbrella. They look for brands they can consolidate and scale the core through bolt ons. Synergy has become a dirty word, but the principle that 1+1=3 through revenue growth & cost savings is the backbone of the strategy.

This math only maths when you can reduce the back office expenses (Typically SG&A and COGS through economies of scale). Running 4, 15, 100 brands all at once is an expensive, distracting endeavor.

Culture Kings is definitely the odd man out asset here, as it’s the only Retailer. It’s too hard to be too many things, all at the same time.

If AKA Brands wants to be a Brand House, that’s fine. It’s a good strategy, but they need to divest the retailer Culture Kings. I also think the lack of expertise here is why they impaired so much goodwill.

Set Culture Kings free to an owner who will make the investments a Retailer needs, not what a brand needs.

The difference here matters.

Retailer: Curation + Customer Experience, regardless of the brands you sell.

Brand: All that matters is the product.

Maybe they want to run the opposite strategy and acquired Culture Kings to pivot the other brands into Retailers, but that gives me strong Revolve vibes. And it’s not a strong move, either.

Takeaway: Divest Culture Kings. Obsessively Build Brands.

3) Laser in on 1 Audience

AKA brands still needs to figure out who they want to be when they grow up. Acquiring assets in different markets for different audiences is a great spreadsheet exercise, but misses the whole purpose of building a biz…

Getting the same customer to buy more from you with diminishing effort.

At this stage, the portfolio play is the same concept as product lines within a brand, just at a larger scale. My biggest questions:

Do younger Princess Polly customers graduate and become Petal & Pup customers?

Do Petal & Pup Customers fill out their wardrobe with Princess Polly products?

Do either PP customers buy Culture Kings or mnml for their SOs?

In their 10k, they mentioned that mnml products are sold in Culture Kings…

But I struggle to see <25 yr old males buying a lot of tops or bodysuits from either PP for their SOs.

Assuming we’re divesting Culture Kings, then the question becomes what to do with the 3 other brands. I’m most interested in the female audience, so mnml may be getting divested as well.

