🧠 The Takeaways

Today, we’re unpacking where the consumer is and where they’re going in 2025.

Mega Retailers saw ~5% YoY Q3 Sales Growth

The Shopify Ecosystem saw +20% YoY Growth

Unemployment and Credit Card Delinquencies look good.

+ We Crushed BFCM again!

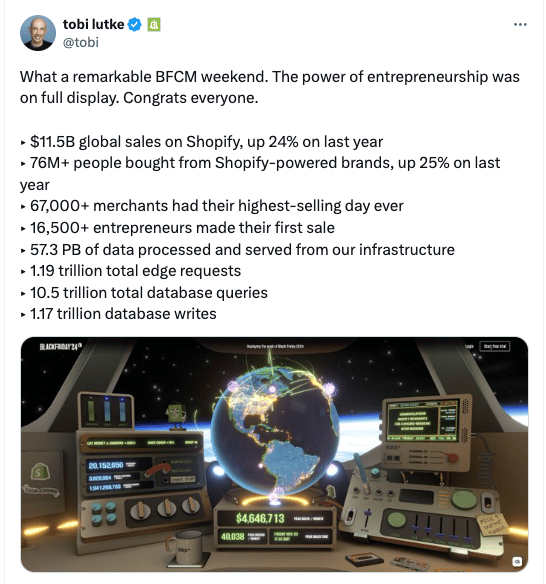

Let’s Community - New BFCM highs! Again.

Today, I’m taking the newsletter in a slightly different direction. I’m going to consolidate the best sources I know and run you through my process of where I believe the consumer is.

Hopefully everyone crushed BFCM. It was incredible to see the Shopify ecosystem as a whole hit a record high.

It slightly underperformed my guess of $12B but overall was a killer weekend for brands.

And all the brands I’ve been talking to say the same thing: BFCM and Nov were strong, though not gangbusters.

Depending on the brand, Dec has been too.

So what happened to the consumer?

We’ve been hearing for 6 months that the consumer doesn’t have any money to spend and that they won’t show up.

Let’s unpack the data we have to figure out what is going on with the consumer and what will happen in early 2025.

Let’s Examine the Consumer

Note: As always, none of what follows is legal, tax, investing, financial, or any other sort of advice. And I was never here 😉.

Despite all dooms day predictions that consumers weren’t going to show up, we saw incredible sales over the BFCM period.

The TLDR:

Consumers are cash strapped

They need/looking for deals.

This popped up like a bright red flag around Halloween.

The 2025 marketing challenge to solve: Consumers don’t have money (65% in US live paycheck to paycheck) but are still spending.

Let’s Check The #s

Here are the 3 major data sources I’m looking at to answer: “Are we growing more, or has the consumer back finally been broken?”

1) How are the “GDP Retailers” performing?

We looked at Shopify, but how are the 4 bizs that are essentially their own GDPs performing? Let’s look at the Core 4 Retailers:

Amazon ($2.3T Cap)

Walmart ($752B Cap)

Costco ($435B)

Target ($59B).

Collectively they represent $1.5T+ in Annual Sales. All of that Rev isn’t consumer, but most is.

The quick takes from Q3 Earnings Reports:

Amazon Q3 Product Sales: +7% YoY

Walmart Q3 Sales: +5.5% YoY

Costco: +2% YoY

Target: +0.3% YoY

The 1 trend: The winners of deals + value (Those who could push their COGS down the most) won.

What this tells me about consumer:

They’re always going for key social moments (ie. The Holidays).

They don’t have as much money, Deals/Value wins out.

The best become more profitable by pushing their costs down.

Takeaway: Consumers are cash strapped, but still spending.