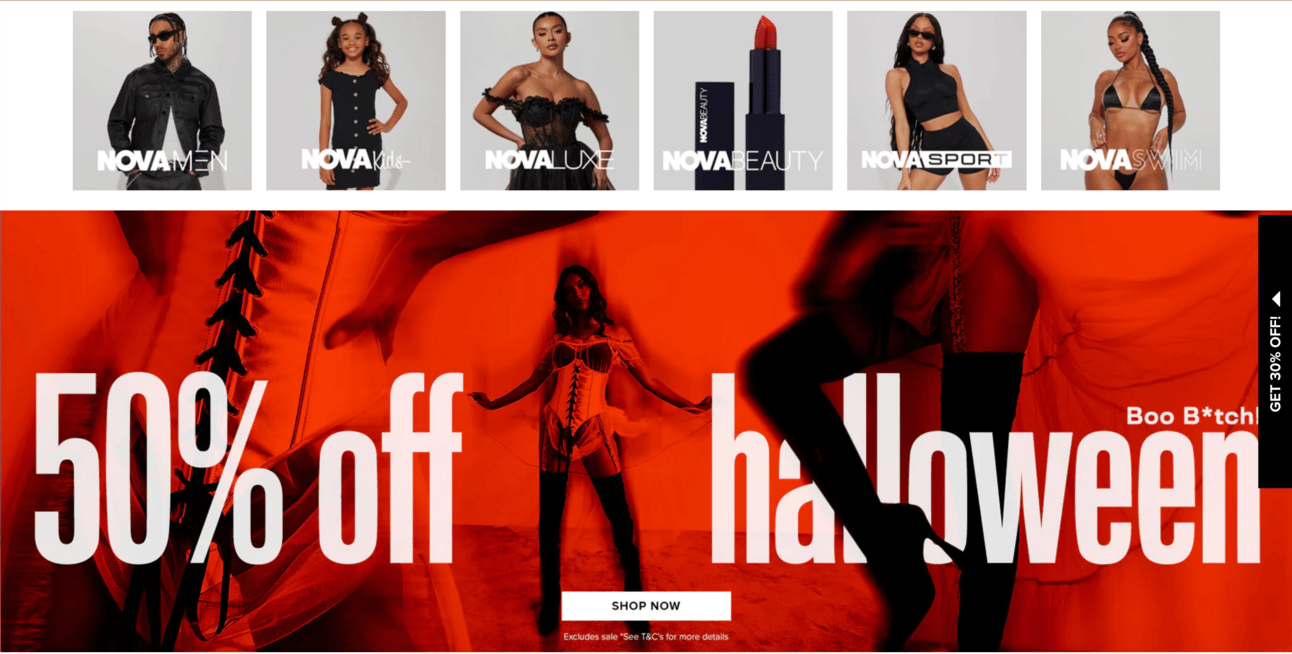

The common playbook today is to consolidate them into one mega brand. I’m going to call this the Fashion Nova/Oh Polly playbook. But that will only get them so far. They need something new to stand out and establish “this” is why customers should buy from them.

Pricing, curation, influencer models, and viral #OOTD content are all played out strategies.

I’d bet the biz on getting out of the provocative and tabloidy streetwear focus and into Young Women’s professional wardrobes.

If you look at Fashion Nova, Oh Polly, or the other scaled Fast Fashion Shopify brands, their catalogs are optimizing for 1 thing.

Male-Driven social engagement to boost views. The play made perfect sense in a Like-driven viral algorithm model. Men would propel engagement for a post, and that became a signal to women of what to wear that those men find attractive.

What I’m more interested in. Who can hit a similar scale but focused on young women’s workwear? Because in the current playbook AKA Brands is bringing a knife to a bazooka fight.

They need to lean into their greater strengths of clothing customers wear out and about. Invest more into inventory that the same customer could wear to the office.

Princess Polly can be the intro price point that twentysomethings buy when going out with friends.

Then buy more pieces they can wear to the office, work functions, etc.

As they mature and get older, graduate them into Petal & Pup to own their home, social, and office wardrobes.

This strategy will shrink the overall customer base because it won’t offer the variety of trendy pieces, but it will vastly extend the LTV of the customers that stick around.

The sales pitch becomes focusing on the catalog that helps customers get promoted, which commands a higher price point than the outfit I want to wear once to boost my Social clout.

Takeaway: Streamline the brand around Young Professional Women.

Final Thought

Focus. Focus. Focus.

I see the same mistake time and time again. We want to grow, so we need to acquire a new audience/demo. AKA brands manifested this through acquiring other bizs, but I see this all the time with product line extensions.

We sell to women and we want men. Let’s launch a Men’s line to capture the other half of the population.

We sell to older customers and we want younger customers. Let’s go launch a new category on TikTok.

This is how you are led astray from the righteous path.

If you are unhappy with your growth, GO TALK TO YOUR CUSTOMERS.

Figure out what problems they are facing. How is that relevant to the products you already sell? Fill those gaps for them.

Why would you want to spend all that time, money, effort, and mental anguish launching a whole new company within your company?

When you could just launch another product through the channels and Ops you already have.

Spoiler Alert: it’s WAY more profitable then launching a second startup to a demo you aren’t familiar with.

By solving existing customers core you plow your way into bigger markets with better cash turns. That’s how real brands grow.

Not brute forcing new demos and audiences. 👈 is how big ad agencies/management consultants get paid to say smart-sounding BS.

At the end of the day, this game isn’t complicated. Make something people love. Ask them what else they want. Make that. Overdeliver on their expectations. Repeat.

🧠 The Takeaways

DTC isn’t dead. But the DTC-or-Die philosophy is. Take care of your customers in every channel, and they’ll take care of you.

Wholesale isn’t the enemy. The same 50% you’re worried about giving to them is going to Meta, Google and Overhead.

Aggregator models don’t work. Focus on building 1 incredible brand. Not 16.

When everyone else Zigs, it’s time to deeply know your customer and Zag.