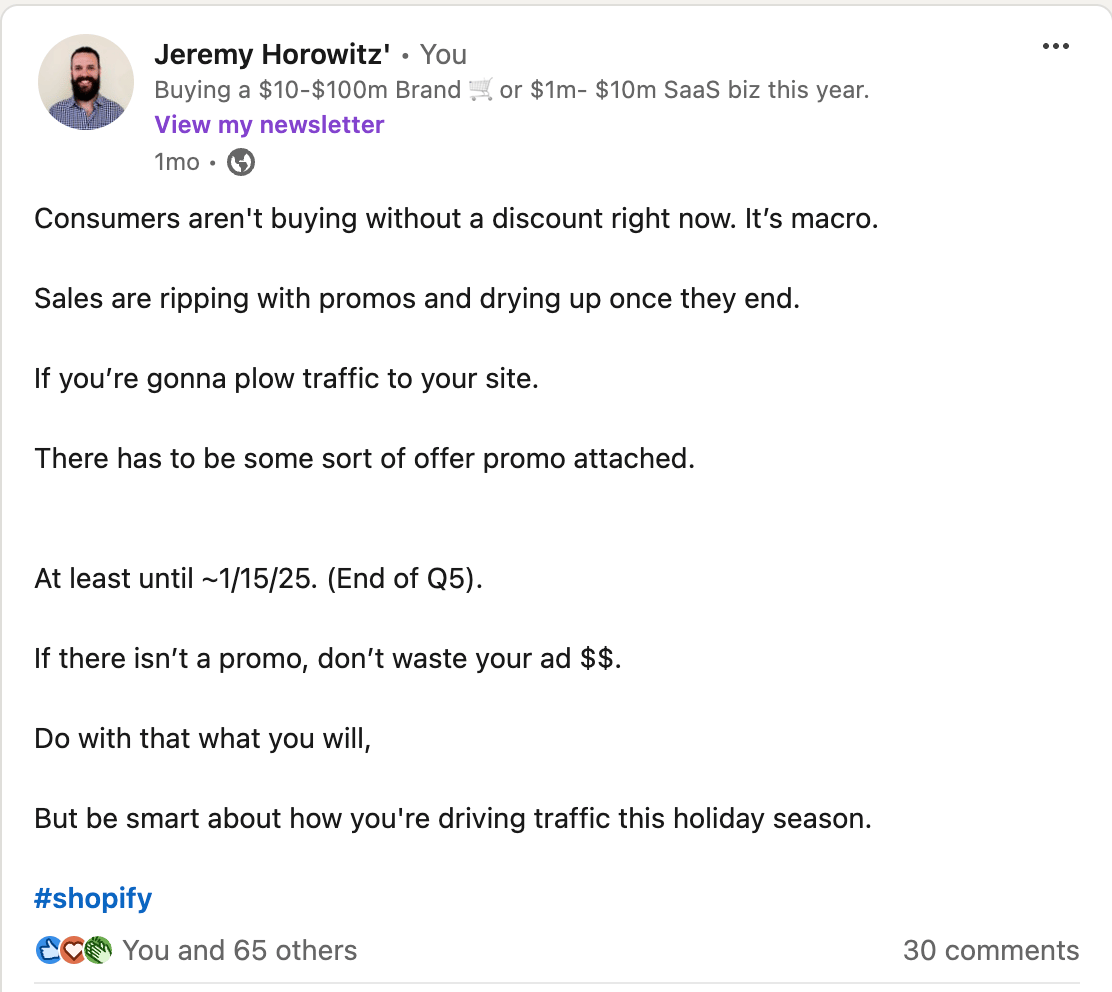

2) Reading the tea leaves based on our industry’s data

There are a lot of people who have been willing to share their performance privately and publicly. Overall, I’d rate the sentiment + growth trends during BFCM/Nov as good.

One of the best aggregated real-time reports came from Jeremiah over at Kno Commerce and the DTC Index.

Every day from Friday 11/22 - Cyber Monday 12/3, he reported on the daily YoY performance increase. This is only looking at 2.3k brands, so we have to take the data with a grain of salt, but it shows interesting trends I think will continue to play out until Mid-Jan.

The space where you can see the Green in the chart is where there were more sales in 2024 vs. 2023.

There were good spikes on big days, but they weren’t massive.

Almost every day was up YoY.

Growth trended around 22%.

At a high level, Kno’s data trended almost exactly at Shopify’s +22% YoY. The one big callout that Jeremiah made that I don’t think enough brands are taking into consideration is how much sales were pulled forward by launching their BFCM sales in late Oct/early Nov.

The baseline he was using to compare all of BFCM performance was the sales performance from the week before BFCM, which was already +52% YoY.

The BFCM season is killing the sales peaks of BFCM and spreading the Rev out over longer periods of time.

I’d expect this to continue into the new year.

Takeaway: Growth was good but not great.

3) The Super Macro

At the macro level, there are only 2 data points I look at closely.

Unemployment

Credit Card Delinquency Rates.

1) Unemployment

When people have jobs and feel good about the economy, they spend more.

Quick read: When unemployment goes vertical we hit a recession.

While we are seeing a slight increase in unemployment since the recent low of 3.4% in April ‘23, the increase has already started to slow down and reverse.

Hitting a relative high in July ‘24 of 4.3% then coming back down to 4.1% in Oct ‘24.

These trends can reverse, but what’s most important is how fast the line is accelerating. Usually, increases of ~1.5-2x in a year = recessions where consumers feel real pain.

Right now, it’s bouncing along what seems like a relative low.

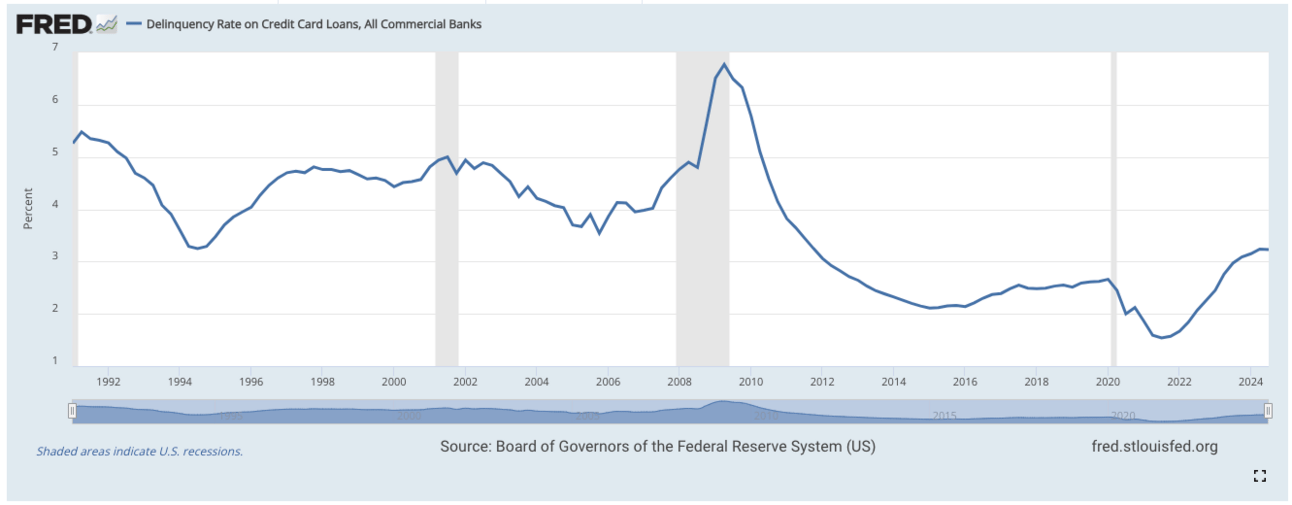

2) Credit Card Delinquency (Aka Credit Card defaults)

In English: how many people stop paying their credit cards. The usual remedy is bankruptcy.

While we have significantly less data here, to me, this is more of a leading indicator on Consumer sentiment.

In America, if consumers can’t take on more credit card debt/lose access to credit, that's a really bad sign for the economy. And a worse sign for our industry.

I’d say the Credit Card market is in a similar place. We are seeing an incredibly weird historical pattern.

During COVID Lockdowns, many consumers took their Stimi checks and paid off their credit cards.

We saw a considerable climb, but coming off the lowest Delinquency rate ever recorded.

The rate is flattening but still significantly lower rates than in either the 2010s or late 90s.

The credit card curve is looking very similar to the Unemployment curve (where the increase seems to have temporarily stopped, and we’re waiting for EOY data to see if the curve will flatten or not). Seems like the bad recession isn’t coming tomorrow.

Obviously we have to watch both of these, but the “New economic normal” seems to be settling.

The biggest macro question left: how much will rate cuts impact the real economy. If Inflation keeps slowing down, and the rate keeps cutting, more spending and confidence will come back.

Takeaway: Marco signs are good, but not great.

Final Thought

All of this leads me to believe that this is what the new normal is going to look like for a while.

Good but not great with no obvious direction either way.

Depending on how many new policy proposals Trump can actually put in place will change that. But default is new administrations accomplish little.

If he can make major sweeping changes quickly, we’ll be redoing this analysis in 12 months.

The big takeaway for me: both Macro metrics represent a lot of what the “Vibecession” has expressed anecdotally.

The bottom didn’t fall out, but money isn’t pouring out of people’s pockets.

There’s poor visibility into what’s coming, so consumers don’t have a lot of confidence.

Everything seems to be going okay yet hanging on by a thread.

For the 35% of Americans who were in a strong financial position going into Stimi-checks, their position only got stronger, so they feel more confident even though the outlook is uncertain.

The 65% of Americans that live paycheck to paycheck feel like they’re walking uphill in a windstorm. While they are surviving, going the same distance is harder, more painful, and they don’t feel like the win will be as big when they get there.

Maybe this is the “soft landing” that was promised.

But what does that mean for you?

There will continue to be a separation between what people say/consumer confidence and what they do.

Presenting Value will be what determines success.

The brands that can reverse the COVID cost inflation trend + pass savings along to customers will win the most.

Consumers have taken 4 years of Inflation on the chin. They rode out a once-in-a-generation pandemic and the following economic and political roller coaster.

They’re tired.

They don’t want to have to work so hard to get to the same place, and brands that can provide customers with more value than they feel like they’re spending will win.

Regardless if those brands are in discretionary or non-discretionary categories.